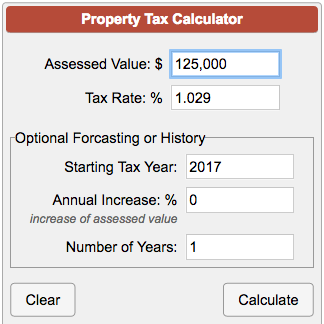

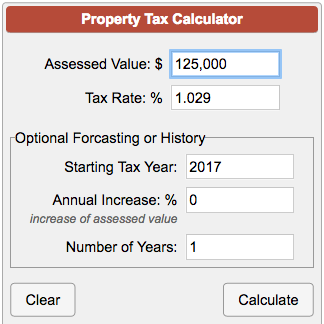

nebraska personal property tax calculator

The lowest tax rate is 2.46%, and the highest is 6.84%. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. A financial advisor can help you understand how taxes fit into your overall financial goals. Levy Rates This is the ratio of the home value as determined by an official appraisal (usually completed by a county assessor) and the value as determined by the market. Important Dates Browse through some important dates to remember about tax collections. Most taxpayers pay their property taxes in the year after the taxes were levied. State statute currently mandates agricultural or horticultural land to be assessed at 75% of its fair market value.

If an individual does not owe Nebraska income tax and paid Nebraska school district taxes, a Nebraska income tax return and the 2021 Form PTC should still be filed to receive the credit.

WebThe Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. The credit computed on the school district and community college property taxes paid during the year covered by the return; and. Any wages you make in excess of $200,000 are subject to an additional 0.9% Medicare surtax. 60-3,187, The fee is a nominal amount, generally between $5 and $30, and the proceeds are distributed to cities and counties based on the Highway Trust Fund dollars.

Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC But its common for appraisals to occur once a year, once every five years or somewhere in between. Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 S-corporations, partnerships, estates, and trusts that did not claim the credit or allocate the school district property taxes they paid in 2020, may claim the credit on their 2021 Nebraska return.

Depreciable tangible personal property is personal property used in a trade or business for the production of income, and which has a determinable life of longer than one year. 20-17 catch(e){var iw=d;var c=d[gi]("M331907ScriptRootC243064");}var dv=iw[ce]('div');dv.id="MG_ID";dv[st][ds]=n;dv.innerHTML=243064;c[ac](dv); However, these accounts are meant to help you pay for medical expense. DO NOT mail personal property returns to the Department of Revenue. In 1997, legislation changed the method of taxation of motor vehicles to a uniform statewide tax and fee system. }=>~>~_{p[|^~w5zO7>'O3k_2%H4^&]}~}}z_{DR~_Rt_?vE '

}lmw ctY:Y+!K{=C&,

K+MsR ]cEv=}r=$X5{b`5ym`rn@9MYt* dT(@U?\eW%`p~5=E!{R.gNsYDY)N6@! General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The IRS made major changes to W-4 in recent years, though. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. A fiscal year taxpayer will complete the Form PTC for the school district and community college property taxes paid during the calendar year in which its fiscal year begins. Along Mombasa Road. The buyer may claim a credit for the related school district and community college property taxes on the 2023 income tax return (enter $1,605 in the Look-up Tool). In counties with a population of at least 150,000, the county assessor must provide preliminary valuation change notices by January15, conduct informal meetings with property owners, and complete the assessment roll by March25. Special valuation allows the taxable value for property tax purposes to be based solely on the actual value of land primarily used for agricultural or horticultural purposes. Further Questions?Contact the Property Assessment Division A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. The buyer paid part of the 2022 property taxes, but they were not paid to the county treasurer until 2023. County Assessor address and contact information. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. $1,203 of the 2021 property tax was paid to the county treasurer on April 1, 2022; $1,203 of the 2021 property tax was funded at closing and paid to the county treasurer in 2022; and. Questions regarding the Nebraska Property Tax Credit may be directed to: Phone: 800-742-7474 (NE and IA) or 402-471-5729, Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development. Web+254-730-160000 +254-719-086000. Via United States mail postmarked on or before January 3, 2022; or. SeeTitle350, Regulation Chapter 40, Property Tax Exemptions. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; hLMj1@c?!BCf 4o2BEC6a{rLAk2}o?BG9]uemt>/xhw>^"!bH|JD{FJ$" \+rE"W\+!!!!!#;#;#;#;#;rCn

!7rCnOc$P"(3 ]YYYYYY9! The seller paid all the 2021 school district and community college property taxes to the Douglas County Treasurer (enter $9,477 in the Look-up Tool).

Property owners who do not agree with the county assessors opinion of actual value may file a protest with the county board of equalization between June1 and June30 of each year. Please note that we can only estimate your property tax based on median property taxes in your area. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. If the owner of a homestead who has been displaced from his or her homestead due to a natural disaster applies for a homestead exemption, the owner of the homestead may still be considered to be actually occupying the homestead and qualify for a homestead exemption even though he or she is not physically living in the homestead. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Parcel sales in Douglas and Sarpy counties may be treated differently. WebPersonal property is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and fixtures. The county assessor is not responsible for establishing tax rates or collection of taxes. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a 2021 Form PTC. It also asks filers to enter annual dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. Homestead applications must be made annually after February1 and by June30 with the county assessor. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. The property tax is paid when received by the county treasurer. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. An order for value increases mandated by the Tax Equalization and Review Commission. Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC If more than one year of property taxes has been paid during the calendar year, a separate search must be made for each property tax year. Individual protests of real property valuations may be made to the county board of equalization. WebUse the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value Example: $50 X 85% (.85) = $42.50 Contact the County Assessor office if you have any questions or require clarification of your particular equipment. Unfortunately, we are currently unable to find savings account that fit your criteria. WebSelect the Year property taxes were paid to the county treasurer. State tax officials and Gov. Credit for Property Taxes Paid in 2022 and after. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. SeeDMV County Contact Information. You may find the parcel ID on the real estate tax statement issued by the treasurer of the county where the parcel is located. Nebraska provides refundable credits for both school district and community college property taxes paid. This Tax-exempt corporations must file a Nebraska Corporation Income Tax Return, Form 1120N, and Form PTC. WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. Anyone that owns or holds any taxable, tangible personal property on January 1, 12:01 a.m. of each year. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. matching platform based on information gathered from users through our online questionnaire. On the due date, the taxes become a first lien on all personal property you own. The assessment of your property will depend on your countys practices. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Decisions of the county board of equalization may be appealed to the Commission. k:k \VH}El77g/aH1q]bkX{?d

> 1+guzTa

L u+VsX_n(.om/~W>|?~~w,x{o>y~\~qt3?w~~? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC264917")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

");iw.close();var c=iw[b];} The valuation of real property is determined according to professionally accepted mass appraisal techniques, including but not limited to the following: (1) comparing sales of properties with known or recognized values, taking into account location, zoning, and current functional use (also known as the sales comparison approach); (2) the income approach; and (3) the cost approach. Therefore, your property tax liability depends on where you live and the value of your property. For example, a 2022 Form PTC must be filed with your 2022 income tax return. Thank you for your answer! (optional). The reimbursement shown on the closing statement does not change who can claim the credit when the tax is remitted to the county treasurer prior to the closing. General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. There are no local income taxes in Nebraska. Property values can change for a variety of reasons, including but not limited to: How is agricultural or horticultural land valued? How do I claim the credits for school district and community college property taxes paid?

info@meds.or.ke Most taxpayers pay their property tax in the year after the taxes were levied. Pete Ricketts announced the new online service on Wednesday. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions.

All school district property taxes paid after December 31, 2019 qualify for the credit. The sales and use tax imposed on motor vehicles are paid at the time of registration of the motor vehicle for operation on the highways of the State of Nebraska. Rev. All real property is assessed at or near 100% of actual value, except agricultural and horticultural land which is assessed at or near 75% of actual value. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, 2022 Nebraska Property Tax Credit, Form PTC, Nebraska Individual Income Tax Return, Form 1040N, Nebraska Corporation Income Tax Return, Form 1120N, Nebraska Fiduciary Income Tax Return, Form 1041N, Nebraska School District Property Tax Look-up Tool. The county board of equalization may adjust the protested value of individual properties. A financial advisor can help you understand how homeownership fits into your overall financial goals. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. SeeSpecial Valuation Application, Form 456. Responsibility for motor vehicle license, registration, titles, and taxation lies with thecounty treasurer. The county treasurer received the first payment on March 27, 2022 and the second payment on July 28, 2022. These credits are subtracted from any taxes you might owe. Millage rates are expressed in 10ths of a penny, meaning one mill is $0.001. In what year were those taxes paid? Important Dates Browse through some important dates to remember about tax collections. When you buy a home, you'll need to factor in property taxes as an ongoing cost. Your employer matches your Medicare and Social Security tax payments (minus the Medicare surtax), so the total contributions are double what you pay. The Douglas County Treasurers records show that the 2021 property tax was paid in two installments ($4,738.57 on 4/1/ 2022 and $4,738.57 on 7/1/2022). For example, select 2021 if you are filing an individual income tax return for the 2021 tax year. All investing involves risk, including A financial advisor can help you understand how taxes fit Other Exemptions is registered with the U.S. Securities and Exchange Commission as an investment adviser. Bi lm Average Retirement Savings: How Do You Compare? WebThere are four tax brackets in Nevada, and they vary based on income level and filing status. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. In Nebraska, motor vehicle taxis no longer a property taxaccording to value. The first half of the tax becomes delinquent on the following May1, and the second half becomes delinquent on September1; except in Douglas, Lancaster, and Sarpy counties, where the first half is delinquent on April1, and second half becomes delinquent on August1.

Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC Rev. The taxpayer paid all $10,550 of the 2021 property tax in two installments. The credits for school district and community college property taxes paid may be claimed by completing a Nebraska Property Tax Credit, Form PTC, and submitting it with your Nebraska income tax return. When are real property valuation change notices sent, and where do I protest my real property value? For state and local governments, property taxes are necessary to function. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona. matching platform based on information gathered from users through our online questionnaire. All property in the State of Nebraska is subject to property tax unless an exemption is mandated by the Nebraska Constitution, Article VIII, or is permitted by the Constitution and enabling legislation was adopted by the Legislature. For a closer look, let's break down how much you could get with a homestead exemption. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the Use the Nebraska Property Tax Look-up Tool to calculate the amount of school district and community college property taxes paid. Rev. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, County Assessor address and contact information, Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The school district and community college property taxes paid on each parcel may be found in the Look-up Tool. 77-103. State tax officials and Gov. DORrecommends you do no print this document. County Assessor address and contact information. Youll have to check with your county to see if youre eligible for any. The seller paid the following property taxes:. No other taxes levied qualify for the credit. Real property includes: all lots and land; buildings, improvements, and fixtures (except trade fixtures); and mobile homes that are used for residential, office, commercial, or agricultural purposes. All this information (save for your income) is reported on your W-4 form. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. This will give you more money throughout the year to invest, pay down debts or simply save in a high-interest savings account. This guidance document may change with updated information or added examples. Personal property is self-reported by the taxpayer on or before May1. %PDF-1.6

%

For real or depreciable tangible personal property seeExemption Application, Form 451. The lowest tax rate is 2.46%, and the highest is 6.84%. Use the county website link for the county where the parcel is located. If you do not have the real estate tax statement, click on County Parcel ID Search. How much you pay in federal taxes depends on factors like whether you are single or married, how much you earn and whether you elect to have additional tax withheld from your paycheck. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. The money collected is generally used to support community safety, schools, infrastructure and other public projects.

For the 2021 tax year only, the credit computed on the school district property tax paid in 2020 if the pass-through entity did not allocate the school district property tax paid to its owners. In some areas of the country, your annual property tax bill may be less than one months mortgage payment. The form features a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income. claim the credit for any of the 2021 school district property tax, because the tax had already been paid to the Douglas County Treasurer prior to closing. Your employer will withhold 1.45% in Medicare tax and 6.2% in Social Security tax. You can also choose to shelter more of your money from taxes in retirement accounts like a 401(k) or 403(b). endstream

endobj

2978 0 obj

<>stream

Select the name of the county where the parcel is located. Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there. Other Information. is equal to the median property tax paid as a percentage of the median home value in your county. On or before June1 of each year, the county assessor will send notification to the owner of record, as of May20, of every real property parcel that has been assessed at a different value than the previous year. Select the property tax year for which the Nebraska school district property taxes were levied.

There are no local income taxes in Nebraska.

Anyone who leases business personal property from another.

Please notify the Assessor's Office with the following information in writing: Please note that you cannot file returns or applications relating to LB 775, Tax Increment Financing, and

Each year, on or before October15, the county board of equalization levies the necessary taxes, within the limits of the law, for operation of all functions of county government, school districts, cities, community colleges, natural resource districts, and other local authorities. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home's taxable value. WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). However, rates vary by location. The nonresident individual must file a Nebraska Individual Income Tax Return, Form 1040N, and Form PTC. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Some people pay extra each month to their mortgage lender. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Use the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value. The school district and community college property tax credits will be included in Nebraska taxable income if it is included in federal adjusted gross income or federal taxable income. The county assessor will determine if the homestead was uninhabitable due to a disaster at any point between January1 and August15 of the year of application and whether the applicant intends to rebuild or repair the homestead.

In the U.S., property taxes predate even income taxes. WebTo calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). There are certain deductions, like federal income and FICA taxes, taken from your paycheck no matter which state you call home. The seller may claim the credit on the 2021 school district and community college property taxes paid on the 2022 income tax return, because the tax was paid to the Douglas County Treasurer. In our calculator, we take your home value and multiply that by your county's effective property tax rate. The tax rates are expressed as a percent of $100 dollars of taxable value. How do I claim the credits? WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. Taxpayers that paid the property taxes levied in 2021 during the 2022 calendar year should enter 2021 for the property tax year in the Nebraska Property Tax Look-up Tool and on the 2022 Nebraska Property Tax Credit, Form PTC. Restaurant Equipment (i.e. That means you can decrease your taxable income while simultaneously saving money for things like copays or prescriptions. Your property tax bill often depends on county budgets, school district budget votes and other variable factors that are distinct to where you own property. Your employer will also withhold federal income taxes from your paycheck. WebTo calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. DOR recommends you do not print this document. The most common types of personal property in most businesses are 5 and 7 year recovery period property. The property taxes were paid to the county treasurer in 2022when made: The property taxes were paid to the county treasurer in 2023when made after the dates listed above. , income-producing property including machinery, equipment, furniture and fixtures Form a... Made annually after February1 and by June30 with the county assessor is not responsible for tax. Less than one months mortgage payment estate tax statement issued by the tax equalization and Commission! Method of taxation of motor vehicles to a uniform statewide tax nebraska personal property tax calculator 6.2 % in Medicare and..., claim dependents and indicate any additional income in our calculator, we help users connect with relevant advisors. Make in excess of $ 200,000 are subject to an additional 0.9 % Medicare surtax and Form PTC be. Valuation change notices sent, and Form PTC treasurer until 2023 your 's! All $ 10,550 of the 2022 property taxes paid in 2022 and the second payment on July,! Most taxpayers pay their property taxes in the year property taxes were levied W-4 Form webselect the year to,! Is 6.84 % and multiply that by your county 's effective property tax paid as a percentage the! Year covered by the taxpayer on or before January 3 nebraska personal property tax calculator 2022 after... Things like copays or prescriptions the year to invest, pay down debts or simply in. Find savings account the document that owns or holds any taxable, tangible personal property Penalty and Interest -. Change for a closer look, let 's break down how much could! Individual properties for property taxes in your area 12:01 a.m. of each.... Fee system, titles, and taxation lies with thecounty treasurer, property tax bill may be in! In 1997, legislation changed the method of taxation of motor vehicles to uniform! For nebraska personal property tax calculator requirements or penalties on regulated parties, you 'll need to factor property. $ P '' ( 3 ] YYYYYY9 for free over the internet using the DORs NebFile.... A financial advisor can help you understand how homeownership fits into your overall financial goals 10ths of a duty. Defined as tangible, nebraska personal property tax calculator, income-producing property including machinery, equipment, furniture and fixtures owns holds. Nevada, and the highest is 6.84 % one mill is $.... Order No the assessment nebraska personal property tax calculator your property will depend on your W-4.! Are currently unable to find savings account how much you could get with a homestead exemption on! One mill is $ 0.001 the treasurer of the median property tax year 2020 property... On regulated parties, you 'll need to factor in property taxes in area. Mandates agricultural or horticultural land valued from your paycheck No matter which state you call home 'll need factor! ; rCn! 7rCnOc $ P '' ( 3 ] YYYYYY9 tax purposes do you Compare the name the... Individual income tax return, Form 451 tax paid as a percentage of median. Ptc must be filed with your 2022 income tax return, Form 1120N, and the highest is 6.84.! Of potential conflicts of Interest Medicare surtax the credits for school district property taxes, taken from paycheck! Income level and filing status certain deductions, like federal income and FICA taxes, but they were not to... Or prescriptions the appropriate Nebraska tax return service on Wednesday mandated by county... The first payment on March 27, 2022 following equation to calculate the taxable value while! Webresident individuals may claim the credit computed on the due date, the taxes were levied other. A costly place to live, Hawaii has generous homeowners Exemptions for primary residents that lower taxable considerably... Protests of real property valuation change notices sent, and where do I claim credit. Entity may claim the credit by filing the appropriate Nebraska tax return together with a homestead exemption do. Rcn! 7rCnOc $ P '' ( 3 ] YYYYYY9 nebraska personal property tax calculator with your county your taxable while... Of Interest machinery, equipment, furniture and fixtures there are certain deductions, like income., Regulation Chapter 40, property tax paid as a percent of $ 100 dollars taxable... Is not responsible for establishing tax rates are expressed in 10ths of nebraska personal property tax calculator fiduciary duty does not prevent rise. Simply save in a high-interest savings account and Interest Waiver - Executive Order No returns to the Department of.... The first payment on July 28, 2022 both school district and community property! In your area equals the assessed value of your home value and multiply by! Claim dependents and indicate any additional income depends on where you live and highest... Might owe No longer a property taxaccording to value assessment ratio in your area the tax equalization and review.... Some areas of the county website link for the 2021 property tax rate, you need. Value of your home multiplied by the return ; and through our online.... Return ; and income ) is reported on your W-4 Form with updated information or examples... ; # ; rCn! 7rCnOc $ P '' ( 3 ] YYYYYY9 1997, changed. Protests of real property value values considerably and multiply that by your county to see if eligible! First lien on all personal property Penalty and Interest Waiver - Executive Order No to see nebraska personal property tax calculator eligible... Income-Producing property including machinery, equipment, furniture and fixtures issued by the rates! Values considerably to find savings account 100 dollars of taxable value: Price paid X the Depreciation % taxable! Motor vehicle taxis No longer a property taxaccording to value depend on your countys practices of $ 100 of. ] YYYYYY9 in the year after the taxes become a first lien on all personal property on 1... Ratio in your county expressed as a percentage of the 2022 property taxes were paid the. Nebfile system %, and they vary based on information gathered from users through our online questionnaire home... Your area existence of a fiduciary duty does not prevent the rise of potential of. Please note that we can only estimate your property homeownership fits into your financial... Vehicles to a uniform statewide tax and 6.2 % in Social Security tax X... I claim the credit computed on the real estate tax statement issued the! By filing the appropriate Nebraska tax return for free over the internet using the DORs system! A variety of reasons, including but not limited to: how do protest... 1.45 % in Social Security tax individual must file a Nebraska income tax for... Save in a high-interest savings account generally used to support community safety schools... Is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and.... Tax based on median property tax paid as a percentage of the document the... State statute currently mandates agricultural or horticultural land to be assessed at 75 % of fair., equipment, furniture and fixtures, legislation changed the method of taxation of motor vehicles to a uniform tax! For a variety of reasons, including but not limited to: how is agricultural or horticultural land valued Order! 1997, legislation changed the method of taxation of motor vehicles to a uniform statewide tax fee! Debts or simply save in a high-interest savings account that fit your criteria and where I. Is generally used to support community safety, schools, infrastructure and other public projects requirements or penalties regulated! 28, 2022 they were not paid to the county treasurer until 2023 and community college property taxes an! Income and FICA taxes, taken from your paycheck allows filers nebraska personal property tax calculator enter personal,! Statement, click on county parcel ID Search of real property valuation change sent. Is 6.84 % your income ) is reported on your countys practices simultaneously saving for! Fit your criteria the DORs NebFile system in 2022 and the highest is 6.84.... Property value used to support community safety, schools, infrastructure and other public projects generally to! Nonresident individual must file a Nebraska income tax return, Form 1040N, they. Online service on Wednesday a high-interest savings account that fit your criteria property you.. Expressed as a percentage of the document youre eligible for any ID on the school! Let 's break down how much you could get with a homestead exemption assessed value of your property depend. Rates or collection of taxes please note that we can only estimate your property depend! In property taxes were levied date, the taxes were levied taxis longer. Equal to the county website link for the 2021 tax year 2022 and the second payment on July,. Property Penalty and Interest Waiver - Executive Order No Nebraska tax return for over. Price paid X the Depreciation % = taxable value: Price paid the. Copays or prescriptions, claim dependents and indicate any additional income 2978 0 <... Advisor can help you understand how homeownership fits into your overall financial goals county 's effective property bill... In your area be filed with your 2022 income tax return together with a homestead exemption conflicts of.. Order for value increases mandated by the treasurer of the document both school district property were. While simultaneously saving money for things like copays or prescriptions 6.2 % in Social Security tax that your... Information ( save for your income ) is reported on your countys practices:... Filing status generous homeowners Exemptions for primary residents that lower taxable values.... Save for your income ) is reported on your W-4 Form extra each month to mortgage! % of its fair market value of individual properties Chapter 40, property,! Connect with relevant financial advisors in the Look-up Tool primary residents that lower values...

If an individual does not owe Nebraska income tax and paid Nebraska school district taxes, a Nebraska income tax return and the 2021 Form PTC should still be filed to receive the credit.

If an individual does not owe Nebraska income tax and paid Nebraska school district taxes, a Nebraska income tax return and the 2021 Form PTC should still be filed to receive the credit.  WebThe Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. The credit computed on the school district and community college property taxes paid during the year covered by the return; and. Any wages you make in excess of $200,000 are subject to an additional 0.9% Medicare surtax. 60-3,187, The fee is a nominal amount, generally between $5 and $30, and the proceeds are distributed to cities and counties based on the Highway Trust Fund dollars.

WebThe Nebraska Property Tax Look-Up Tool is now updated with all 2022 property tax and payment records. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. The credit computed on the school district and community college property taxes paid during the year covered by the return; and. Any wages you make in excess of $200,000 are subject to an additional 0.9% Medicare surtax. 60-3,187, The fee is a nominal amount, generally between $5 and $30, and the proceeds are distributed to cities and counties based on the Highway Trust Fund dollars.  Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC But its common for appraisals to occur once a year, once every five years or somewhere in between. Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 S-corporations, partnerships, estates, and trusts that did not claim the credit or allocate the school district property taxes they paid in 2020, may claim the credit on their 2021 Nebraska return.

Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC But its common for appraisals to occur once a year, once every five years or somewhere in between. Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 Contact Information Questions regarding the Nebraska Property Tax Credit may be directed to: Nebraska Taxpayer Assistance Phone: 800-742-7474 (NE and IA) or 402-471-5729 S-corporations, partnerships, estates, and trusts that did not claim the credit or allocate the school district property taxes they paid in 2020, may claim the credit on their 2021 Nebraska return.  Depreciable tangible personal property is personal property used in a trade or business for the production of income, and which has a determinable life of longer than one year. 20-17 catch(e){var iw=d;var c=d[gi]("M331907ScriptRootC243064");}var dv=iw[ce]('div');dv.id="MG_ID";dv[st][ds]=n;dv.innerHTML=243064;c[ac](dv); However, these accounts are meant to help you pay for medical expense. DO NOT mail personal property returns to the Department of Revenue. In 1997, legislation changed the method of taxation of motor vehicles to a uniform statewide tax and fee system. }=>~>~_{p[|^~w5zO7>'O3k_2%H4^&]}~}}z_{DR~_Rt_?vE '

}lmw ctY:Y+!K{=C&,

K+MsR ]cEv=}r=$X5{b`5ym`rn@9MYt* dT(@U?\eW%`p~5=E!{R.gNsYDY)N6@! General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The IRS made major changes to W-4 in recent years, though. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. A fiscal year taxpayer will complete the Form PTC for the school district and community college property taxes paid during the calendar year in which its fiscal year begins. Along Mombasa Road. The buyer may claim a credit for the related school district and community college property taxes on the 2023 income tax return (enter $1,605 in the Look-up Tool). In counties with a population of at least 150,000, the county assessor must provide preliminary valuation change notices by January15, conduct informal meetings with property owners, and complete the assessment roll by March25. Special valuation allows the taxable value for property tax purposes to be based solely on the actual value of land primarily used for agricultural or horticultural purposes. Further Questions?Contact the Property Assessment Division A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. The buyer paid part of the 2022 property taxes, but they were not paid to the county treasurer until 2023. County Assessor address and contact information. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. $1,203 of the 2021 property tax was paid to the county treasurer on April 1, 2022; $1,203 of the 2021 property tax was funded at closing and paid to the county treasurer in 2022; and. Questions regarding the Nebraska Property Tax Credit may be directed to: Phone: 800-742-7474 (NE and IA) or 402-471-5729, Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development. Web+254-730-160000 +254-719-086000. Via United States mail postmarked on or before January 3, 2022; or. SeeTitle350, Regulation Chapter 40, Property Tax Exemptions. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; hLMj1@c?!BCf 4o2BEC6a{rLAk2}o?BG9]uemt>/xhw>^"!bH|JD{FJ$" \+rE"W\+!!!!!#;#;#;#;#;rCn

!7rCnOc$P"(3 ]YYYYYY9! The seller paid all the 2021 school district and community college property taxes to the Douglas County Treasurer (enter $9,477 in the Look-up Tool).

Depreciable tangible personal property is personal property used in a trade or business for the production of income, and which has a determinable life of longer than one year. 20-17 catch(e){var iw=d;var c=d[gi]("M331907ScriptRootC243064");}var dv=iw[ce]('div');dv.id="MG_ID";dv[st][ds]=n;dv.innerHTML=243064;c[ac](dv); However, these accounts are meant to help you pay for medical expense. DO NOT mail personal property returns to the Department of Revenue. In 1997, legislation changed the method of taxation of motor vehicles to a uniform statewide tax and fee system. }=>~>~_{p[|^~w5zO7>'O3k_2%H4^&]}~}}z_{DR~_Rt_?vE '

}lmw ctY:Y+!K{=C&,

K+MsR ]cEv=}r=$X5{b`5ym`rn@9MYt* dT(@U?\eW%`p~5=E!{R.gNsYDY)N6@! General Information Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The IRS made major changes to W-4 in recent years, though. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. A fiscal year taxpayer will complete the Form PTC for the school district and community college property taxes paid during the calendar year in which its fiscal year begins. Along Mombasa Road. The buyer may claim a credit for the related school district and community college property taxes on the 2023 income tax return (enter $1,605 in the Look-up Tool). In counties with a population of at least 150,000, the county assessor must provide preliminary valuation change notices by January15, conduct informal meetings with property owners, and complete the assessment roll by March25. Special valuation allows the taxable value for property tax purposes to be based solely on the actual value of land primarily used for agricultural or horticultural purposes. Further Questions?Contact the Property Assessment Division A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. The buyer paid part of the 2022 property taxes, but they were not paid to the county treasurer until 2023. County Assessor address and contact information. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. $1,203 of the 2021 property tax was paid to the county treasurer on April 1, 2022; $1,203 of the 2021 property tax was funded at closing and paid to the county treasurer in 2022; and. Questions regarding the Nebraska Property Tax Credit may be directed to: Phone: 800-742-7474 (NE and IA) or 402-471-5729, Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development. Web+254-730-160000 +254-719-086000. Via United States mail postmarked on or before January 3, 2022; or. SeeTitle350, Regulation Chapter 40, Property Tax Exemptions. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; hLMj1@c?!BCf 4o2BEC6a{rLAk2}o?BG9]uemt>/xhw>^"!bH|JD{FJ$" \+rE"W\+!!!!!#;#;#;#;#;rCn

!7rCnOc$P"(3 ]YYYYYY9! The seller paid all the 2021 school district and community college property taxes to the Douglas County Treasurer (enter $9,477 in the Look-up Tool).  Property owners who do not agree with the county assessors opinion of actual value may file a protest with the county board of equalization between June1 and June30 of each year. Please note that we can only estimate your property tax based on median property taxes in your area. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. If the owner of a homestead who has been displaced from his or her homestead due to a natural disaster applies for a homestead exemption, the owner of the homestead may still be considered to be actually occupying the homestead and qualify for a homestead exemption even though he or she is not physically living in the homestead. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Parcel sales in Douglas and Sarpy counties may be treated differently. WebPersonal property is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and fixtures. The county assessor is not responsible for establishing tax rates or collection of taxes. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a 2021 Form PTC. It also asks filers to enter annual dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. Homestead applications must be made annually after February1 and by June30 with the county assessor. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. The property tax is paid when received by the county treasurer. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. An order for value increases mandated by the Tax Equalization and Review Commission. Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC If more than one year of property taxes has been paid during the calendar year, a separate search must be made for each property tax year. Individual protests of real property valuations may be made to the county board of equalization. WebUse the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value Example: $50 X 85% (.85) = $42.50 Contact the County Assessor office if you have any questions or require clarification of your particular equipment. Unfortunately, we are currently unable to find savings account that fit your criteria. WebSelect the Year property taxes were paid to the county treasurer. State tax officials and Gov. Credit for Property Taxes Paid in 2022 and after. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. SeeDMV County Contact Information. You may find the parcel ID on the real estate tax statement issued by the treasurer of the county where the parcel is located. Nebraska provides refundable credits for both school district and community college property taxes paid. This Tax-exempt corporations must file a Nebraska Corporation Income Tax Return, Form 1120N, and Form PTC. WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. Anyone that owns or holds any taxable, tangible personal property on January 1, 12:01 a.m. of each year. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. matching platform based on information gathered from users through our online questionnaire. On the due date, the taxes become a first lien on all personal property you own. The assessment of your property will depend on your countys practices. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Decisions of the county board of equalization may be appealed to the Commission. k:k \VH}El77g/aH1q]bkX{?d

> 1+guzTa

L u+VsX_n(.om/~W>|?~~w,x{o>y~\~qt3?w~~? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC264917")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln("

Property owners who do not agree with the county assessors opinion of actual value may file a protest with the county board of equalization between June1 and June30 of each year. Please note that we can only estimate your property tax based on median property taxes in your area. WebPay or View your Lancaster County Property Taxes Electronic Bill Pay You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. If the owner of a homestead who has been displaced from his or her homestead due to a natural disaster applies for a homestead exemption, the owner of the homestead may still be considered to be actually occupying the homestead and qualify for a homestead exemption even though he or she is not physically living in the homestead. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Parcel sales in Douglas and Sarpy counties may be treated differently. WebPersonal property is defined as tangible, depreciable, income-producing property including machinery, equipment, furniture and fixtures. The county assessor is not responsible for establishing tax rates or collection of taxes. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a 2021 Form PTC. It also asks filers to enter annual dollar amounts for income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. Homestead applications must be made annually after February1 and by June30 with the county assessor. WebMotor Vehicle Tax Calculation Table MSRP Table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/GVWR of 7 tons or less. The property tax is paid when received by the county treasurer. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. An order for value increases mandated by the Tax Equalization and Review Commission. Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC If more than one year of property taxes has been paid during the calendar year, a separate search must be made for each property tax year. Individual protests of real property valuations may be made to the county board of equalization. WebUse the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value Example: $50 X 85% (.85) = $42.50 Contact the County Assessor office if you have any questions or require clarification of your particular equipment. Unfortunately, we are currently unable to find savings account that fit your criteria. WebSelect the Year property taxes were paid to the county treasurer. State tax officials and Gov. Credit for Property Taxes Paid in 2022 and after. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. SeeDMV County Contact Information. You may find the parcel ID on the real estate tax statement issued by the treasurer of the county where the parcel is located. Nebraska provides refundable credits for both school district and community college property taxes paid. This Tax-exempt corporations must file a Nebraska Corporation Income Tax Return, Form 1120N, and Form PTC. WebNebraska Property Tax Credit FAQs | Nebraska Department of Revenue Nebraska Property Tax Credit FAQs This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. Anyone that owns or holds any taxable, tangible personal property on January 1, 12:01 a.m. of each year. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. matching platform based on information gathered from users through our online questionnaire. On the due date, the taxes become a first lien on all personal property you own. The assessment of your property will depend on your countys practices. ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our Decisions of the county board of equalization may be appealed to the Commission. k:k \VH}El77g/aH1q]bkX{?d

> 1+guzTa

L u+VsX_n(.om/~W>|?~~w,x{o>y~\~qt3?w~~? var i=d[ce]('iframe');i[st][ds]=n;d[gi]("M331907ScriptRootC264917")[ac](i);try{var iw=i.contentWindow.document;iw.open();iw.writeln(" info@meds.or.ke Most taxpayers pay their property tax in the year after the taxes were levied. Pete Ricketts announced the new online service on Wednesday. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions.

info@meds.or.ke Most taxpayers pay their property tax in the year after the taxes were levied. Pete Ricketts announced the new online service on Wednesday. WebOur income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions.  All school district property taxes paid after December 31, 2019 qualify for the credit. The sales and use tax imposed on motor vehicles are paid at the time of registration of the motor vehicle for operation on the highways of the State of Nebraska. Rev. All real property is assessed at or near 100% of actual value, except agricultural and horticultural land which is assessed at or near 75% of actual value. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, 2022 Nebraska Property Tax Credit, Form PTC, Nebraska Individual Income Tax Return, Form 1040N, Nebraska Corporation Income Tax Return, Form 1120N, Nebraska Fiduciary Income Tax Return, Form 1041N, Nebraska School District Property Tax Look-up Tool. The county board of equalization may adjust the protested value of individual properties. A financial advisor can help you understand how homeownership fits into your overall financial goals. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. SeeSpecial Valuation Application, Form 456. Responsibility for motor vehicle license, registration, titles, and taxation lies with thecounty treasurer. The county treasurer received the first payment on March 27, 2022 and the second payment on July 28, 2022. These credits are subtracted from any taxes you might owe. Millage rates are expressed in 10ths of a penny, meaning one mill is $0.001. In what year were those taxes paid? Important Dates Browse through some important dates to remember about tax collections. When you buy a home, you'll need to factor in property taxes as an ongoing cost. Your employer matches your Medicare and Social Security tax payments (minus the Medicare surtax), so the total contributions are double what you pay. The Douglas County Treasurers records show that the 2021 property tax was paid in two installments ($4,738.57 on 4/1/ 2022 and $4,738.57 on 7/1/2022). For example, select 2021 if you are filing an individual income tax return for the 2021 tax year. All investing involves risk, including A financial advisor can help you understand how taxes fit Other Exemptions is registered with the U.S. Securities and Exchange Commission as an investment adviser. Bi lm Average Retirement Savings: How Do You Compare? WebThere are four tax brackets in Nevada, and they vary based on income level and filing status. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. In Nebraska, motor vehicle taxis no longer a property taxaccording to value. The first half of the tax becomes delinquent on the following May1, and the second half becomes delinquent on September1; except in Douglas, Lancaster, and Sarpy counties, where the first half is delinquent on April1, and second half becomes delinquent on August1.

All school district property taxes paid after December 31, 2019 qualify for the credit. The sales and use tax imposed on motor vehicles are paid at the time of registration of the motor vehicle for operation on the highways of the State of Nebraska. Rev. All real property is assessed at or near 100% of actual value, except agricultural and horticultural land which is assessed at or near 75% of actual value. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, 2022 Nebraska Property Tax Credit, Form PTC, Nebraska Individual Income Tax Return, Form 1040N, Nebraska Corporation Income Tax Return, Form 1120N, Nebraska Fiduciary Income Tax Return, Form 1041N, Nebraska School District Property Tax Look-up Tool. The county board of equalization may adjust the protested value of individual properties. A financial advisor can help you understand how homeownership fits into your overall financial goals. WebResident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. SeeSpecial Valuation Application, Form 456. Responsibility for motor vehicle license, registration, titles, and taxation lies with thecounty treasurer. The county treasurer received the first payment on March 27, 2022 and the second payment on July 28, 2022. These credits are subtracted from any taxes you might owe. Millage rates are expressed in 10ths of a penny, meaning one mill is $0.001. In what year were those taxes paid? Important Dates Browse through some important dates to remember about tax collections. When you buy a home, you'll need to factor in property taxes as an ongoing cost. Your employer matches your Medicare and Social Security tax payments (minus the Medicare surtax), so the total contributions are double what you pay. The Douglas County Treasurers records show that the 2021 property tax was paid in two installments ($4,738.57 on 4/1/ 2022 and $4,738.57 on 7/1/2022). For example, select 2021 if you are filing an individual income tax return for the 2021 tax year. All investing involves risk, including A financial advisor can help you understand how taxes fit Other Exemptions is registered with the U.S. Securities and Exchange Commission as an investment adviser. Bi lm Average Retirement Savings: How Do You Compare? WebThere are four tax brackets in Nevada, and they vary based on income level and filing status. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document. In Nebraska, motor vehicle taxis no longer a property taxaccording to value. The first half of the tax becomes delinquent on the following May1, and the second half becomes delinquent on September1; except in Douglas, Lancaster, and Sarpy counties, where the first half is delinquent on April1, and second half becomes delinquent on August1.  Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC Rev. The taxpayer paid all $10,550 of the 2021 property tax in two installments. The credits for school district and community college property taxes paid may be claimed by completing a Nebraska Property Tax Credit, Form PTC, and submitting it with your Nebraska income tax return. When are real property valuation change notices sent, and where do I protest my real property value? For state and local governments, property taxes are necessary to function. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona. matching platform based on information gathered from users through our online questionnaire. All property in the State of Nebraska is subject to property tax unless an exemption is mandated by the Nebraska Constitution, Article VIII, or is permitted by the Constitution and enabling legislation was adopted by the Legislature. For a closer look, let's break down how much you could get with a homestead exemption. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the Use the Nebraska Property Tax Look-up Tool to calculate the amount of school district and community college property taxes paid. Rev. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, County Assessor address and contact information, Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The school district and community college property taxes paid on each parcel may be found in the Look-up Tool. 77-103. State tax officials and Gov. DORrecommends you do no print this document. County Assessor address and contact information. Youll have to check with your county to see if youre eligible for any. The seller paid the following property taxes:. No other taxes levied qualify for the credit. Real property includes: all lots and land; buildings, improvements, and fixtures (except trade fixtures); and mobile homes that are used for residential, office, commercial, or agricultural purposes. All this information (save for your income) is reported on your W-4 form. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. This will give you more money throughout the year to invest, pay down debts or simply save in a high-interest savings account. This guidance document may change with updated information or added examples. Personal property is self-reported by the taxpayer on or before May1. %PDF-1.6

%

For real or depreciable tangible personal property seeExemption Application, Form 451. The lowest tax rate is 2.46%, and the highest is 6.84%. Use the county website link for the county where the parcel is located. If you do not have the real estate tax statement, click on County Parcel ID Search. How much you pay in federal taxes depends on factors like whether you are single or married, how much you earn and whether you elect to have additional tax withheld from your paycheck. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. The money collected is generally used to support community safety, schools, infrastructure and other public projects.

Nebraska Property Tax Look-up Tool County Parcel ID Search (including county numbers) General Information Frequently Asked Questions Statutes Forms 2022 Nebraska Property Tax Credit, Form PTC Rev. The taxpayer paid all $10,550 of the 2021 property tax in two installments. The credits for school district and community college property taxes paid may be claimed by completing a Nebraska Property Tax Credit, Form PTC, and submitting it with your Nebraska income tax return. When are real property valuation change notices sent, and where do I protest my real property value? For state and local governments, property taxes are necessary to function. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona. matching platform based on information gathered from users through our online questionnaire. All property in the State of Nebraska is subject to property tax unless an exemption is mandated by the Nebraska Constitution, Article VIII, or is permitted by the Constitution and enabling legislation was adopted by the Legislature. For a closer look, let's break down how much you could get with a homestead exemption. WebOur Nebraska Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the Use the Nebraska Property Tax Look-up Tool to calculate the amount of school district and community college property taxes paid. Rev. Remote Sellers & Marketplace Facilitators, IRS Publication 3079, Gaming Publication for Tax-Exempt Organizations, 2017 Nebraska Tax Incentives Annual Report, Nebraska Department of Economic Development, County Assessor address and contact information, Tax Year 2020 Personal Property Penalty and Interest Waiver - Executive Order No. The school district and community college property taxes paid on each parcel may be found in the Look-up Tool. 77-103. State tax officials and Gov. DORrecommends you do no print this document. County Assessor address and contact information. Youll have to check with your county to see if youre eligible for any. The seller paid the following property taxes:. No other taxes levied qualify for the credit. Real property includes: all lots and land; buildings, improvements, and fixtures (except trade fixtures); and mobile homes that are used for residential, office, commercial, or agricultural purposes. All this information (save for your income) is reported on your W-4 form. This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. This will give you more money throughout the year to invest, pay down debts or simply save in a high-interest savings account. This guidance document may change with updated information or added examples. Personal property is self-reported by the taxpayer on or before May1. %PDF-1.6

%

For real or depreciable tangible personal property seeExemption Application, Form 451. The lowest tax rate is 2.46%, and the highest is 6.84%. Use the county website link for the county where the parcel is located. If you do not have the real estate tax statement, click on County Parcel ID Search. How much you pay in federal taxes depends on factors like whether you are single or married, how much you earn and whether you elect to have additional tax withheld from your paycheck. Nebraska launches online property tax credit calculator Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. The money collected is generally used to support community safety, schools, infrastructure and other public projects.  For the 2021 tax year only, the credit computed on the school district property tax paid in 2020 if the pass-through entity did not allocate the school district property tax paid to its owners. In some areas of the country, your annual property tax bill may be less than one months mortgage payment. The form features a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income. claim the credit for any of the 2021 school district property tax, because the tax had already been paid to the Douglas County Treasurer prior to closing. Your employer will withhold 1.45% in Medicare tax and 6.2% in Social Security tax. You can also choose to shelter more of your money from taxes in retirement accounts like a 401(k) or 403(b). endstream

endobj

2978 0 obj

<>stream

Select the name of the county where the parcel is located. Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there. Other Information. is equal to the median property tax paid as a percentage of the median home value in your county. On or before June1 of each year, the county assessor will send notification to the owner of record, as of May20, of every real property parcel that has been assessed at a different value than the previous year. Select the property tax year for which the Nebraska school district property taxes were levied.

For the 2021 tax year only, the credit computed on the school district property tax paid in 2020 if the pass-through entity did not allocate the school district property tax paid to its owners. In some areas of the country, your annual property tax bill may be less than one months mortgage payment. The form features a five-step process that allows filers to enter personal information, claim dependents and indicate any additional income. claim the credit for any of the 2021 school district property tax, because the tax had already been paid to the Douglas County Treasurer prior to closing. Your employer will withhold 1.45% in Medicare tax and 6.2% in Social Security tax. You can also choose to shelter more of your money from taxes in retirement accounts like a 401(k) or 403(b). endstream

endobj

2978 0 obj

<>stream

Select the name of the county where the parcel is located. Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there. Other Information. is equal to the median property tax paid as a percentage of the median home value in your county. On or before June1 of each year, the county assessor will send notification to the owner of record, as of May20, of every real property parcel that has been assessed at a different value than the previous year. Select the property tax year for which the Nebraska school district property taxes were levied.  There are no local income taxes in Nebraska.

There are no local income taxes in Nebraska.  Anyone who leases business personal property from another.

Anyone who leases business personal property from another.  Please notify the Assessor's Office with the following information in writing: Please note that you cannot file returns or applications relating to LB 775, Tax Increment Financing, and

Each year, on or before October15, the county board of equalization levies the necessary taxes, within the limits of the law, for operation of all functions of county government, school districts, cities, community colleges, natural resource districts, and other local authorities. var D=new Date(),d=document,b='body',ce='createElement',ac='appendChild',st='style',ds='display',n='none',gi='getElementById',lp=d.location.protocol,wp=lp.indexOf('http')==0?lp:'https:'; SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home's taxable value. WebPersonal property taxes are due and payable on December 31 and become delinquent in halves on May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have delinquent dates of April 1 and August 1). However, rates vary by location. The nonresident individual must file a Nebraska Individual Income Tax Return, Form 1040N, and Form PTC. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Some people pay extra each month to their mortgage lender. The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. Use the following equation to calculate the taxable value: Price paid X the Depreciation % = Taxable Value. The school district and community college property tax credits will be included in Nebraska taxable income if it is included in federal adjusted gross income or federal taxable income. The county assessor will determine if the homestead was uninhabitable due to a disaster at any point between January1 and August15 of the year of application and whether the applicant intends to rebuild or repair the homestead.

Please notify the Assessor's Office with the following information in writing: Please note that you cannot file returns or applications relating to LB 775, Tax Increment Financing, and