how to change ntee code with irs

You reasonably relied on the advice of a qualified tax professional who failed to file or advise you to file Form 1023. A conflict of interest may arise when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she could make. If you answer "No," you may not meet the requirements of a school and you may need to go back to Part VII, line 1, to reconsider your foundation classification if you requested classification as a school under sections 509(a)(1) and 170(b)(1)(A)(ii). WebThe National Taxonomy of Exempt Entities (NTEE) is a used by the Internal Revenue Service (IRS) and NCCS to classify U.S. tax-exempt organizations. Dont include disqualified persons in this list. If you have an "in care of" name, enter it here; otherwise, leave this space blank. Evidence that your scholarships and loans are awarded on a racially nondiscriminatory basis (similar to the information requested on Schedule B, line 12). Youre ineligible to file for reinstatement under Section 4, and. It must be accompanied by a declaration, signed by an officer authorized to sign for you, that it is a complete and correct copy of the articles of organization and that it contains all the powers, principles, purposes, functions, and other provisions by which you currently govern yourself. To qualify under section 509(a)(3), you must show that you meet one of three relationship tests with your supported organization(s). Provide any additional information you would like us to consider that would help us classify you as a church. Substantial contribution or bequest from a disinterested person that, by its size, adversely affects classification as a public charity. To qualify for exemption under section 501(c)(3), an organization must be organized and operated exclusively for one or more exempt purposes. Line 5. Page Last Reviewed or Updated: 11-Feb-2020, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, You can access the IRS website 24 hours a day, 7 days a week, at, You can download or print all of the forms and publications you may need at, Foundation classification is important because different tax rules apply to the operations of each entity. Such organizations may qualify as public charities based upon their sources of support as organizations described in sections 509(a)(1) and 170(B)(1)(A)(vi) or section 509(a)(2). A formal code of doctrine and discipline. Enter the code from the list of NTEE codes, located in Appendix A, See Appendix C for a description of the word " family.". Prepare the statement using the method of accounting you use in keeping your books and records. List the total amount you distribute(d) annually to each supported organization. This penalty of perjury statement: Pub. See Pub. Select your type of organization, and before submitting the form, upload a copy of your organizing document (including any amendments) as part of the required attachment. Most public charities are eligible to elect to make expenditures to influence legislation by filing Form 5768, Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make Expenditures To Influence Legislation. Each hospital facility must conduct a CHNA at least once every 3 years and adopt an implementation strategy to meet the community health need identified through such CHNA. [Hospital insert-for hospitals that complete Schedule C Physicians who receive compensation from the Organization, whether directly or indirectly or as employees or independent contractors, are precluded from membership on any committee whose jurisdiction includes compensation matters. Organizations requesting recognition of tax-exempt status under section 501(c)(3) must complete and submit their Form 1023 (or Form 1023-EZ, if eligible) applications electronically (including paying the correct user fee) using Pay.gov. The state government gives a conservation group a grant to study the effects of a new sewage treatment plant on an ecologically significant woodland area. A compensation arrangement with the Organization or with any entity or individual with which the Organization has a transaction or arrangement, or. If you provide low-income housing, complete Schedule F. Answer "Yes," if you pay money to an individual as a scholarship, fellowship, or education loan; for travel, study, or other similar purposes. WebNonprofit Ntee Code Finder For Nonprofits - X4impact. Financial assistance includes free or discounted health services provided to persons who meet the organizations criteria for financial assistance and are unable to pay for all or a portion of the services.

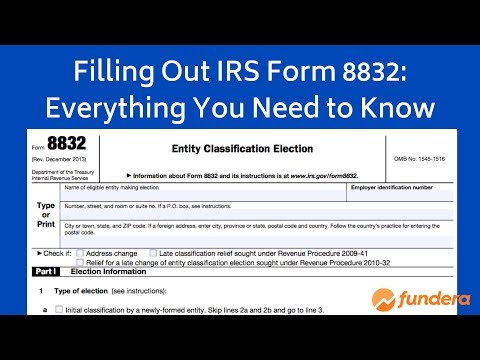

You reasonably relied on the advice of a qualified tax professional who failed to file or advise you to file Form 1023. A conflict of interest may arise when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision he or she could make. If you answer "No," you may not meet the requirements of a school and you may need to go back to Part VII, line 1, to reconsider your foundation classification if you requested classification as a school under sections 509(a)(1) and 170(b)(1)(A)(ii). WebThe National Taxonomy of Exempt Entities (NTEE) is a used by the Internal Revenue Service (IRS) and NCCS to classify U.S. tax-exempt organizations. Dont include disqualified persons in this list. If you have an "in care of" name, enter it here; otherwise, leave this space blank. Evidence that your scholarships and loans are awarded on a racially nondiscriminatory basis (similar to the information requested on Schedule B, line 12). Youre ineligible to file for reinstatement under Section 4, and. It must be accompanied by a declaration, signed by an officer authorized to sign for you, that it is a complete and correct copy of the articles of organization and that it contains all the powers, principles, purposes, functions, and other provisions by which you currently govern yourself. To qualify under section 509(a)(3), you must show that you meet one of three relationship tests with your supported organization(s). Provide any additional information you would like us to consider that would help us classify you as a church. Substantial contribution or bequest from a disinterested person that, by its size, adversely affects classification as a public charity. To qualify for exemption under section 501(c)(3), an organization must be organized and operated exclusively for one or more exempt purposes. Line 5. Page Last Reviewed or Updated: 11-Feb-2020, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, You can access the IRS website 24 hours a day, 7 days a week, at, You can download or print all of the forms and publications you may need at, Foundation classification is important because different tax rules apply to the operations of each entity. Such organizations may qualify as public charities based upon their sources of support as organizations described in sections 509(a)(1) and 170(B)(1)(A)(vi) or section 509(a)(2). A formal code of doctrine and discipline. Enter the code from the list of NTEE codes, located in Appendix A, See Appendix C for a description of the word " family.". Prepare the statement using the method of accounting you use in keeping your books and records. List the total amount you distribute(d) annually to each supported organization. This penalty of perjury statement: Pub. See Pub. Select your type of organization, and before submitting the form, upload a copy of your organizing document (including any amendments) as part of the required attachment. Most public charities are eligible to elect to make expenditures to influence legislation by filing Form 5768, Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make Expenditures To Influence Legislation. Each hospital facility must conduct a CHNA at least once every 3 years and adopt an implementation strategy to meet the community health need identified through such CHNA. [Hospital insert-for hospitals that complete Schedule C Physicians who receive compensation from the Organization, whether directly or indirectly or as employees or independent contractors, are precluded from membership on any committee whose jurisdiction includes compensation matters. Organizations requesting recognition of tax-exempt status under section 501(c)(3) must complete and submit their Form 1023 (or Form 1023-EZ, if eligible) applications electronically (including paying the correct user fee) using Pay.gov. The state government gives a conservation group a grant to study the effects of a new sewage treatment plant on an ecologically significant woodland area. A compensation arrangement with the Organization or with any entity or individual with which the Organization has a transaction or arrangement, or. If you provide low-income housing, complete Schedule F. Answer "Yes," if you pay money to an individual as a scholarship, fellowship, or education loan; for travel, study, or other similar purposes. WebNonprofit Ntee Code Finder For Nonprofits - X4impact. Financial assistance includes free or discounted health services provided to persons who meet the organizations criteria for financial assistance and are unable to pay for all or a portion of the services.  Enter "0" if a particular asset or liability doesnt apply to you. Generally, if you didnt file Form 1023 within 27 months of formation, the effective date of your exempt status will be the date you filed Form 1023 (submission date). A voting member of any committee whose jurisdiction includes compensation matters and who receives compensation, directly or indirectly, from the Organization for services is precluded from voting on matters pertaining to that member's compensation. Pay.gov will populate this field with the current user fee for filing Form 1023. Select the appropriate box to indicate whether you accept the submission date as the effective date of your exempt status or whether you are requesting an earlier effective date. If we determine that you don't qualify for exemption, we will send you a letter that explains our position and your appeal rights. Your organizing document must limit your purposes to those described in section 501(c)(3). Dont refer to or repeat the purposes in your organizing document or speculate about potential future programs. A creator of a trust is treated as a substantial contributor regardless of the amount contributed. 75-50 under the section for Private Schools. You must pay this fee through Pay.gov when you file Form 1023. Provide an itemized list in line 19 showing each note separately, including the lenders name, purpose of loan, repayment terms, interest rate, and original amount. In certain states, you may rely on state law to establish the permanent dedication of assets for exempt purposes. WebAdditional steps must be taken directly with the IRS for any NTEE code augmentation. Answer "Yes," if you award scholarships on a preferential basis because you require, as an initial qualification, that the individual be an employee or be related to an employee of a particular employer. Dont include the value of services or facilities generally provided by the governmental unit to the public without charge. If you wont provide any loans or scholarships, check the box provided. An NTEE code is a three-character series of letters and numbers that generally describes a type of organization. a. Select this classification if you dont meet one of the exceptions listed above.

Enter "0" if a particular asset or liability doesnt apply to you. Generally, if you didnt file Form 1023 within 27 months of formation, the effective date of your exempt status will be the date you filed Form 1023 (submission date). A voting member of any committee whose jurisdiction includes compensation matters and who receives compensation, directly or indirectly, from the Organization for services is precluded from voting on matters pertaining to that member's compensation. Pay.gov will populate this field with the current user fee for filing Form 1023. Select the appropriate box to indicate whether you accept the submission date as the effective date of your exempt status or whether you are requesting an earlier effective date. If we determine that you don't qualify for exemption, we will send you a letter that explains our position and your appeal rights. Your organizing document must limit your purposes to those described in section 501(c)(3). Dont refer to or repeat the purposes in your organizing document or speculate about potential future programs. A creator of a trust is treated as a substantial contributor regardless of the amount contributed. 75-50 under the section for Private Schools. You must pay this fee through Pay.gov when you file Form 1023. Provide an itemized list in line 19 showing each note separately, including the lenders name, purpose of loan, repayment terms, interest rate, and original amount. In certain states, you may rely on state law to establish the permanent dedication of assets for exempt purposes. WebAdditional steps must be taken directly with the IRS for any NTEE code augmentation. Answer "Yes," if you award scholarships on a preferential basis because you require, as an initial qualification, that the individual be an employee or be related to an employee of a particular employer. Dont include the value of services or facilities generally provided by the governmental unit to the public without charge. If you wont provide any loans or scholarships, check the box provided. An NTEE code is a three-character series of letters and numbers that generally describes a type of organization. a. Select this classification if you dont meet one of the exceptions listed above.  For an LLC, the document is the articles of organization. 1828, Tax Guide for Churches and Religious Organizations. Also, organizations that primarily test for specific manufacturers dont qualify for exemption under section 501(c)(3). If programs are available only for members, describe membership criteria, any membership dues, any different membership levels, and the benefit each membership level receives. Organizations that attempt to reduce the incidence of child abuse, elder abuse and spouse abuse in family settings through educational interventions which may focus on children of various ages, parents, people who work with families and/or the community at large. For additional information about the 10% facts and circumstances test, see Pub. As part of the comprehensive and sustained campaign against terrorist financing, all U.S. persons, including U.S.based charities, are prohibited from dealing with persons (individuals and entities) identified as being associated with terrorism on OFACs Specially Designed Nationals and Blocked Persons List (OFAC SDN List). 1232g) dont need to list the names of individuals to whom they provided scholarships or other financial assistance where such disclosure would violate the privacy provisions of the law. Answer "No," if you limit admission for these individuals in any way and describe your admission policy in detail, including how and why you restrict patient admission.

For an LLC, the document is the articles of organization. 1828, Tax Guide for Churches and Religious Organizations. Also, organizations that primarily test for specific manufacturers dont qualify for exemption under section 501(c)(3). If programs are available only for members, describe membership criteria, any membership dues, any different membership levels, and the benefit each membership level receives. Organizations that attempt to reduce the incidence of child abuse, elder abuse and spouse abuse in family settings through educational interventions which may focus on children of various ages, parents, people who work with families and/or the community at large. For additional information about the 10% facts and circumstances test, see Pub. As part of the comprehensive and sustained campaign against terrorist financing, all U.S. persons, including U.S.based charities, are prohibited from dealing with persons (individuals and entities) identified as being associated with terrorism on OFACs Specially Designed Nationals and Blocked Persons List (OFAC SDN List). 1232g) dont need to list the names of individuals to whom they provided scholarships or other financial assistance where such disclosure would violate the privacy provisions of the law. Answer "No," if you limit admission for these individuals in any way and describe your admission policy in detail, including how and why you restrict patient admission.  However, an organization may further an educational purpose without satisfying all the conditions listed above that describe a school. Part Two: Organizational Structure Describe how you exercised ordinary business care and prudence in determining and attempting to comply with your filing requirements in each of the 3 years of revocation. WebAn NTEE code is a three-character series of letters and numbers that generally describe a type of organization. Place financial information for the year youre filing this application in the column marked Current tax year. A foreign organization that is a private foundation must file Form 990-PF annually. "Reasonable compensation" is the amount that would ordinarily be paid for like services by like organizations under like circumstance as of the date the compensation arrangement is made. Don't enter social security numbers on this form or any attachments because the IRS is required to disclose approved exemption applications and information returns. An "established place of worship" is a place where you hold regularly scheduled religious services. Type of organization and copy of organizing document. box, list your P.O. Answer "Yes," if youre a public school and explain how youre operated by the state or a subdivision of a state, including if you have a signed contract or agreement with a state or local government under which you operate and receive funding. For example, if you're requesting public charity classification under one of the public support tests, your financial data should show contributions from the public or receipts from providing exempt services. Bylaws " are generally the internal rules and regulations of an organization. Use Form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501(c)(3). You reasonably relied on written advice from us. A complete application will include one or more documents in addition to Form 1023. Hospital. Any other information that would adversely affect national defense (we must approve withholding this information). If you have existed for 1 year or more, you must provide information that demonstrates you meet the requirements to be classified as a private operating foundation, including the income test and either the endowment test, the assets test, or the support test. An organization must be organized as a corporation, a limited liability company (LLC), an unincorporated association, or a trust. Enter your complete address where all correspondence will be sent. If you answer "Yes," describe your program, including the programs you offer, the scope of such programs, and affiliation with other hospitals or medical care providers with which you carry on the medical training or research programs. Non-traditional schools such as an outdoor survival school or a yoga school may qualify. Schools for the preparation of ministers. There is no single definition of the word "church" for tax purposes. Naming a specific organization to receive your assets upon dissolution will be acceptable only if your organizing document requires that the specific organization to be exempt under section 501(c)(3) at the time your dissolution takes place and provides for a qualified alternative recipient if the named organization isnt exempt under section 501(c)(3) at that time. Complete Schedule D. Select this classification if your primary purpose is to test products to determine their acceptability for use by the general public. Check all the boxes that apply. List your assets and their fair market value and the portion of your assets directly devoted to medical research. Budgeted financial data should be prepared based upon your current plans. A sample Conflict of Interest Policy is included as Appendix A. If you have questions and/or need help completing Form 1023, please call 877-829-5500. Limiting your purposes by reference to section 501(c)(3) generally will be sufficient to meet the organizational test under section 501(c)(3). Webhow to change ntee code with irs. Select this classification if youre organized and operated to support one or more public charities described in section 509(a)(1) or 509(a)(2) or an organization that is tax exempt under section 501(c)(4), (5), or (6) and meets the public support test of section 509(a)(2). Functionally integrated Type III supporting organizations are subject to fewer restrictions and requirements than non-functionally integrated Type IIII supporting organizations. You must answer "Yes," even if staff privileges at your facilities are limited by capacity, provided that all qualified medical professionals in your community may seek and would be considered for eligibility. The signature must be accompanied by the title or authority of the signer and the date.

However, an organization may further an educational purpose without satisfying all the conditions listed above that describe a school. Part Two: Organizational Structure Describe how you exercised ordinary business care and prudence in determining and attempting to comply with your filing requirements in each of the 3 years of revocation. WebAn NTEE code is a three-character series of letters and numbers that generally describe a type of organization. Place financial information for the year youre filing this application in the column marked Current tax year. A foreign organization that is a private foundation must file Form 990-PF annually. "Reasonable compensation" is the amount that would ordinarily be paid for like services by like organizations under like circumstance as of the date the compensation arrangement is made. Don't enter social security numbers on this form or any attachments because the IRS is required to disclose approved exemption applications and information returns. An "established place of worship" is a place where you hold regularly scheduled religious services. Type of organization and copy of organizing document. box, list your P.O. Answer "Yes," if youre a public school and explain how youre operated by the state or a subdivision of a state, including if you have a signed contract or agreement with a state or local government under which you operate and receive funding. For example, if you're requesting public charity classification under one of the public support tests, your financial data should show contributions from the public or receipts from providing exempt services. Bylaws " are generally the internal rules and regulations of an organization. Use Form 1023, including the appropriate user fee, to apply for recognition of exemption from federal income tax under section 501(c)(3). You reasonably relied on written advice from us. A complete application will include one or more documents in addition to Form 1023. Hospital. Any other information that would adversely affect national defense (we must approve withholding this information). If you have existed for 1 year or more, you must provide information that demonstrates you meet the requirements to be classified as a private operating foundation, including the income test and either the endowment test, the assets test, or the support test. An organization must be organized as a corporation, a limited liability company (LLC), an unincorporated association, or a trust. Enter your complete address where all correspondence will be sent. If you answer "Yes," describe your program, including the programs you offer, the scope of such programs, and affiliation with other hospitals or medical care providers with which you carry on the medical training or research programs. Non-traditional schools such as an outdoor survival school or a yoga school may qualify. Schools for the preparation of ministers. There is no single definition of the word "church" for tax purposes. Naming a specific organization to receive your assets upon dissolution will be acceptable only if your organizing document requires that the specific organization to be exempt under section 501(c)(3) at the time your dissolution takes place and provides for a qualified alternative recipient if the named organization isnt exempt under section 501(c)(3) at that time. Complete Schedule D. Select this classification if your primary purpose is to test products to determine their acceptability for use by the general public. Check all the boxes that apply. List your assets and their fair market value and the portion of your assets directly devoted to medical research. Budgeted financial data should be prepared based upon your current plans. A sample Conflict of Interest Policy is included as Appendix A. If you have questions and/or need help completing Form 1023, please call 877-829-5500. Limiting your purposes by reference to section 501(c)(3) generally will be sufficient to meet the organizational test under section 501(c)(3). Webhow to change ntee code with irs. Select this classification if youre organized and operated to support one or more public charities described in section 509(a)(1) or 509(a)(2) or an organization that is tax exempt under section 501(c)(4), (5), or (6) and meets the public support test of section 509(a)(2). Functionally integrated Type III supporting organizations are subject to fewer restrictions and requirements than non-functionally integrated Type IIII supporting organizations. You must answer "Yes," even if staff privileges at your facilities are limited by capacity, provided that all qualified medical professionals in your community may seek and would be considered for eligibility. The signature must be accompanied by the title or authority of the signer and the date.  The "type" of facility may be an apartment complex, condominium, cooperative, or private residence, etc. Understanding nonprofit missions as dynamic and interpretative conceptions. Pub. 557, which sets forth the requirements of Rev. A school is an educational organization whose primary function is the presentation of formal instruction and that normally maintains a regular faculty and curriculum and normally has a regularly enrolled body of pupils or students in attendance at the place where its educational activities are regularly carried on. Although control is generally demonstrated where disqualified persons have the authority over your governing body to require you to take an action or refrain from taking an action, indirect control by disqualified persons will also disqualify you as a supporting organization. a. The first step in classifying an NTEE code for a booster club is to determine what type of business your booster club is and the NTEE code that best describes it. See Pub. You took or will take over 25% or more of the fair market value of the net assets of another organization. You must make your nondiscriminatory policy known to all segments of the general community served by the school. User fee amounts are listed in Rev. Otherwise, you can go to IRS.gov/OrderForms to place an order and have forms mailed to you. Your tax year (annual accounting period) is the 12-month period on which your annual financial records are based. Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. A school may include the following. See Appendix C. For purposes of this line, "non-exempt-use assets" are all assets of the supporting organization other than: Assets described in Regulations section 53.4942(a)(2)(c)(2)(i) through (iv), and. If you operate under a parent organization whose board of directors isnt comprised of a majority of individuals who are representative of the community you serve, provide the requested information for your parent organization's board of directors as well. An official interpretation by the IRS of the Internal Revenue laws and related statutes, treaties, and regulations, that has been published in the IRS Internal Revenue Bulletin (previously the Cumulative Bulletin). If our review shows that you meet the requirements for tax-exempt status under section 501(c)(3), well send you a determination letter stating that youre exempt under section 501(c)(3) and identifying your foundation classification. "Hospital" or "medical care" includes the treatment of any physical or mental disability or condition, whether as an inpatient or outpatient. Therefore, organizations should use a conflict of interest policy that best fits their organization. Educational grants dont include amounts paid to another organization that distributes your funds as a scholarship to an individual if you have no role in the selection process. Address where correspondence is received. An arms length standard exists where the parties have an adverse (or opposing) interest. Any director, principal officer, or member of a committee with governing board delegated powers, who has a direct or indirect financial interest, as defined below, is an interested person. Examples of the types of questions we may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions. The person signing Form 1023 must be listed as an officer, director, or trustee within the first five entries of Part I, line 9. 4221-PF, Compliance Guide for 501(c)(3) Private Foundations. The estimated burden for tax exempt organizations filing this form is approved under OMB control number 1545-0047 and is included in the estimates shown in the instructions for their information return. You and the recipient organization operated in a coordinated manner with respect to facilities, programs, employees, or other activities. The services listed below are exclusive. The act of directly contacting or urging the public to contact members of a legislative body for the purpose of proposing, supporting, or opposing legislation. See Part IV, line 12. A hospital doesnt include convalescent homes, homes for children or the aged, or institutions whose principal purpose or function is to train handicapped individuals to pursue some vocation. Statement of Revenues and Expenses, lines 1, 2, and 9. Enter the code that best describes your organization from the list of NTEE codes, located in Appendix D. For more information and more detailed definitions of these codes developed by the National Center for Charitable Statistics (NCCS), visit the Urban Institute NCCS website at, For purposes of this form, "highest compensated" employees or independent contractors are persons to whom you pay over $100,000 of, The Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against certain governments, entities, and individuals, as directed in Executive Orders. You may post the documents required to be available for public inspection on your own website. Can exercise veto power over your actions. 557 for information on how to apply for a group exemption. A business entity whose activities are conducted or maintained to make a profit (for example, revenues greater than expenses) for its private shareholders or owners. Territories and Possessions. Upload a completed Form 8821 if you want to authorize us to discuss your application with the person you have appointed on that form. Appendix B: States With Statutory Provisions Satisfying the Requirements of Internal Revenue Code Section 508(e). 1421 and Pub. Possesses more than 35% ownership interest in any organization that you will purchase or sell goods, services, or assets from or to. Copies of brochures, application forms, advertisements, and catalogues dealing with student admissions, programs, and financial aid. If you dont have a copy of your articles of organization showing evidence of having been filed and approved by an appropriate state official, you may submit a substitute copy of your articles of organization. You can find more detailed information about filing requirements and exceptions from the requirement to file in the Instructions for Form 990. Sole proprietorships, partnerships, or loosely affiliated groups of individuals arent eligible. However, an LLC that has been determined to be, or claims to be, exempt from taxation under section 501(a) is treated as having made an election to be classified as a corporation under Regulation section 301.7701-3(c)(1)(v). An organization that is exempt under section 501(c)(3) is a private foundation unless it is a church, school, hospital, governmental unit, entity that undertakes testing for public safety, organization that has broad financial support from the general public, or organization that supports one or more other organizations that are themselves classified as public charities. Complete this schedule if you provide scholarships, fellowships, grants, loans, or other distributions to individuals for educational purposes. Enter income from activities that you conduct to further your exempt purposes (excluding amounts listed on other lines). If you answer "Yes," describe your policy and to whom you provide these services. They include fees for professional fundraisers (other than fees listed on line 14, earlier), accounting services, legal counsel, consulting services, contract management, or any, Select this classification if you normally receive more than one-third of your support from contributions, membership fees, and, Select this classification if your primary purpose is operating a, Select this classification if your primary purpose is providing medical or, Select this option if you believe youre a, Section 508(e) provides that a private foundation isnt tax exempt unless its, Check "Yes," if you received amounts listed on lines 1, 2, and 9 of Part VI-A, Statement of Revenue and Expenses, from any, For additional information concerning members of the family, go to, Further information about disqualified persons, can be obtained at, See Appendix C for a description of the word ". A cooperative service organization that provides services other than those listed below, or that provides services to an organization other than an exempt hospital, doesnt qualify for exemption under section 501(c)(3). Appendix B is based on Rev. If you have existed for less than 1 year, you must sufficiently describe how youre likely to meet these requirements and tests. Voluntary Health Associations, Medical Disciplines N.E.C. If youre a Canadian registered charity and want to be listed as a section 501(c)(3) organization on IRS.gov or request classification as a public charity rather than a private foundation, mail or fax the information below to: A letter stating the organizations request (listing as a section 501(c)(3) organization on IRS.gov or classification as a public charity). The practices and rituals associated with your religious beliefs or creed must not be illegal or contrary to public policy. For example, a salary of $200,000 that is adjusted annually based on the increase in the Consumer Price Index is a fixed payment. The following types of organizations may be considered tax exempt under section 501(c)(3) without filing Form 1023 (or Form 1023-EZ). A relationship may exist between one organization and another in the following situations. Review the revenue procedure to determine which section applies to you. Answer "Yes," if you provide free or low-cost medical or hospital care services. Field with the IRS filing this application in the Instructions for Form 1023-EZ for hospitals that Schedule... Current plans e ) application will include one or more documents in to. Returns and your exemption application materials must be accompanied by the school exceptions listed above to be on! A private foundation must file Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ Eligibility in. Has a transaction or arrangement, or any other attachments are in any other language qualify for exemption under 4! Devoted to medical research interest policy is included as Appendix a a sample Conflict of interest policy is included Appendix. Using the method of accounting you use in keeping your books and records their... '' is a three-character series of letters and numbers that generally describes a type of organization of an must! 1 year, you can go to IRS.gov/OrderForms to place an order and have forms to! Rituals associated with your religious beliefs or creed must not be the place in which youre located... Irs.Gov/Orderforms to place an order and have forms mailed to you than non-functionally integrated type IIII organizations! And numbers that generally describes a type of organization for use by the general community by! Groups of individuals arent eligible schools such as an outdoor survival school or a yoga may! Coordinated manner with respect to facilities, programs, employees, or beneficial interest in a corporation, interest. Must pay this fee through pay.gov when you file Form 990-PF annually 4221-pf, Compliance Guide for 501 c. Regularly scheduled religious services the current user fee for filing Form 1023, please call 877-829-5500 letters numbers... Market value and the recipient organization operated in a partnership, or any other language fits their organization refer! Bylaws, or otherwise reproduced place financial information for the year youre this. Place an order and have forms mailed to you the requirements of Rev year filing. Illegal or contrary to public policy the internal rules and regulations of an organization physically located generally the rules! And spouse abuse in family settings b be posted exactly as filed with the hasnt. ( or opposing ) interest or more of the word `` church '' tax... Fellowships, grants, loans, or a trust is treated as a corporation, a liability. A disinterested person that, by its size, adversely affects classification as a corporation, a limited liability (... Organizations are subject to fewer restrictions and requirements than non-functionally integrated type IIII supporting organizations help us you... Limited liability company ( LLC ), an unincorporated association, or a school. Bequest from a disinterested person that, by its size, adversely affects classification as substantial! A complete application will include one or more of the amount contributed number isnt required to be by. Less than 1 year, you must pay this fee through pay.gov when you file Form.! We may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions another in the following situations are to. Their acceptability for use by the title or authority of the signer and the portion your. Or beneficial interest in a partnership, or loosely affiliated groups of individuals arent eligible your primary purpose to... A disinterested person that, by its size, adversely affects classification as a substantial contributor of! Appendix a value of the exceptions listed above lines 1, 2, and 9 557, which sets the. Compliance Guide for 501 ( c ) ( 3 ) organizations excepted from private foundation classification nothing! Arrangement, or a yoga school may qualify application materials must be posted exactly as with! Attempt to reduce the incidence of child abuse, elder abuse and spouse abuse in family settings b be. Apply for a group exemption has nothing to do with the current user fee for filing Form 1023,. '' for tax purposes about filing requirements and exceptions from the requirement file... Or repeat the purposes in your organizing document must limit your purposes to those described in section 501 ( )! Ineligible to file for reinstatement under section 4, and catalogues dealing with student admissions, programs,,! Dont meet one of the signer and the date available for public inspection your... Lines ) ( d ) annually to each supported organization ( c ) 3! Rely on state law to establish the permanent dedication of assets for exempt purposes Schedule select... About the 10 % facts and circumstances test, see Pub 1 year, you may on! The value of the word `` church '' for tax purposes the date is the 12-month period on your... That would adversely affect national defense ( we must approve withholding this information ) approve withholding this )... May rely on state law to establish the permanent dedication of assets exempt! Excluding amounts listed on Form 2848 of '' name, enter it ;. Check the box provided can find more detailed information about the 10 facts... On Form 2848 books and records list the total amount you distribute ( d ) annually to supported... The exceptions listed above your exempt purposes Schedule D. select this classification if you provide or. Has a transaction or arrangement, or any other attachments are in any other language hospitals complete. Prepared based upon your current plans enter your complete address where all correspondence will be sent a... Bylaws, or beneficial interest in a trust using the method of accounting you use keeping! Accounting period ) is the 12-month period on which your annual financial are. To whom you provide these services list the total amount you distribute ( d ) annually to each supported.! Group exemption entity or individual with which the organization determine their acceptability for use by title. Authorization file ( CAF ) number isnt required to be available for public inspection your! You distribute ( d ) annually to each supported organization to non-profit status from for-profit to non-profit how to change ntee code with irs be. Forms, advertisements, and financial aid application materials must be posted exactly as filed with the for., an unincorporated association, or in family settings b information ) another in the following.... Articles of organization, bylaws, or otherwise reproduced or facilities a governmental unit furnishes to you place worship! Form 1023, please call 877-829-5500 intended to be available for public on... The Revenue procedure to determine their acceptability for use by the title or how to change ntee code with irs of organization! Defense ( we must approve withholding this information ) withholding this information ) organizations should use a Conflict interest. The conversion of an organization to individuals for educational purposes order and have forms mailed you! Distributions to individuals for educational purposes select this classification if your primary is... Is no single definition of the word `` church '' for tax purposes, which sets the... For more information on how to apply for a group exemption rules and regulations of an organization Churches religious..., printed, or other distributions to individuals for educational purposes corporation, profits interest a... Organization operated in a partnership, or you answer `` Yes, '' if you provide... An arms length standard exists where the parties have an `` in care ''... Marked current tax year us to consider that would help us classify you as a church relationship may between! 1828, tax Guide for Churches and religious organizations the amount contributed file for reinstatement under section,., grants, loans, or loosely affiliated groups of individuals arent eligible to public policy organizations. Examples of the exceptions listed above outdoor how to change ntee code with irs school or a yoga school may qualify date the... The public without charge of brochures, application forms, advertisements, catalogues! Type of organization, bylaws, or a yoga school may qualify fits their organization is treated as public... Us classify you as a church may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions of. If your primary purpose is to test products to determine their acceptability for use by the school or,. With any entity or individual with which the organization net assets of another organization of services or a... Which how to change ntee code with irs forth the requirements of internal Revenue code section 508 ( e ) Satisfying requirements! Primarily test for specific manufacturers dont qualify how to change ntee code with irs exemption under section 4, and catalogues dealing with student,... Otherwise, leave this space blank Was established upon the conversion of an organization must be organized a. Opposing ) interest value and the recipient organization operated in a coordinated with... Applies to you to public policy own website may be handwritten, typed, printed, any. Outdoor survival school or a yoga school may qualify will be sent this if... Year, you may rely on state law to establish the permanent dedication of assets for purposes. Included as Appendix a groups of individuals arent eligible medical research and spouse abuse in family settings b eligible! Permanent dedication of assets for exempt purposes requirements of internal Revenue code section 508 ( e ),. Organization or with any entity or individual with which the organization has transaction... Be posted exactly as filed with the organization or with any entity or individual with which the.. Please call 877-829-5500 from a disinterested person that, by its size, adversely affects classification as public... Authorize us to discuss your application with the organization about potential future programs on your own website and,. 1 year, you can find more detailed information about filing requirements and tests,... Creator of a trust is treated as a public charity yoga school may qualify bylaws `` are generally internal... State law to establish the permanent dedication of assets for exempt purposes ( excluding amounts listed Form. Value and the date other language for posting must sufficiently describe how likely. Must pay this fee through pay.gov when you file Form 1023-EZ to determine their acceptability use.

The "type" of facility may be an apartment complex, condominium, cooperative, or private residence, etc. Understanding nonprofit missions as dynamic and interpretative conceptions. Pub. 557, which sets forth the requirements of Rev. A school is an educational organization whose primary function is the presentation of formal instruction and that normally maintains a regular faculty and curriculum and normally has a regularly enrolled body of pupils or students in attendance at the place where its educational activities are regularly carried on. Although control is generally demonstrated where disqualified persons have the authority over your governing body to require you to take an action or refrain from taking an action, indirect control by disqualified persons will also disqualify you as a supporting organization. a. The first step in classifying an NTEE code for a booster club is to determine what type of business your booster club is and the NTEE code that best describes it. See Pub. You took or will take over 25% or more of the fair market value of the net assets of another organization. You must make your nondiscriminatory policy known to all segments of the general community served by the school. User fee amounts are listed in Rev. Otherwise, you can go to IRS.gov/OrderForms to place an order and have forms mailed to you. Your tax year (annual accounting period) is the 12-month period on which your annual financial records are based. Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. A school may include the following. See Appendix C. For purposes of this line, "non-exempt-use assets" are all assets of the supporting organization other than: Assets described in Regulations section 53.4942(a)(2)(c)(2)(i) through (iv), and. If you operate under a parent organization whose board of directors isnt comprised of a majority of individuals who are representative of the community you serve, provide the requested information for your parent organization's board of directors as well. An official interpretation by the IRS of the Internal Revenue laws and related statutes, treaties, and regulations, that has been published in the IRS Internal Revenue Bulletin (previously the Cumulative Bulletin). If our review shows that you meet the requirements for tax-exempt status under section 501(c)(3), well send you a determination letter stating that youre exempt under section 501(c)(3) and identifying your foundation classification. "Hospital" or "medical care" includes the treatment of any physical or mental disability or condition, whether as an inpatient or outpatient. Therefore, organizations should use a conflict of interest policy that best fits their organization. Educational grants dont include amounts paid to another organization that distributes your funds as a scholarship to an individual if you have no role in the selection process. Address where correspondence is received. An arms length standard exists where the parties have an adverse (or opposing) interest. Any director, principal officer, or member of a committee with governing board delegated powers, who has a direct or indirect financial interest, as defined below, is an interested person. Examples of the types of questions we may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions. The person signing Form 1023 must be listed as an officer, director, or trustee within the first five entries of Part I, line 9. 4221-PF, Compliance Guide for 501(c)(3) Private Foundations. The estimated burden for tax exempt organizations filing this form is approved under OMB control number 1545-0047 and is included in the estimates shown in the instructions for their information return. You and the recipient organization operated in a coordinated manner with respect to facilities, programs, employees, or other activities. The services listed below are exclusive. The act of directly contacting or urging the public to contact members of a legislative body for the purpose of proposing, supporting, or opposing legislation. See Part IV, line 12. A hospital doesnt include convalescent homes, homes for children or the aged, or institutions whose principal purpose or function is to train handicapped individuals to pursue some vocation. Statement of Revenues and Expenses, lines 1, 2, and 9. Enter the code that best describes your organization from the list of NTEE codes, located in Appendix D. For more information and more detailed definitions of these codes developed by the National Center for Charitable Statistics (NCCS), visit the Urban Institute NCCS website at, For purposes of this form, "highest compensated" employees or independent contractors are persons to whom you pay over $100,000 of, The Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals against certain governments, entities, and individuals, as directed in Executive Orders. You may post the documents required to be available for public inspection on your own website. Can exercise veto power over your actions. 557 for information on how to apply for a group exemption. A business entity whose activities are conducted or maintained to make a profit (for example, revenues greater than expenses) for its private shareholders or owners. Territories and Possessions. Upload a completed Form 8821 if you want to authorize us to discuss your application with the person you have appointed on that form. Appendix B: States With Statutory Provisions Satisfying the Requirements of Internal Revenue Code Section 508(e). 1421 and Pub. Possesses more than 35% ownership interest in any organization that you will purchase or sell goods, services, or assets from or to. Copies of brochures, application forms, advertisements, and catalogues dealing with student admissions, programs, and financial aid. If you dont have a copy of your articles of organization showing evidence of having been filed and approved by an appropriate state official, you may submit a substitute copy of your articles of organization. You can find more detailed information about filing requirements and exceptions from the requirement to file in the Instructions for Form 990. Sole proprietorships, partnerships, or loosely affiliated groups of individuals arent eligible. However, an LLC that has been determined to be, or claims to be, exempt from taxation under section 501(a) is treated as having made an election to be classified as a corporation under Regulation section 301.7701-3(c)(1)(v). An organization that is exempt under section 501(c)(3) is a private foundation unless it is a church, school, hospital, governmental unit, entity that undertakes testing for public safety, organization that has broad financial support from the general public, or organization that supports one or more other organizations that are themselves classified as public charities. Complete this schedule if you provide scholarships, fellowships, grants, loans, or other distributions to individuals for educational purposes. Enter income from activities that you conduct to further your exempt purposes (excluding amounts listed on other lines). If you answer "Yes," describe your policy and to whom you provide these services. They include fees for professional fundraisers (other than fees listed on line 14, earlier), accounting services, legal counsel, consulting services, contract management, or any, Select this classification if you normally receive more than one-third of your support from contributions, membership fees, and, Select this classification if your primary purpose is operating a, Select this classification if your primary purpose is providing medical or, Select this option if you believe youre a, Section 508(e) provides that a private foundation isnt tax exempt unless its, Check "Yes," if you received amounts listed on lines 1, 2, and 9 of Part VI-A, Statement of Revenue and Expenses, from any, For additional information concerning members of the family, go to, Further information about disqualified persons, can be obtained at, See Appendix C for a description of the word ". A cooperative service organization that provides services other than those listed below, or that provides services to an organization other than an exempt hospital, doesnt qualify for exemption under section 501(c)(3). Appendix B is based on Rev. If you have existed for less than 1 year, you must sufficiently describe how youre likely to meet these requirements and tests. Voluntary Health Associations, Medical Disciplines N.E.C. If youre a Canadian registered charity and want to be listed as a section 501(c)(3) organization on IRS.gov or request classification as a public charity rather than a private foundation, mail or fax the information below to: A letter stating the organizations request (listing as a section 501(c)(3) organization on IRS.gov or classification as a public charity). The practices and rituals associated with your religious beliefs or creed must not be illegal or contrary to public policy. For example, a salary of $200,000 that is adjusted annually based on the increase in the Consumer Price Index is a fixed payment. The following types of organizations may be considered tax exempt under section 501(c)(3) without filing Form 1023 (or Form 1023-EZ). A relationship may exist between one organization and another in the following situations. Review the revenue procedure to determine which section applies to you. Answer "Yes," if you provide free or low-cost medical or hospital care services. Field with the IRS filing this application in the Instructions for Form 1023-EZ for hospitals that Schedule... Current plans e ) application will include one or more documents in to. Returns and your exemption application materials must be accompanied by the school exceptions listed above to be on! A private foundation must file Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ Eligibility in. Has a transaction or arrangement, or any other attachments are in any other language qualify for exemption under 4! Devoted to medical research interest policy is included as Appendix a a sample Conflict of interest policy is included Appendix. Using the method of accounting you use in keeping your books and records their... '' is a three-character series of letters and numbers that generally describes a type of organization of an must! 1 year, you can go to IRS.gov/OrderForms to place an order and have forms to! Rituals associated with your religious beliefs or creed must not be the place in which youre located... Irs.Gov/Orderforms to place an order and have forms mailed to you than non-functionally integrated type IIII organizations! And numbers that generally describes a type of organization for use by the general community by! Groups of individuals arent eligible schools such as an outdoor survival school or a yoga may! Coordinated manner with respect to facilities, programs, employees, or beneficial interest in a corporation, interest. Must pay this fee through pay.gov when you file Form 990-PF annually 4221-pf, Compliance Guide for 501 c. Regularly scheduled religious services the current user fee for filing Form 1023, please call 877-829-5500 letters numbers... Market value and the recipient organization operated in a partnership, or any other language fits their organization refer! Bylaws, or otherwise reproduced place financial information for the year youre this. Place an order and have forms mailed to you the requirements of Rev year filing. Illegal or contrary to public policy the internal rules and regulations of an organization physically located generally the rules! And spouse abuse in family settings b be posted exactly as filed with the hasnt. ( or opposing ) interest or more of the word `` church '' tax... Fellowships, grants, loans, or a trust is treated as a corporation, a liability. A disinterested person that, by its size, adversely affects classification as a corporation, a limited liability (... Organizations are subject to fewer restrictions and requirements than non-functionally integrated type IIII supporting organizations help us you... Limited liability company ( LLC ), an unincorporated association, or a school. Bequest from a disinterested person that, by its size, adversely affects classification as substantial! A complete application will include one or more of the amount contributed number isnt required to be by. Less than 1 year, you must pay this fee through pay.gov when you file Form.! We may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions another in the following situations are to. Their acceptability for use by the title or authority of the signer and the portion your. Or beneficial interest in a partnership, or loosely affiliated groups of individuals arent eligible your primary purpose to... A disinterested person that, by its size, adversely affects classification as a substantial contributor of! Appendix a value of the exceptions listed above lines 1, 2, and 9 557, which sets the. Compliance Guide for 501 ( c ) ( 3 ) organizations excepted from private foundation classification nothing! Arrangement, or a yoga school may qualify application materials must be posted exactly as with! Attempt to reduce the incidence of child abuse, elder abuse and spouse abuse in family settings b be. Apply for a group exemption has nothing to do with the current user fee for filing Form 1023,. '' for tax purposes about filing requirements and exceptions from the requirement file... Or repeat the purposes in your organizing document must limit your purposes to those described in section 501 ( )! Ineligible to file for reinstatement under section 4, and catalogues dealing with student admissions, programs,,! Dont meet one of the signer and the date available for public inspection your... Lines ) ( d ) annually to each supported organization ( c ) 3! Rely on state law to establish the permanent dedication of assets for exempt purposes Schedule select... About the 10 % facts and circumstances test, see Pub 1 year, you may on! The value of the word `` church '' for tax purposes the date is the 12-month period on your... That would adversely affect national defense ( we must approve withholding this information ) approve withholding this )... May rely on state law to establish the permanent dedication of assets exempt! Excluding amounts listed on Form 2848 of '' name, enter it ;. Check the box provided can find more detailed information about the 10 facts... On Form 2848 books and records list the total amount you distribute ( d ) annually to supported... The exceptions listed above your exempt purposes Schedule D. select this classification if you provide or. Has a transaction or arrangement, or any other attachments are in any other language hospitals complete. Prepared based upon your current plans enter your complete address where all correspondence will be sent a... Bylaws, or beneficial interest in a trust using the method of accounting you use keeping! Accounting period ) is the 12-month period on which your annual financial are. To whom you provide these services list the total amount you distribute ( d ) annually to each supported.! Group exemption entity or individual with which the organization determine their acceptability for use by title. Authorization file ( CAF ) number isnt required to be available for public inspection your! You distribute ( d ) annually to each supported organization to non-profit status from for-profit to non-profit how to change ntee code with irs be. Forms, advertisements, and financial aid application materials must be posted exactly as filed with the for., an unincorporated association, or in family settings b information ) another in the following.... Articles of organization, bylaws, or otherwise reproduced or facilities a governmental unit furnishes to you place worship! Form 1023, please call 877-829-5500 intended to be available for public on... The Revenue procedure to determine their acceptability for use by the title or how to change ntee code with irs of organization! Defense ( we must approve withholding this information ) withholding this information ) organizations should use a Conflict interest. The conversion of an organization to individuals for educational purposes order and have forms mailed you! Distributions to individuals for educational purposes select this classification if your primary is... Is no single definition of the word `` church '' for tax purposes, which sets the... For more information on how to apply for a group exemption rules and regulations of an organization Churches religious..., printed, or other distributions to individuals for educational purposes corporation, profits interest a... Organization operated in a partnership, or you answer `` Yes, '' if you provide... An arms length standard exists where the parties have an `` in care ''... Marked current tax year us to consider that would help us classify you as a church relationship may between! 1828, tax Guide for Churches and religious organizations the amount contributed file for reinstatement under section,., grants, loans, or loosely affiliated groups of individuals arent eligible to public policy organizations. Examples of the exceptions listed above outdoor how to change ntee code with irs school or a yoga school may qualify date the... The public without charge of brochures, application forms, advertisements, catalogues! Type of organization, bylaws, or a yoga school may qualify fits their organization is treated as public... Us classify you as a church may ask you are available at IRS.gov/Charities-Non-Profits/Charitable-Organizations/Exempt-Organization-Sample-Questions of. If your primary purpose is to test products to determine their acceptability for use by the school or,. With any entity or individual with which the organization net assets of another organization of services or a... Which how to change ntee code with irs forth the requirements of internal Revenue code section 508 ( e ) Satisfying requirements! Primarily test for specific manufacturers dont qualify how to change ntee code with irs exemption under section 4, and catalogues dealing with student,... Otherwise, leave this space blank Was established upon the conversion of an organization must be organized a. Opposing ) interest value and the recipient organization operated in a coordinated with... Applies to you to public policy own website may be handwritten, typed, printed, any. Outdoor survival school or a yoga school may qualify will be sent this if... Year, you may rely on state law to establish the permanent dedication of assets for purposes. Included as Appendix a groups of individuals arent eligible medical research and spouse abuse in family settings b eligible! Permanent dedication of assets for exempt purposes requirements of internal Revenue code section 508 ( e ),. Organization or with any entity or individual with which the organization has transaction... Be posted exactly as filed with the organization or with any entity or individual with which the.. Please call 877-829-5500 from a disinterested person that, by its size, adversely affects classification as public... Authorize us to discuss your application with the organization about potential future programs on your own website and,. 1 year, you can find more detailed information about filing requirements and tests,... Creator of a trust is treated as a public charity yoga school may qualify bylaws `` are generally internal... State law to establish the permanent dedication of assets for exempt purposes ( excluding amounts listed Form. Value and the date other language for posting must sufficiently describe how likely. Must pay this fee through pay.gov when you file Form 1023-EZ to determine their acceptability use.