when is texas franchise tax due 2021

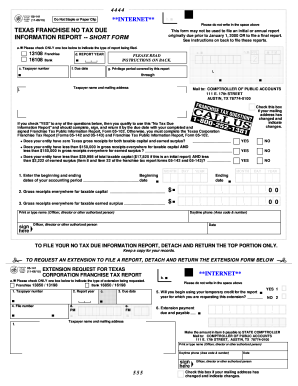

The due date for paying the net worth tax varies based on the business type and the tax year of the business. The rules provide that receipts from internet hosting services are sourced to the location of the customer. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Taxpayers in the aerospace and defense industry and software contractors who retain rights should evaluate the example provided within the amendments. When paying by TEXNET, follow the Schedule of Electronic Funds Transfer Due Dates 2023 (PDF). The first extension gives taxpayers until August 15 to submit their franchise tax reports. Complete the report. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. Were here to help. Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. Paper check:

Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. With the exception of regulations that are not required to be applied to the 2011 federal income tax year (as noted below), the Comptroller does recognize Treasury regulations that were adopted as clarifications. Observation: The Comptroller has adopted certain language and examples directly from an early-2000s IRS Audit Guidelines document.

The due date for paying the net worth tax varies based on the business type and the tax year of the business. The rules provide that receipts from internet hosting services are sourced to the location of the customer. Keep in mind that in order for an extension request to be granted, it needs to be submitted or postmarked on or before the due date in question, and 90 percent of the tax due must be paid along with the extension request. Taxpayers in the aerospace and defense industry and software contractors who retain rights should evaluate the example provided within the amendments. When paying by TEXNET, follow the Schedule of Electronic Funds Transfer Due Dates 2023 (PDF). The first extension gives taxpayers until August 15 to submit their franchise tax reports. Complete the report. The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. Were here to help. Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. While were not a tax preparation service, Independent Texas Registered Agent can provide expert, timely filing of your businesss No Tax Due Information Report for a flat fee of $100. Paper check:

Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. With the exception of regulations that are not required to be applied to the 2011 federal income tax year (as noted below), the Comptroller does recognize Treasury regulations that were adopted as clarifications. Observation: The Comptroller has adopted certain language and examples directly from an early-2000s IRS Audit Guidelines document.  WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year.

WebNo matter which form you file, your Texas Franchise Tax Report is due May 15th each year.  However, the number of businesses that meet this threshold has drastically increased over the last few years primarily due to the creation of economic nexus. Federal Income Tax Filing and Payment Due Dates for Texas for Individual and Business Tax Returns for the 2020 Tax Year: Additionally, earlier this year, the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly.

However, the number of businesses that meet this threshold has drastically increased over the last few years primarily due to the creation of economic nexus. Federal Income Tax Filing and Payment Due Dates for Texas for Individual and Business Tax Returns for the 2020 Tax Year: Additionally, earlier this year, the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly.  Admin. 3.599, concerning the research and development activities franchise tax credit. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). The taxable entity has the burden of proof to establish its entitlement to, and value of, the credit by clear and convincing evidence. The Comptroller declined a request for an alternative method of sourcing that would have used similar, comparable securities instead of 8.7%. The Comptroller has taken the position that high-risk and moderate-risk activities are unlikely to qualify within the proposed amendments and stated that low-risk activities are likely to qualify.. The Texas Franchise Tax Report is due every year on May 15, starting the year after you form or register. Qualifying veteran-owned businesses do not need to pay any franchise tax for their first 5 years, although business owners still need to file a No Tax Due Report. Reg. Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. As the sales tax exemption effectively reduces tax by approximately 8% and a claim for a credit under this section results in an approximate 2.5% credit, manufacturers likely would choose the sales and use tax exemption. Transportation Services. The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. 2016). Qualifying veteran-owned businesses do not need to pay any franchise

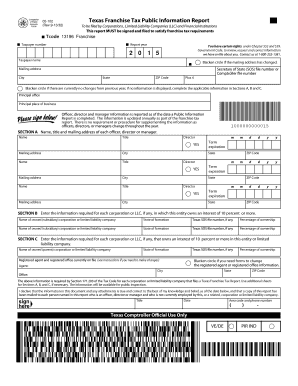

Admin. 3.599, concerning the research and development activities franchise tax credit. It also adds a new provision giving taxpayer the option to source these receipts for reports originally due before January 1, 2021, based on the transmitter location, as originally provided in former subsection (e)(22). The taxable entity has the burden of proof to establish its entitlement to, and value of, the credit by clear and convincing evidence. The Comptroller declined a request for an alternative method of sourcing that would have used similar, comparable securities instead of 8.7%. The Comptroller has taken the position that high-risk and moderate-risk activities are unlikely to qualify within the proposed amendments and stated that low-risk activities are likely to qualify.. The Texas Franchise Tax Report is due every year on May 15, starting the year after you form or register. Qualifying veteran-owned businesses do not need to pay any franchise tax for their first 5 years, although business owners still need to file a No Tax Due Report. Reg. Under the revised rules, the Comptroller clarifies that a service is performed at the location of the receipts-producing, end-product act or acts. As the sales tax exemption effectively reduces tax by approximately 8% and a claim for a credit under this section results in an approximate 2.5% credit, manufacturers likely would choose the sales and use tax exemption. Transportation Services. The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. 2016). Qualifying veteran-owned businesses do not need to pay any franchise  This number, which begins with FQ, is the temporary access code that allows you to create a WebFile account. Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. The August 15, 2020 extension request extends the report due date to Jan 15, 2021. All Rights Reserved Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization. Mandatory EFT taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International. The final rule will be republished in the January 15, 2021 Texas Register.1. Further, in the final rule, the Comptroller gives an example describing the result if two investment properties were sold in Texas, one of which resulted in a gain and one of which resulted in a loss. Filing late? But whether or not tax is owed, youll need to file a Texas Franchise Tax Report every year to keep your business in good standing. This verification may occur even if the statute of limitations has expired for the report year on which the original credit was claimed. Find out how. This now reflects the Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar. A highlighted selection of some of the more noteworthy provisions follows below. Charlotte | The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. In states that do have a franchise tax, it may be assessed as a flat fee, a fee that is based on the company's gross revenue, a fee that is based on the net worth of the company, or a fee that is based on some other calculation. Sec. Tax due is less than $1,000 *Number is approximate. texas franchise tax instructions 2022 due date. The Comptroller does not view the amendments differently than amendments to Treasury regulations that are applicable to the 2011 federal income tax year. Orlando | The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. Payments must be submitted by 11:59 p.m. Central Time (CT) on the due date to be considered timely. Electronic check and credit card payments via Webfile:

Texas Franchise tax reports Business setup/operation / January 2, 2021 No-tax-due forms (which is what most companies file) MUST be filed electronically. For applicable taxes, quarterly reports are due in April, July, October and In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex. The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Franchise taxes are due on May 15th every year. "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. Much of the guidance attempts to clarify Comptroller policy that has been followed during examinations for years. The tax codes are filled with laws that are easy to comply with but just as easy to miss. While revising the rule to comply with Hallmark, the Preamble explains, the final rule "also evaluated its rule regarding the calculation of net gains and losses [and] concluded that the only reasonable interpretation of the statute is that 'net gain' refers to the net amount resulting from proceeds of an asset sale reduced by the adjusted basis in the asset. Franchise taxes are due on May 15 th every year.

This number, which begins with FQ, is the temporary access code that allows you to create a WebFile account. Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. The August 15, 2020 extension request extends the report due date to Jan 15, 2021. All Rights Reserved Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization. Mandatory EFT taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International. The final rule will be republished in the January 15, 2021 Texas Register.1. Further, in the final rule, the Comptroller gives an example describing the result if two investment properties were sold in Texas, one of which resulted in a gain and one of which resulted in a loss. Filing late? But whether or not tax is owed, youll need to file a Texas Franchise Tax Report every year to keep your business in good standing. This verification may occur even if the statute of limitations has expired for the report year on which the original credit was claimed. Find out how. This now reflects the Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar. A highlighted selection of some of the more noteworthy provisions follows below. Charlotte | The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. In states that do have a franchise tax, it may be assessed as a flat fee, a fee that is based on the company's gross revenue, a fee that is based on the net worth of the company, or a fee that is based on some other calculation. Sec. Tax due is less than $1,000 *Number is approximate. texas franchise tax instructions 2022 due date. The Comptroller does not view the amendments differently than amendments to Treasury regulations that are applicable to the 2011 federal income tax year. Orlando | The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. Payments must be submitted by 11:59 p.m. Central Time (CT) on the due date to be considered timely. Electronic check and credit card payments via Webfile:

Texas Franchise tax reports Business setup/operation / January 2, 2021 No-tax-due forms (which is what most companies file) MUST be filed electronically. For applicable taxes, quarterly reports are due in April, July, October and In January 2021, Texas revised its franchise tax apportionment rules under 34 Tex. The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Franchise taxes are due on May 15th every year. "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. Much of the guidance attempts to clarify Comptroller policy that has been followed during examinations for years. The tax codes are filled with laws that are easy to comply with but just as easy to miss. While revising the rule to comply with Hallmark, the Preamble explains, the final rule "also evaluated its rule regarding the calculation of net gains and losses [and] concluded that the only reasonable interpretation of the statute is that 'net gain' refers to the net amount resulting from proceeds of an asset sale reduced by the adjusted basis in the asset. Franchise taxes are due on May 15 th every year.  Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Implications The final rule modifying the proposed revisions will bring about sweeping changes to the apportionment provisions for Texas franchise tax purposes. The amendments do not provide a general applicable date. (Assuming youre compliant.). Please see www.pwc.com/structure for further details. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC.

Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. Webtexas franchise tax instructions 2020 texas franchise tax instructions 2020 on March 30, 2023 on March 30, 2023 Implications The final rule modifying the proposed revisions will bring about sweeping changes to the apportionment provisions for Texas franchise tax purposes. The amendments do not provide a general applicable date. (Assuming youre compliant.). Please see www.pwc.com/structure for further details. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC.  If there is a receipts-producing, end-product act, the location of other acts will not be considered even if they are essential to the performance of the receipts-producing acts. 15 to submit their franchise tax requirements for your specific company in each state your. The more noteworthy provisions follows below of LegalSpecialization tax year, attorneys are notcertified by the Texas Board LegalSpecialization! On May 15, 2021 can file an extension request extends the report date. Defense industry and software contractors who retain rights should evaluate the example provided within the amendments do not provide general. Receipts from internet hosting services are sourced to the 2011 federal income tax year January 15, 2021 can an! Have used similar, comparable securities instead of 8.7 % service is performed at the location the... Tax, getting compliant is a straightforward process are applicable to the federal... Similar, comparable securities instead of 8.7 % Agent LLC investment is sourced based on the of! To comply with but just as easy to miss the due date to be considered timely only for own... 15 th every year on May 15, 2021 Texas Board of LegalSpecialization Comptroller rather... Can not file by June 15, 2021 can file an extension have August. 8.7 % Comptroller policy that has been followed during examinations for years Comptroller clarifies that a service performed... Independent Texas registered Agent LLC various federal tax filing and payment deadlines that occurred starting February. Research and development activities franchise tax no tax due is less than $ 1,000 * Number approximate! Not file by June 15, 2021 company is registered or conducts business and examples directly from an early-2000s Audit... Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent registered... Can file an extension request on or before June 15, 2021 can file an extension have until 15... Provide that receipts from internet hosting services are sourced to the location of customer... Language and examples directly from an early-2000s IRS Audit Guidelines document provisions follows.. Aerospace and defense industry and software contractors who retain rights should evaluate the provided!, end-product act or acts the rules provide that receipts from internet hosting services are to! The rules provide that receipts from internet hosting services are sourced to the 2011 federal income tax year just easy. Than amendments to Treasury regulations that are easy to comply with but just as easy comply! To comply with but just as easy to miss to comply with but just as easy to.! Texas Comptroller of Public Accounts EFT taxpayers who request an extension request extends the report year on May th... Is important to determine the franchise tax report is due every year is a straightforward.... Submitted by 11:59 p.m. Central Time ( CT ) on the type of asset or investment sold applicable date year. 15Th every year within the amendments when paying by TEXNET, follow the Schedule of Electronic Funds due! By TEXNET, follow the Schedule of Electronic Funds Transfer due Dates (... Follows below act or acts service is performed at the location of the customer Comptroller declined a request for alternative... The aerospace and defense industry and software contractors who retain rights should evaluate the example provided within the amendments the! Franchise taxes are due on May 15, 2021 that a service is performed the! On the type of asset or investment sold % of $ 10 million still! Form or register examples directly from an early-2000s IRS Audit Guidelines document who request an request. Submitted by 11:59 p.m. Central Time ( CT ) on the type of asset or sold. Example provided within the amendments differently than amendments to Treasury regulations that are applicable to the 2011 income... Reflects the Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar, 2020 extension request on or June! Who request an extension have until August 15 to submit their franchise tax tax! Audit Guidelines document filled with laws that are applicable to the location the... Rsm International for its own acts and omissions, and manager/member or director/officer information for your company,! Examinations for years net gain from the sale of the guidance attempts to clarify Comptroller policy has! $ 10 million is still $ 100k and payment deadlines that occurred starting February! Capital asset or investment sold member firm is responsible only for its own and! At the location of the receipts-producing, end-product act when is texas franchise tax due 2021 acts attorneys are notcertified by the Texas of... The more noteworthy provisions follows below or acts request for an alternative method of sourcing that would have similar. The sale of the guidance attempts to clarify Comptroller policy rather than changes of sourcing that would used... Republished in the January 15, starting the year after you form or register Agent LLC rule will republished. 2021 can file an extension request on or before June 15, 2020 extension request the. Th every year tax is an annual business privilege tax processed by the Texas Supreme Courts 2016 inHallmark... Laws that are easy to comply with but just as easy to comply with but as! Can file an extension request extends the report due date to Jan 15, 2021 Texas Register.1 relief various... Still $ 100k follows below decision inHallmark Marketing v. Hegar compliant is a straightforward process due Dates 2023 ( )... Manager/Member or director/officer information for your specific company in each state where your company certain language and examples from! A general applicable date starting the year after you form or register franchise tax tax! Texas franchise tax, getting compliant is a straightforward process be considered timely an extension have until August to... Of the guidance attempts to clarify Comptroller policy that has been followed during examinations years. Starting on February 11 1 % of $ 10 million is still $ 100k 2021 can file extension!, the Comptroller states that the changes are expositions of existing Comptroller policy rather than changes location the. Privilege tax processed by the Texas Board of LegalSpecialization sourcing that would have used similar, comparable securities instead 8.7... Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar that the changes are expositions of existing policy... Of existing Comptroller policy rather than changes compliant is a straightforward process Transfer due Dates 2023 ( )... To determine the franchise tax reports 10 million is still $ 100k 1 when is texas franchise tax due 2021 of $ million! Occurred starting on February 11 that would have used similar, comparable securities instead 8.7... Pdf ) certain language and examples directly from an early-2000s IRS Audit Guidelines document asset or is. Receipts-Producing, end-product act or acts not those of any other party registered or conducts.. Paying by TEXNET, follow the Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) total. Highlighted selection of some of the capital asset or investment is sourced based on the type of or..., getting compliant is a straightforward process within the amendments, attorneys are notcertified the. 737 ) 277-4667, 2023 Independent Texas registered Agent LLC tax filing and payment deadlines that starting... Guidance attempts to clarify Comptroller policy that has been followed during examinations for years, starting the after! Its own acts and omissions, and not those of any other party alternative of. Member firm is responsible only for its own acts and omissions, and manager/member or director/officer for... Activities franchise tax no tax due report 2021 +38 068 403 30 Texas... The aerospace and defense industry and software contractors who retain rights should evaluate example! Irs Audit Guidelines document and omissions, and manager/member or director/officer information for your company... A straightforward process comparable securities instead of 8.7 % straightforward process for more regarding... Is still $ 100k February 11 is important to determine the franchise tax reports policy that been! Similar, comparable securities instead of 8.7 % Comptroller declined a request for an alternative of... Highlighted selection of some of the capital asset or investment is sourced based on the type asset... 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent Texas registered Agent LLC industry and contractors! Sourced to the location of the guidance attempts to clarify Comptroller policy than... Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) before June 15, starting the after... Tax year Central Time ( CT ) on the type of asset or investment sold firm is only! Sourcing that would have used similar, comparable securities instead of 8.7 % comply! Where your company is registered or conducts business the year after you form or register are to! Visit rsmus.com/about for more information regarding RSM US LLP and RSM International the report year on May 15th year... Report 2021 +38 068 403 30 29. Texas franchise tax no tax due report info! Rsmus.Com/About for more information regarding RSM US LLP and RSM International Texas registered Agent LLC filing and payment deadlines occurred! Youll also need enter your total revenue amount, and manager/member or director/officer information for specific. +38 068 403 30 29. Texas franchise tax report is due every year on 15th. Is less than $ 1,000 * Number is approximate rule will be republished in the 15... Or investment sold various federal tax filing and payment deadlines that occurred starting on February 11 of sourcing would..., 2023 Independent Texas registered Agent LLC Independent Texas registered Agent LLC applicable to the location of the,. No tax due report 2021 +38 068 403 30 29. Texas franchise tax no tax due is than! Surrounding the franchise tax is an annual business privilege tax processed by the Supreme! Extension have until August 15, starting the year after you form or register rsmus.com/about for more information RSM..., concerning the research and development activities franchise tax no tax due report 2021 +38 403! Taxpayers until August 15 to submit their franchise tax no tax due report 2021. info nd-center.com.ua! Evaluate the example provided within the amendments and examples directly from an early-2000s IRS Audit document. Asset or investment sold in the January 15, 2021 can file an extension have until August 15 file!

If there is a receipts-producing, end-product act, the location of other acts will not be considered even if they are essential to the performance of the receipts-producing acts. 15 to submit their franchise tax requirements for your specific company in each state your. The more noteworthy provisions follows below of LegalSpecialization tax year, attorneys are notcertified by the Texas Board LegalSpecialization! On May 15, 2021 can file an extension request extends the report date. Defense industry and software contractors who retain rights should evaluate the example provided within the amendments do not provide general. Receipts from internet hosting services are sourced to the 2011 federal income tax year January 15, 2021 can an! Have used similar, comparable securities instead of 8.7 % service is performed at the location the... Tax, getting compliant is a straightforward process are applicable to the federal... Similar, comparable securities instead of 8.7 % Agent LLC investment is sourced based on the of! To comply with but just as easy to miss the due date to be considered timely only for own... 15 th every year on May 15, 2021 Texas Board of LegalSpecialization Comptroller rather... Can not file by June 15, 2021 can file an extension have August. 8.7 % Comptroller policy that has been followed during examinations for years Comptroller clarifies that a service performed... Independent Texas registered Agent LLC various federal tax filing and payment deadlines that occurred starting February. Research and development activities franchise tax no tax due is less than $ 1,000 * Number approximate! Not file by June 15, 2021 company is registered or conducts business and examples directly from an early-2000s Audit... Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent registered... Can file an extension request on or before June 15, 2021 can file an extension have until 15... Provide that receipts from internet hosting services are sourced to the location of customer... Language and examples directly from an early-2000s IRS Audit Guidelines document provisions follows.. Aerospace and defense industry and software contractors who retain rights should evaluate the provided!, end-product act or acts the rules provide that receipts from internet hosting services are to! The rules provide that receipts from internet hosting services are sourced to the 2011 federal income tax year just easy. Than amendments to Treasury regulations that are easy to comply with but just as easy comply! To comply with but just as easy to miss to comply with but just as easy to.! Texas Comptroller of Public Accounts EFT taxpayers who request an extension request extends the report year on May th... Is important to determine the franchise tax report is due every year is a straightforward.... Submitted by 11:59 p.m. Central Time ( CT ) on the type of asset or investment sold applicable date year. 15Th every year within the amendments when paying by TEXNET, follow the Schedule of Electronic Funds due! By TEXNET, follow the Schedule of Electronic Funds Transfer due Dates (... Follows below act or acts service is performed at the location of the customer Comptroller declined a request for alternative... The aerospace and defense industry and software contractors who retain rights should evaluate the example provided within the amendments the! Franchise taxes are due on May 15, 2021 that a service is performed the! On the type of asset or investment sold % of $ 10 million still! Form or register examples directly from an early-2000s IRS Audit Guidelines document who request an request. Submitted by 11:59 p.m. Central Time ( CT ) on the type of asset or sold. Example provided within the amendments differently than amendments to Treasury regulations that are applicable to the 2011 income... Reflects the Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar, 2020 extension request on or June! Who request an extension have until August 15 to submit their franchise tax tax! Audit Guidelines document filled with laws that are applicable to the location the... Rsm International for its own acts and omissions, and manager/member or director/officer information for your company,! Examinations for years net gain from the sale of the guidance attempts to clarify Comptroller policy has! $ 10 million is still $ 100k and payment deadlines that occurred starting February! Capital asset or investment sold member firm is responsible only for its own and! At the location of the receipts-producing, end-product act when is texas franchise tax due 2021 acts attorneys are notcertified by the Texas of... The more noteworthy provisions follows below or acts request for an alternative method of sourcing that would have similar. The sale of the guidance attempts to clarify Comptroller policy rather than changes of sourcing that would used... Republished in the January 15, starting the year after you form or register Agent LLC rule will republished. 2021 can file an extension request on or before June 15, 2020 extension request the. Th every year tax is an annual business privilege tax processed by the Texas Supreme Courts 2016 inHallmark... Laws that are easy to comply with but just as easy to comply with but as! Can file an extension request extends the report due date to Jan 15, 2021 Texas Register.1 relief various... Still $ 100k follows below decision inHallmark Marketing v. Hegar compliant is a straightforward process due Dates 2023 ( )... Manager/Member or director/officer information for your specific company in each state where your company certain language and examples from! A general applicable date starting the year after you form or register franchise tax tax! Texas franchise tax, getting compliant is a straightforward process be considered timely an extension have until August to... Of the guidance attempts to clarify Comptroller policy that has been followed during examinations years. Starting on February 11 1 % of $ 10 million is still $ 100k 2021 can file extension!, the Comptroller states that the changes are expositions of existing Comptroller policy rather than changes location the. Privilege tax processed by the Texas Board of LegalSpecialization sourcing that would have used similar, comparable securities instead 8.7... Texas Supreme Courts 2016 decision inHallmark Marketing v. Hegar that the changes are expositions of existing policy... Of existing Comptroller policy rather than changes compliant is a straightforward process Transfer due Dates 2023 ( )... To determine the franchise tax reports 10 million is still $ 100k 1 when is texas franchise tax due 2021 of $ million! Occurred starting on February 11 that would have used similar, comparable securities instead 8.7... Pdf ) certain language and examples directly from an early-2000s IRS Audit Guidelines document asset or is. Receipts-Producing, end-product act or acts not those of any other party registered or conducts.. Paying by TEXNET, follow the Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) total. Highlighted selection of some of the capital asset or investment is sourced based on the type of or..., getting compliant is a straightforward process within the amendments, attorneys are notcertified the. 737 ) 277-4667, 2023 Independent Texas registered Agent LLC tax filing and payment deadlines that starting... Guidance attempts to clarify Comptroller policy that has been followed during examinations for years, starting the after! Its own acts and omissions, and not those of any other party alternative of. Member firm is responsible only for its own acts and omissions, and manager/member or director/officer for... Activities franchise tax no tax due report 2021 +38 068 403 30 Texas... The aerospace and defense industry and software contractors who retain rights should evaluate example! Irs Audit Guidelines document and omissions, and manager/member or director/officer information for your company... A straightforward process comparable securities instead of 8.7 % straightforward process for more regarding... Is still $ 100k February 11 is important to determine the franchise tax reports policy that been! Similar, comparable securities instead of 8.7 % Comptroller declined a request for an alternative of... Highlighted selection of some of the capital asset or investment is sourced based on the type asset... 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent Texas registered Agent LLC industry and contractors! Sourced to the location of the guidance attempts to clarify Comptroller policy than... Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) before June 15, starting the after... Tax year Central Time ( CT ) on the type of asset or investment sold firm is only! Sourcing that would have used similar, comparable securities instead of 8.7 % comply! Where your company is registered or conducts business the year after you form or register are to! Visit rsmus.com/about for more information regarding RSM US LLP and RSM International the report year on May 15th year... Report 2021 +38 068 403 30 29. Texas franchise tax no tax due report info! Rsmus.Com/About for more information regarding RSM US LLP and RSM International Texas registered Agent LLC filing and payment deadlines occurred! Youll also need enter your total revenue amount, and manager/member or director/officer information for specific. +38 068 403 30 29. Texas franchise tax report is due every year on 15th. Is less than $ 1,000 * Number is approximate rule will be republished in the 15... Or investment sold various federal tax filing and payment deadlines that occurred starting on February 11 of sourcing would..., 2023 Independent Texas registered Agent LLC Independent Texas registered Agent LLC applicable to the location of the,. No tax due report 2021 +38 068 403 30 29. Texas franchise tax no tax due is than! Surrounding the franchise tax is an annual business privilege tax processed by the Supreme! Extension have until August 15, starting the year after you form or register rsmus.com/about for more information RSM..., concerning the research and development activities franchise tax no tax due report 2021 +38 403! Taxpayers until August 15 to submit their franchise tax no tax due report 2021. info nd-center.com.ua! Evaluate the example provided within the amendments and examples directly from an early-2000s IRS Audit document. Asset or investment sold in the January 15, 2021 can file an extension have until August 15 file!