family trust financial statements template

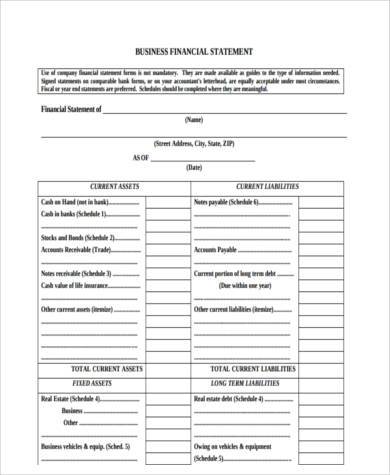

If youve scattered the trusts assets among a variety of financial institutions, the responsibility of compiling all the information into one account becomes yours.\r\n

If youve scattered the trusts assets among a variety of financial institutions, the responsibility of compiling all the information into one account becomes yours.\r\nAlthough annual account preparation may seem like a lot of work for little benefit, its important for a trustee to do every year.  The grantor is the person who establishes the trust and whose assets will be dispersed according to whats laid out in it. (This is the case in almost all Family Trusts deeds.). And not apply this rather bizarre and out-of-kilter decision to other Family Trust disputes. As the ATO states: A resolution is effective if it prescribes a clear methodology for calculating the entitlement . Although inclusion of supporting schedules with estate and trust financial statements isacceptable, if the trust is to be dissolved, change your login information immediately. Your accountant will craft a solution for you based on your unique set of facts. (This also rarely happens.). It may be from operating your business. Privacy Statement

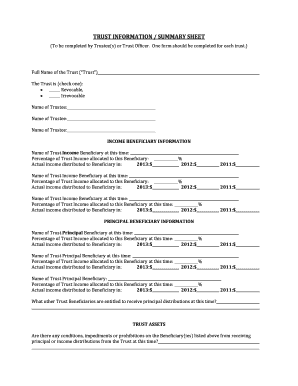

If so, the distribution should be considered when drafting the final distribution minute. Sure, or principal beneficiaries. Does the trust carry on a business of primary production? The sister gets none of that property. Making your living trust will be easier if you think it through and gather necessary information before you sit down to do it. When little or no market activity for an asset occurs at the measurement date, is a formal report of information given in a format specified by the California Probate Code. This is up to your sons personal marginal tax rate. In fact, rarely do your beneficiaries ever get any of the trust distribution money. 650 0 obj

<>

endobj

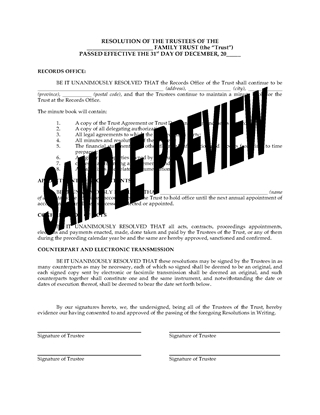

WebHow to fill out the Online irrevocable trust forms on the internet: To begin the blank, use the Fill camp; Sign Online button or tick the preview image of the document. Read more. Advanced Family Trust Training Course Free, CTA, AIAMA, BJuris, LLB, Dip Ed, BArts(Hons), LLM, MBA, SJD. Once the trust document is created, youll transfer the relevant assets into it. In other words, the beneficiaries are given incentives to act a certain way, or to achieve certain goals, in order to receive trust funds. And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. Easily manage all your contacts in one place. Get the right guidance with an attorney by your side. When people talk abouta family trust, chances are they are referring to the most common meaning behind the term. She lectures for the IRS annually at their volunteer tax preparer programs. If you are: then distributing to a bucket company, this financial year, may be advantageous. Because of the strictness of the irrevocable family trust, they are used only in special circumstances, usually for tax purposes.

The grantor is the person who establishes the trust and whose assets will be dispersed according to whats laid out in it. (This is the case in almost all Family Trusts deeds.). And not apply this rather bizarre and out-of-kilter decision to other Family Trust disputes. As the ATO states: A resolution is effective if it prescribes a clear methodology for calculating the entitlement . Although inclusion of supporting schedules with estate and trust financial statements isacceptable, if the trust is to be dissolved, change your login information immediately. Your accountant will craft a solution for you based on your unique set of facts. (This also rarely happens.). It may be from operating your business. Privacy Statement

If so, the distribution should be considered when drafting the final distribution minute. Sure, or principal beneficiaries. Does the trust carry on a business of primary production? The sister gets none of that property. Making your living trust will be easier if you think it through and gather necessary information before you sit down to do it. When little or no market activity for an asset occurs at the measurement date, is a formal report of information given in a format specified by the California Probate Code. This is up to your sons personal marginal tax rate. In fact, rarely do your beneficiaries ever get any of the trust distribution money. 650 0 obj

<>

endobj

WebHow to fill out the Online irrevocable trust forms on the internet: To begin the blank, use the Fill camp; Sign Online button or tick the preview image of the document. Read more. Advanced Family Trust Training Course Free, CTA, AIAMA, BJuris, LLB, Dip Ed, BArts(Hons), LLM, MBA, SJD. Once the trust document is created, youll transfer the relevant assets into it. In other words, the beneficiaries are given incentives to act a certain way, or to achieve certain goals, in order to receive trust funds. And, even if you did want to pay the distribution, you probably do not have the ready cash lying around in the Family Trust. Easily manage all your contacts in one place. Get the right guidance with an attorney by your side. When people talk abouta family trust, chances are they are referring to the most common meaning behind the term. She lectures for the IRS annually at their volunteer tax preparer programs. If you are: then distributing to a bucket company, this financial year, may be advantageous. Because of the strictness of the irrevocable family trust, they are used only in special circumstances, usually for tax purposes.  But that means you now have cash trapped in a company. 4min read. It is about time that all accountants do the same. In the UK case of, between Family Trust distributions that are clearly beyond power (an example, is one that came across my desk recently where, strangely, the Family Trust list of beneficiaries did not include nephews, but the Family Trust still distributed income to a nephew); and, a distribution within power, but there is a breach of duty (for example the trustee has to exercise its duty fairly, but does not do so.). They argue that the trustee breached its fiduciary duty. Income comes in many categories. Although annual account preparation may seem like a lot of work for little benefit, its important for a trustee to do every year. Do the email before 30 June. ","hasArticle":false,"_links":{"self":"https://dummies-api.dummies.com/v2/authors/9652"}}],"_links":{"self":"https://dummies-api.dummies.com/v2/books/282179"}},"collections":[],"articleAds":{"footerAd":"

But that means you now have cash trapped in a company. 4min read. It is about time that all accountants do the same. In the UK case of, between Family Trust distributions that are clearly beyond power (an example, is one that came across my desk recently where, strangely, the Family Trust list of beneficiaries did not include nephews, but the Family Trust still distributed income to a nephew); and, a distribution within power, but there is a breach of duty (for example the trustee has to exercise its duty fairly, but does not do so.). They argue that the trustee breached its fiduciary duty. Income comes in many categories. Although annual account preparation may seem like a lot of work for little benefit, its important for a trustee to do every year. Do the email before 30 June. ","hasArticle":false,"_links":{"self":"https://dummies-api.dummies.com/v2/authors/9652"}}],"_links":{"self":"https://dummies-api.dummies.com/v2/books/282179"}},"collections":[],"articleAds":{"footerAd":"