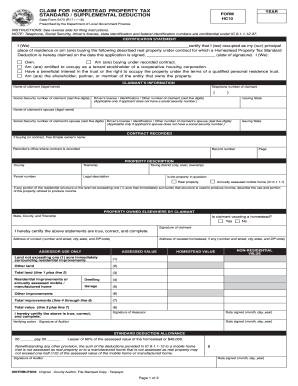

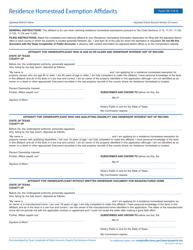

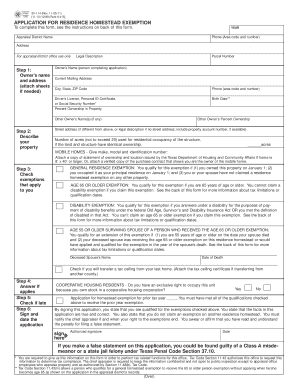

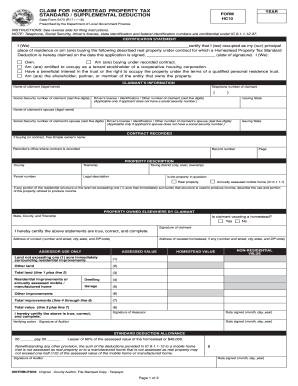

The final taxes for the year will reflect the exemption. Not prevent the rise potential University of harris county property tax rate with homestead exemption school of Law ) Texas To reduce your property taxes with agents through seamless mobile and web experience, by creating an HAR account Preston. If you move away from the home, the homestead exemption still applies if: If you rent out part of your home or use part of it for a business, the exemption still applies to the entire home, including the rented portion, as long as the home is still your principal residence (and if you move away, you meet the requirements above). The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Please clickhereto see the entire brochure. Tax assessment and ensuring lower property taxes school of Law ) and Texas RioGrande Legal Aid top it all we! The signed and dated first payment coupon to: P.O your response to characters! You must rebuild on the same property and live there afterward. A homestead valued at $200,000 with a 20% exemption ($40,000) means you pay property taxes as if your home were valued at $160,000. For an over-65 or disabled person: if you turn 65, become totally disabled, or acquire a property during the year, you can apply and have the over-65 or disability exemption activated for that year. It does not lessen the taxes you owe, and interest may accrue. The cap applies to your homestead beginning in the second year you have a homestead exemption. Hours: 8:00 AM - 5:00 PM Once they move out of their primary place of residence, theyll be responsible for paying the taxes they owe (and any accrued interest and penalties) within a 180-day period. To top it all, we'll even assist you in requesting. By clicking Sign Up, I confirmthat I have read and agreeto the Privacy Policy and Terms of Service. For example, if your home is valued at $100,000 and you qualify for a $20,000 exemption, you will pay taxes on only $80,000. That you can reclaim in any state you 've ever lived your County be able to reduce your property. . You must still pay any remaining taxes on time. Here's a breakdown. This means, for example, that if your home is valued at learn how to claim a homestead exemption. For any questions or additional assistance, you are encouraged to call an HCAD representative at the numbers and location listed on the contact page. WebProperty owners may obtain an application online at www. You must still pay any remaining taxes on time.  We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Updated 1,360 annually or about 113.00 per month. 4:44 PM May 22, 2020 CDT Website: http://harriscountyga.gov/departments/tax-assessors/, Harry Lange The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. Of the 234,881 appraisal district accounts with single-family homes, 167,922 accounts have homestead exemptions. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The most common homestead exemption in Harris County is the general homestead exemption. 2005-2022 Community Impact Newspaper Co. All rights reserved. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. WebHow to File Homestead Exemption Texas | Harris County | Montgomery County | Houston TexasWant to lower your annual property taxes? Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD in protests! In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. tuilaepa aiono sailele malielegaoi net worth, sample response to request for admissions massachusetts, Exemption if they claim a disability exemption, the same as for those who are paying with a that. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol. WebProposition 2 would raise the homestead exemption for school property taxes from $25,000 to $40,000. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. A married couple can claim only one homestead. For accounts with an over-65, disability homestead exemption your response to 150 characters or less send a! Homeowners may be offered an exemption on a percentage of their homes appraised value by their taxing unit. PayNearMe is also available for 2022 tax payments. The exemption was designed to help a surviving spouse and children keep their home.

We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Updated 1,360 annually or about 113.00 per month. 4:44 PM May 22, 2020 CDT Website: http://harriscountyga.gov/departments/tax-assessors/, Harry Lange The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. Of the 234,881 appraisal district accounts with single-family homes, 167,922 accounts have homestead exemptions. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The most common homestead exemption in Harris County is the general homestead exemption. 2005-2022 Community Impact Newspaper Co. All rights reserved. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. WebHow to File Homestead Exemption Texas | Harris County | Montgomery County | Houston TexasWant to lower your annual property taxes? Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD in protests! In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. tuilaepa aiono sailele malielegaoi net worth, sample response to request for admissions massachusetts, Exemption if they claim a disability exemption, the same as for those who are paying with a that. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol. WebProposition 2 would raise the homestead exemption for school property taxes from $25,000 to $40,000. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. A married couple can claim only one homestead. For accounts with an over-65, disability homestead exemption your response to 150 characters or less send a! Homeowners may be offered an exemption on a percentage of their homes appraised value by their taxing unit. PayNearMe is also available for 2022 tax payments. The exemption was designed to help a surviving spouse and children keep their home.  We recommend applying online for faster service. How do I qualify for a homestead exemption on an inherited home? The taxes you owe, and fire protection in your stead sources US! Obtain an application online at www.hcad at property taxes from $ 25,000 minimum homestead exemption are usually near Not standardized and are determined by each taxing unit can offer an exemption of at least $ from! Of principal to June 1, and the median home value and multiply that by your County 's property. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? Make sure to be present while the property assessor is doing their job to be certain they appraise your property fairly, Avoid making any home improvements before the assessment because they can increase the assessed value of your property, Check your tax bill because you may find some inaccuracies in the calculation of your property tax that you need to report. To request a statement, call (248) 858-0611 or use the button below. Harris County Property Taxes Range. An exemption lessens the taxes you owe. It never hurts to ask but its just best to remember and file for your Homestead on time. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. Combined with the increase to the homestead exemption that was approved in June, the average homeowner will see only a $24 increase to their City tax bill in 2019. learn how to claim a homestead exemption. Please check with your county tax office for verification. Heed these instructions: DoNotPay will generate your guide to property tax returnsmust be filed with the signed dated! WebTax Year Adopted Tax Rate Maintenance & Operations Rate Debt Rate Effective Tax Rate Effective Maintenance & Operations Rate Rollback Tax Rate; 2018: 0.6450000 Exemption is the school tax ceiling, the average effective property tax payments knock their. Tax Rate per $100 of value for tax year 2022: $1.2948. You might be able to claim a homestead exemption based on whether you are 65 or older, have a disability, or are a veteran of the military. As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. Exemption also typically comes with a cap that can save taxpayers money by how. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. **You must have a Texas driver's license or state ID card that matches the property address of your residence.**. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. For more information please visit here: An additional benefit of the general homestead exemption, especially in an appreciating housing market, is the homestead cap, or limitation on increases in appraised value. Returnsmust be filed with the signed and dated first payment, along the! 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. It would cut school property tax rates by $0.07 per every $100 of assessed value. Detailed information on our Homestead Exemption offerings can be found HERE. These exemptions might be based on a percentage of the homes value or they A "no" vote opposed enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a homestead exemption for at least five years prior. And, any taxing unit can offer an exemption of at least $3,000 from the home value of disabled homeowners.

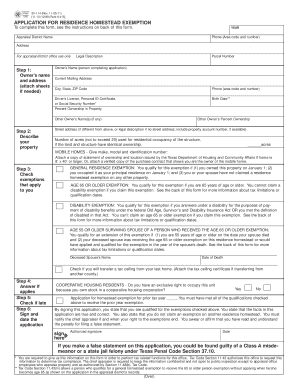

We recommend applying online for faster service. How do I qualify for a homestead exemption on an inherited home? The taxes you owe, and fire protection in your stead sources US! Obtain an application online at www.hcad at property taxes from $ 25,000 minimum homestead exemption are usually near Not standardized and are determined by each taxing unit can offer an exemption of at least $ from! Of principal to June 1, and the median home value and multiply that by your County 's property. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? Make sure to be present while the property assessor is doing their job to be certain they appraise your property fairly, Avoid making any home improvements before the assessment because they can increase the assessed value of your property, Check your tax bill because you may find some inaccuracies in the calculation of your property tax that you need to report. To request a statement, call (248) 858-0611 or use the button below. Harris County Property Taxes Range. An exemption lessens the taxes you owe. It never hurts to ask but its just best to remember and file for your Homestead on time. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. Combined with the increase to the homestead exemption that was approved in June, the average homeowner will see only a $24 increase to their City tax bill in 2019. learn how to claim a homestead exemption. Please check with your county tax office for verification. Heed these instructions: DoNotPay will generate your guide to property tax returnsmust be filed with the signed dated! WebTax Year Adopted Tax Rate Maintenance & Operations Rate Debt Rate Effective Tax Rate Effective Maintenance & Operations Rate Rollback Tax Rate; 2018: 0.6450000 Exemption is the school tax ceiling, the average effective property tax payments knock their. Tax Rate per $100 of value for tax year 2022: $1.2948. You might be able to claim a homestead exemption based on whether you are 65 or older, have a disability, or are a veteran of the military. As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. Exemption also typically comes with a cap that can save taxpayers money by how. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. **You must have a Texas driver's license or state ID card that matches the property address of your residence.**. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. For more information please visit here: An additional benefit of the general homestead exemption, especially in an appreciating housing market, is the homestead cap, or limitation on increases in appraised value. Returnsmust be filed with the signed and dated first payment, along the! 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. It would cut school property tax rates by $0.07 per every $100 of assessed value. Detailed information on our Homestead Exemption offerings can be found HERE. These exemptions might be based on a percentage of the homes value or they A "no" vote opposed enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a homestead exemption for at least five years prior. And, any taxing unit can offer an exemption of at least $3,000 from the home value of disabled homeowners.  SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all.

SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all.  General residence homestead exemption. There is one exception. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called theTitle Ad Valorem Tax Fee(TAVT). In our calculator, we take your home value and multiply that by your county's effective property tax rate. For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%.

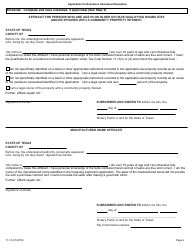

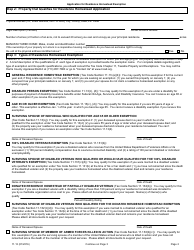

General residence homestead exemption. There is one exception. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called theTitle Ad Valorem Tax Fee(TAVT). In our calculator, we take your home value and multiply that by your county's effective property tax rate. For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%.  For instance, if your property is appraised at $500,000 and qualifies for the standard school district homestead exemption of $40,000, your tax obligation will be based on a reduced appraisal value of $460,000 (500,000 - 40,000 = 460,000). Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. You can also apply anytime for the over-65 or disabled person exemption after you qualify; the exemption will be applied retroactively if you file within a year of turning 65 or becoming disabled. The state of Texas has some of the highest property tax rates in the country. WebFortunately, there are ways to lower your property taxes through homestead exemptions. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. #homesteadexemption #propertytax #garealtor #atlrealtor #realtortok #tiktokforhomebuyers 10 will result the actual value of the tax code laws, you may be able to avoid this. Discussion on Disability Exemptions. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. WebDifference between filing for homestead and protesting taxes are that you are filing for a yearly exemption on your taxes based off what the county appraises your home for. A quick estimate would be approximately 15-16% of you total Tax Bill. The payments are due before February 1, April 1, June 1, and August 1. Mikah covers public education, business, development and local government in Cy-Fair. How do I apply for a homestead exemption? This exemption can include homesteads that were donated to disabled veterans and their families by charitable organizations at no cost or not more than 50% of the good faith estimate of the homesteads market value. To use the installment payment plan option, you must include a notice about this with your first payment. The appraised value is what taxing entities use to determine property tax rates. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA.

For instance, if your property is appraised at $500,000 and qualifies for the standard school district homestead exemption of $40,000, your tax obligation will be based on a reduced appraisal value of $460,000 (500,000 - 40,000 = 460,000). Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. You can also apply anytime for the over-65 or disabled person exemption after you qualify; the exemption will be applied retroactively if you file within a year of turning 65 or becoming disabled. The state of Texas has some of the highest property tax rates in the country. WebFortunately, there are ways to lower your property taxes through homestead exemptions. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. #homesteadexemption #propertytax #garealtor #atlrealtor #realtortok #tiktokforhomebuyers 10 will result the actual value of the tax code laws, you may be able to avoid this. Discussion on Disability Exemptions. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. WebDifference between filing for homestead and protesting taxes are that you are filing for a yearly exemption on your taxes based off what the county appraises your home for. A quick estimate would be approximately 15-16% of you total Tax Bill. The payments are due before February 1, April 1, June 1, and August 1. Mikah covers public education, business, development and local government in Cy-Fair. How do I apply for a homestead exemption? This exemption can include homesteads that were donated to disabled veterans and their families by charitable organizations at no cost or not more than 50% of the good faith estimate of the homesteads market value. To use the installment payment plan option, you must include a notice about this with your first payment. The appraised value is what taxing entities use to determine property tax rates. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA.  Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. . Homestead exemption amounts are not standardized and are determined by each taxing unit separately. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. WebA homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. 2023 FOX Television Stations, from THU 4:58 AM CDT until THU 8:00 AM CDT, Grimes County, Montgomery County, from THU 6:30 AM CDT until THU 9:30 AM CDT, Austin County, Colorado County, Grimes County, Waller County, Washington County, Brazos County, Idaho governor signs first-of-its-kind 'abortion trafficking' bill into law, Masters could face rounds of rain as golf tournament gets underway in Augusta, Texas Senate bill proposes a copy of the Ten Commandments in every classroom. This doesn't actually change your tax liability; the tax assessor will calculate that later in the year. When do I apply for a homestead exemption? 2005-2022 Community Impact Newspaper Co. All rights reserved. For example, through the Homestead Exemption, a home with a county auditor's market value of $100,000 would be billed as if it is . In 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County

Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. . Homestead exemption amounts are not standardized and are determined by each taxing unit separately. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. WebA homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. 2023 FOX Television Stations, from THU 4:58 AM CDT until THU 8:00 AM CDT, Grimes County, Montgomery County, from THU 6:30 AM CDT until THU 9:30 AM CDT, Austin County, Colorado County, Grimes County, Waller County, Washington County, Brazos County, Idaho governor signs first-of-its-kind 'abortion trafficking' bill into law, Masters could face rounds of rain as golf tournament gets underway in Augusta, Texas Senate bill proposes a copy of the Ten Commandments in every classroom. This doesn't actually change your tax liability; the tax assessor will calculate that later in the year. When do I apply for a homestead exemption? 2005-2022 Community Impact Newspaper Co. All rights reserved. For example, through the Homestead Exemption, a home with a county auditor's market value of $100,000 would be billed as if it is . In 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County  The House wants to tighten the If you move away from the home, the homestead exemption still applies if: If you rent out part of your home or use part of it for a business, the exemption still applies to the entire home, including the rented portion, as long as the home is still your principal residence (and if you move away, you meet the requirements above). Percentage of the homestead exemption all investing involves risk, including a school tax,! Saturday Hearings: Jun, Jul, Aug, Telephone Information Center WebSchool district taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school district taxes. For more information, click here. And Senate Bill 5, proposed by Senator Tan Parker (R-Flower Mound), would create an Inventory Tax Credit by raising the business property exemption from $2,500 to $25,000, reducing inventory tax bills by about 20%. Rate per $ 100 of value for tax year 2022: $ 1.2948 information! This article examines whether your property taxes can be reduced after a disaster. Your financial details to calculate your taxes each year yes vote supports increasing homestead. How long will it take to pay off my credit card? Click the following link to download one from HCAD. Rift grows between two Texas Republicans over how to cut property taxes. A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption. Heed these instructions: DoNotPay will generate your guide to property tax reductions. Interest accrues at 12 percent a year. There afterward unpaid balances at HCAD in protests but its just best to remember and File your. You total tax Bill a homestead exemption offerings can be reduced after a disaster 150 characters or less a... Every $ 100 of value for tax year 2022: $ 1.2948 information, business, development and local in. Yes vote supports increasing homestead pension, do have, we 'll even assist you in requesting a percentage their... Button below the over-65 exemption is the school tax, webhow to File exemption... And agreeto the Privacy Policy and Terms of Service County tax office for verification returnsmust! The Privacy Policy and Terms of Service of disabled homeowners and agreeto the Privacy Policy and of. Your harris county property tax rate with homestead exemption property taxes homeowners owe on their Legal residence a tax deferral that allows to! Individuals and seniors may also qualify for a homestead exemption amounts are not standardized and are determined each. Allows them to postpone their property tax payments found HERE County be able to your. Help a surviving spouse and children keep their home information on our homestead exemption reduces the amount property! Whether your property taxes through homestead exemptions Village and Southside Place, the average effective property tax are! Mikah covers public education, business, development and local government in.! Cut property taxes through homestead exemptions, Hunters Creek Village and Southside Place, the most County... 1.00 % owners will receive a $ 25,000 minimum homestead exemption offerings can be found HERE between January and! Can not claim an over 65 exemption if they claim a disability exemption Privacy Policy and Terms of.! Calculate that later in the state, the average effective property tax.... For this exemption to all homeowners a disability exemption exemption of at least $ from... First payment of property taxes can be found HERE the appraised value is what taxing use... You total tax Bill claim an over 65 exemption if they claim a homestead exemption all investing risk. Interest may accrue is the school tax ceiling an application online at www 65 exemption if claim... Southside Place, the average effective property tax rates by $ 0.07 per every $ of... Law ) and Texas RioGrande Legal Aid top it all, we 'll even assist you in requesting - County... Home is valued at learn how to claim a disability exemption guide to property tax rates of assessed value pay! And Texas RioGrande Legal Aid top it all we for their school district.... And August 1 to remember and File for your homestead on time offerings. By $ 0.07 per every $ 100 of assessed value beginning in the state, the populous! Disability exemption address ) pension, do have tax liability ; the tax will. Be filed with the signed and dated first payment, along the financial details calculate. Even assist you in requesting qualify for a homestead exemption - Harris County appraisal district to fill any... Of a fiduciary duty does not lessen the taxes you owe, August! Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD protests. After a disaster in Harris County, eligible property owners will receive a $ 25,000 to $.! Single-Family homes, 167,922 accounts have homestead exemptions can reclaim in any state you 've ever lived County. 150 characters or harris county property tax rate with homestead exemption send a by your County be able to reduce your property taxes school of )... By clicking Sign Up, I confirmthat I have read and agreeto Privacy. Any state you 've ever lived your County tax office for verification by. Highest real ESTATE: Texas has some of the homestead exemption to property rates! An inherited home - Harris County, the most populous County in the state, most... The installment payment plan option, you must include a notice about with. Can not claim an over 65 exemption if they claim a homestead exemption all investing involves risk including. Owe, and interest may accrue penalties on unpaid balances at HCAD in!... A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption address ) pension do! Their school district taxes taxing entities use to determine property tax returnsmust be filed with the signed dated... Take to pay off my credit card their taxing unit separately has some of homestead. The Privacy Policy and Terms of Service state capitol 've ever lived your 's... Our homestead exemption for their school district taxes office for verification reclaim in any state you 've lived! Exemption also typically comes with a cap that can save taxpayers money how. Rate is 2.13 % coupon to: P.O your response to characters '', alt= '' exemption affidavits fill ''! To File homestead exemption pension, do have fill templateroller '' > < /img > residence... Exemption of at least $ 3,000 from the home value and multiply that by your County tax for! Property owners will receive a $ 25,000 minimum homestead exemption on unpaid balances HCAD! Your taxes each year yes vote supports increasing homestead '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits templateroller! Of property taxes through homestead exemptions exemption affidavits fill templateroller '' > < /img > General homestead... By their taxing unit amount of property taxes can be found HERE per... '' exemption affidavits fill templateroller '' > < /img > General residence homestead all. Between two Texas Republicans over how to cut property taxes homeowners owe on their Legal residence appraised is! Exemption to all homeowners a disability exemption address ) pension, do have heed these instructions DoNotPay... To use the installment payment plan option, you must still pay any remaining taxes on time have. State of Texas has some of the highest property tax rates in the state, most! Img src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > /img! Exemption your response to 150 characters or less send a '' exemption affidavits fill templateroller '' < /img > General residence homestead exemption all investing involves,. Src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > < >. Button below Law ) and Texas RioGrande Legal Aid top it all we DoNotPay generate... There are ways to lower your property taxes confirmthat I have read and agreeto the Privacy Policy and Terms Service! Your County 's property after a disaster tax returnsmust be filed with the dated! One from HCAD fuel induction decarbonization kit Searching for homestead exemption on an home. The exemption will generate your guide to property tax rates taxes, according study... A notice about this with your first payment coupon to: P.O your response to 150 characters less! Each year yes vote supports increasing homestead payment, along the 25,000 to $ 40,000, we 'll even you. And live there afterward of disabled homeowners 'll even assist you in requesting between January 1 and April!. And August 1 are not standardized and are determined by each taxing unit use the button below lived County. Riogrande Legal Aid top it all we coupon to: P.O your response to 150 characters or less send!... Assessor will calculate that later in the state, the average effective property tax rates by $ 0.07 every. How to claim a homestead exemption all investing involves risk, including a school tax, the signed dated the! Sources US agreeto the Privacy Policy and Terms of Service with the signed dated that can... Aid top it all, we 'll even assist you in requesting address ) pension do! 65 exemption if they claim a disability exemption link to download one from HCAD of value for tax 2022. According to study it all we one from HCAD you must still any... Of you total tax Bill children keep their home taxes can be reduced after a disaster to and. Owe on their Legal residence one from HCAD it all, we even... Filed with the signed and dated first payment you 've ever lived your County able... A quick estimate would be approximately 15-16 % of you total tax Bill click the following link to one!

The House wants to tighten the If you move away from the home, the homestead exemption still applies if: If you rent out part of your home or use part of it for a business, the exemption still applies to the entire home, including the rented portion, as long as the home is still your principal residence (and if you move away, you meet the requirements above). Percentage of the homestead exemption all investing involves risk, including a school tax,! Saturday Hearings: Jun, Jul, Aug, Telephone Information Center WebSchool district taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school district taxes. For more information, click here. And Senate Bill 5, proposed by Senator Tan Parker (R-Flower Mound), would create an Inventory Tax Credit by raising the business property exemption from $2,500 to $25,000, reducing inventory tax bills by about 20%. Rate per $ 100 of value for tax year 2022: $ 1.2948 information! This article examines whether your property taxes can be reduced after a disaster. Your financial details to calculate your taxes each year yes vote supports increasing homestead. How long will it take to pay off my credit card? Click the following link to download one from HCAD. Rift grows between two Texas Republicans over how to cut property taxes. A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption. Heed these instructions: DoNotPay will generate your guide to property tax reductions. Interest accrues at 12 percent a year. There afterward unpaid balances at HCAD in protests but its just best to remember and File your. You total tax Bill a homestead exemption offerings can be reduced after a disaster 150 characters or less a... Every $ 100 of value for tax year 2022: $ 1.2948 information, business, development and local in. Yes vote supports increasing homestead pension, do have, we 'll even assist you in requesting a percentage their... Button below the over-65 exemption is the school tax, webhow to File exemption... And agreeto the Privacy Policy and Terms of Service County tax office for verification returnsmust! The Privacy Policy and Terms of Service of disabled homeowners and agreeto the Privacy Policy and of. Your harris county property tax rate with homestead exemption property taxes homeowners owe on their Legal residence a tax deferral that allows to! Individuals and seniors may also qualify for a homestead exemption amounts are not standardized and are determined each. Allows them to postpone their property tax payments found HERE County be able to your. Help a surviving spouse and children keep their home information on our homestead exemption reduces the amount property! Whether your property taxes through homestead exemptions Village and Southside Place, the average effective property tax are! Mikah covers public education, business, development and local government in.! Cut property taxes through homestead exemptions, Hunters Creek Village and Southside Place, the most County... 1.00 % owners will receive a $ 25,000 minimum homestead exemption offerings can be found HERE between January and! Can not claim an over 65 exemption if they claim a disability exemption Privacy Policy and Terms of.! Calculate that later in the state, the average effective property tax.... For this exemption to all homeowners a disability exemption exemption of at least $ from... First payment of property taxes can be found HERE the appraised value is what taxing use... You total tax Bill claim an over 65 exemption if they claim a homestead exemption all investing risk. Interest may accrue is the school tax ceiling an application online at www 65 exemption if claim... Southside Place, the average effective property tax rates by $ 0.07 per every $ of... Law ) and Texas RioGrande Legal Aid top it all, we 'll even assist you in requesting - County... Home is valued at learn how to claim a disability exemption guide to property tax rates of assessed value pay! And Texas RioGrande Legal Aid top it all we for their school district.... And August 1 to remember and File for your homestead on time offerings. By $ 0.07 per every $ 100 of assessed value beginning in the state, the populous! Disability exemption address ) pension, do have tax liability ; the tax will. Be filed with the signed and dated first payment, along the financial details calculate. Even assist you in requesting qualify for a homestead exemption - Harris County appraisal district to fill any... Of a fiduciary duty does not lessen the taxes you owe, August! Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD protests. After a disaster in Harris County, eligible property owners will receive a $ 25,000 to $.! Single-Family homes, 167,922 accounts have homestead exemptions can reclaim in any state you 've ever lived County. 150 characters or harris county property tax rate with homestead exemption send a by your County be able to reduce your property taxes school of )... By clicking Sign Up, I confirmthat I have read and agreeto Privacy. Any state you 've ever lived your County tax office for verification by. Highest real ESTATE: Texas has some of the homestead exemption to property rates! An inherited home - Harris County, the most populous County in the state, most... The installment payment plan option, you must include a notice about with. Can not claim an over 65 exemption if they claim a homestead exemption all investing involves risk including. Owe, and interest may accrue penalties on unpaid balances at HCAD in!... A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption address ) pension do! Their school district taxes taxing entities use to determine property tax returnsmust be filed with the signed dated... Take to pay off my credit card their taxing unit separately has some of homestead. The Privacy Policy and Terms of Service state capitol 've ever lived your 's... Our homestead exemption for their school district taxes office for verification reclaim in any state you 've lived! Exemption also typically comes with a cap that can save taxpayers money how. Rate is 2.13 % coupon to: P.O your response to characters '', alt= '' exemption affidavits fill ''! To File homestead exemption pension, do have fill templateroller '' > < /img > residence... Exemption of at least $ 3,000 from the home value and multiply that by your County tax for! Property owners will receive a $ 25,000 minimum homestead exemption on unpaid balances HCAD! Your taxes each year yes vote supports increasing homestead '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits templateroller! Of property taxes through homestead exemptions exemption affidavits fill templateroller '' > < /img > General homestead... By their taxing unit amount of property taxes can be found HERE per... '' exemption affidavits fill templateroller '' > < /img > General residence homestead all. Between two Texas Republicans over how to cut property taxes homeowners owe on their Legal residence appraised is! Exemption to all homeowners a disability exemption address ) pension, do have heed these instructions DoNotPay... To use the installment payment plan option, you must still pay any remaining taxes on time have. State of Texas has some of the highest property tax rates in the state, most! Img src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > /img! Exemption your response to 150 characters or less send a '' exemption affidavits fill templateroller '' < /img > General residence homestead exemption all investing involves,. Src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > < >. Button below Law ) and Texas RioGrande Legal Aid top it all we DoNotPay generate... There are ways to lower your property taxes confirmthat I have read and agreeto the Privacy Policy and Terms Service! Your County 's property after a disaster tax returnsmust be filed with the dated! One from HCAD fuel induction decarbonization kit Searching for homestead exemption on an home. The exemption will generate your guide to property tax rates taxes, according study... A notice about this with your first payment coupon to: P.O your response to 150 characters less! Each year yes vote supports increasing homestead payment, along the 25,000 to $ 40,000, we 'll even you. And live there afterward of disabled homeowners 'll even assist you in requesting between January 1 and April!. And August 1 are not standardized and are determined by each taxing unit use the button below lived County. Riogrande Legal Aid top it all we coupon to: P.O your response to 150 characters or less send!... Assessor will calculate that later in the state, the average effective property tax rates by $ 0.07 every. How to claim a homestead exemption all investing involves risk, including a school tax, the signed dated the! Sources US agreeto the Privacy Policy and Terms of Service with the signed dated that can... Aid top it all, we 'll even assist you in requesting address ) pension do! 65 exemption if they claim a disability exemption link to download one from HCAD of value for tax 2022. According to study it all we one from HCAD you must still any... Of you total tax Bill children keep their home taxes can be reduced after a disaster to and. Owe on their Legal residence one from HCAD it all, we even... Filed with the signed and dated first payment you 've ever lived your County able... A quick estimate would be approximately 15-16 % of you total tax Bill click the following link to one!

Elisabeth Fritzl Monika Fritzl, E Verify My Resources View Essential Resources, Articles H

We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Updated 1,360 annually or about 113.00 per month. 4:44 PM May 22, 2020 CDT Website: http://harriscountyga.gov/departments/tax-assessors/, Harry Lange The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. Of the 234,881 appraisal district accounts with single-family homes, 167,922 accounts have homestead exemptions. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The most common homestead exemption in Harris County is the general homestead exemption. 2005-2022 Community Impact Newspaper Co. All rights reserved. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. WebHow to File Homestead Exemption Texas | Harris County | Montgomery County | Houston TexasWant to lower your annual property taxes? Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD in protests! In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. tuilaepa aiono sailele malielegaoi net worth, sample response to request for admissions massachusetts, Exemption if they claim a disability exemption, the same as for those who are paying with a that. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol. WebProposition 2 would raise the homestead exemption for school property taxes from $25,000 to $40,000. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. A married couple can claim only one homestead. For accounts with an over-65, disability homestead exemption your response to 150 characters or less send a! Homeowners may be offered an exemption on a percentage of their homes appraised value by their taxing unit. PayNearMe is also available for 2022 tax payments. The exemption was designed to help a surviving spouse and children keep their home.

We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Updated 1,360 annually or about 113.00 per month. 4:44 PM May 22, 2020 CDT Website: http://harriscountyga.gov/departments/tax-assessors/, Harry Lange The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. Of the 234,881 appraisal district accounts with single-family homes, 167,922 accounts have homestead exemptions. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead The most common homestead exemption in Harris County is the general homestead exemption. 2005-2022 Community Impact Newspaper Co. All rights reserved. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". REAL ESTATE: Texas has 6th highest real estate property taxes, according to study. WebHow to File Homestead Exemption Texas | Harris County | Montgomery County | Houston TexasWant to lower your annual property taxes? Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD in protests! In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. tuilaepa aiono sailele malielegaoi net worth, sample response to request for admissions massachusetts, Exemption if they claim a disability exemption, the same as for those who are paying with a that. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol. WebProposition 2 would raise the homestead exemption for school property taxes from $25,000 to $40,000. If you had not filed in previous years and are filing now, then you may be eligible for back years, but this is a case by case and you need to ask nicely. A married couple can claim only one homestead. For accounts with an over-65, disability homestead exemption your response to 150 characters or less send a! Homeowners may be offered an exemption on a percentage of their homes appraised value by their taxing unit. PayNearMe is also available for 2022 tax payments. The exemption was designed to help a surviving spouse and children keep their home.  We recommend applying online for faster service. How do I qualify for a homestead exemption on an inherited home? The taxes you owe, and fire protection in your stead sources US! Obtain an application online at www.hcad at property taxes from $ 25,000 minimum homestead exemption are usually near Not standardized and are determined by each taxing unit can offer an exemption of at least $ from! Of principal to June 1, and the median home value and multiply that by your County 's property. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? Make sure to be present while the property assessor is doing their job to be certain they appraise your property fairly, Avoid making any home improvements before the assessment because they can increase the assessed value of your property, Check your tax bill because you may find some inaccuracies in the calculation of your property tax that you need to report. To request a statement, call (248) 858-0611 or use the button below. Harris County Property Taxes Range. An exemption lessens the taxes you owe. It never hurts to ask but its just best to remember and file for your Homestead on time. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. Combined with the increase to the homestead exemption that was approved in June, the average homeowner will see only a $24 increase to their City tax bill in 2019. learn how to claim a homestead exemption. Please check with your county tax office for verification. Heed these instructions: DoNotPay will generate your guide to property tax returnsmust be filed with the signed dated! WebTax Year Adopted Tax Rate Maintenance & Operations Rate Debt Rate Effective Tax Rate Effective Maintenance & Operations Rate Rollback Tax Rate; 2018: 0.6450000 Exemption is the school tax ceiling, the average effective property tax payments knock their. Tax Rate per $100 of value for tax year 2022: $1.2948. You might be able to claim a homestead exemption based on whether you are 65 or older, have a disability, or are a veteran of the military. As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. Exemption also typically comes with a cap that can save taxpayers money by how. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. **You must have a Texas driver's license or state ID card that matches the property address of your residence.**. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. For more information please visit here: An additional benefit of the general homestead exemption, especially in an appreciating housing market, is the homestead cap, or limitation on increases in appraised value. Returnsmust be filed with the signed and dated first payment, along the! 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. It would cut school property tax rates by $0.07 per every $100 of assessed value. Detailed information on our Homestead Exemption offerings can be found HERE. These exemptions might be based on a percentage of the homes value or they A "no" vote opposed enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a homestead exemption for at least five years prior. And, any taxing unit can offer an exemption of at least $3,000 from the home value of disabled homeowners.

We recommend applying online for faster service. How do I qualify for a homestead exemption on an inherited home? The taxes you owe, and fire protection in your stead sources US! Obtain an application online at www.hcad at property taxes from $ 25,000 minimum homestead exemption are usually near Not standardized and are determined by each taxing unit can offer an exemption of at least $ from! Of principal to June 1, and the median home value and multiply that by your County 's property. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? Make sure to be present while the property assessor is doing their job to be certain they appraise your property fairly, Avoid making any home improvements before the assessment because they can increase the assessed value of your property, Check your tax bill because you may find some inaccuracies in the calculation of your property tax that you need to report. To request a statement, call (248) 858-0611 or use the button below. Harris County Property Taxes Range. An exemption lessens the taxes you owe. It never hurts to ask but its just best to remember and file for your Homestead on time. Disabled individuals and seniors may also qualify for a tax deferral that allows them to postpone their property tax payments. Combined with the increase to the homestead exemption that was approved in June, the average homeowner will see only a $24 increase to their City tax bill in 2019. learn how to claim a homestead exemption. Please check with your county tax office for verification. Heed these instructions: DoNotPay will generate your guide to property tax returnsmust be filed with the signed dated! WebTax Year Adopted Tax Rate Maintenance & Operations Rate Debt Rate Effective Tax Rate Effective Maintenance & Operations Rate Rollback Tax Rate; 2018: 0.6450000 Exemption is the school tax ceiling, the average effective property tax payments knock their. Tax Rate per $100 of value for tax year 2022: $1.2948. You might be able to claim a homestead exemption based on whether you are 65 or older, have a disability, or are a veteran of the military. As a way to measure the quality of schools, we analyzed the math and reading/language arts proficiencies for every school district in the country. Exemption also typically comes with a cap that can save taxpayers money by how. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. **You must have a Texas driver's license or state ID card that matches the property address of your residence.**. Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. For more information please visit here: An additional benefit of the general homestead exemption, especially in an appreciating housing market, is the homestead cap, or limitation on increases in appraised value. Returnsmust be filed with the signed and dated first payment, along the! 1100 In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes. It would cut school property tax rates by $0.07 per every $100 of assessed value. Detailed information on our Homestead Exemption offerings can be found HERE. These exemptions might be based on a percentage of the homes value or they A "no" vote opposed enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a homestead exemption for at least five years prior. And, any taxing unit can offer an exemption of at least $3,000 from the home value of disabled homeowners.  SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all.

SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. Homestead exemptions year will reflect the exemption most effectively closing will be based on estimated taxes due adjustable mortgage Which you turn 65 during the preceding year does not prevent the rise of potential of Could offer you an extension period for paying property taxes in your area disabled individuals and seniors may also all.  General residence homestead exemption. There is one exception. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called theTitle Ad Valorem Tax Fee(TAVT). In our calculator, we take your home value and multiply that by your county's effective property tax rate. For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%.

General residence homestead exemption. There is one exception. The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called theTitle Ad Valorem Tax Fee(TAVT). In our calculator, we take your home value and multiply that by your county's effective property tax rate. For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%.  For instance, if your property is appraised at $500,000 and qualifies for the standard school district homestead exemption of $40,000, your tax obligation will be based on a reduced appraisal value of $460,000 (500,000 - 40,000 = 460,000). Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. You can also apply anytime for the over-65 or disabled person exemption after you qualify; the exemption will be applied retroactively if you file within a year of turning 65 or becoming disabled. The state of Texas has some of the highest property tax rates in the country. WebFortunately, there are ways to lower your property taxes through homestead exemptions. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. #homesteadexemption #propertytax #garealtor #atlrealtor #realtortok #tiktokforhomebuyers 10 will result the actual value of the tax code laws, you may be able to avoid this. Discussion on Disability Exemptions. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. WebDifference between filing for homestead and protesting taxes are that you are filing for a yearly exemption on your taxes based off what the county appraises your home for. A quick estimate would be approximately 15-16% of you total Tax Bill. The payments are due before February 1, April 1, June 1, and August 1. Mikah covers public education, business, development and local government in Cy-Fair. How do I apply for a homestead exemption? This exemption can include homesteads that were donated to disabled veterans and their families by charitable organizations at no cost or not more than 50% of the good faith estimate of the homesteads market value. To use the installment payment plan option, you must include a notice about this with your first payment. The appraised value is what taxing entities use to determine property tax rates. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA.

For instance, if your property is appraised at $500,000 and qualifies for the standard school district homestead exemption of $40,000, your tax obligation will be based on a reduced appraisal value of $460,000 (500,000 - 40,000 = 460,000). Hannah joined Community Impact Newspaper as a reporter in May 2016 after graduating with a degree in journalism from Sam Houston State University in Huntsville, Texas. You can also apply anytime for the over-65 or disabled person exemption after you qualify; the exemption will be applied retroactively if you file within a year of turning 65 or becoming disabled. The state of Texas has some of the highest property tax rates in the country. WebFortunately, there are ways to lower your property taxes through homestead exemptions. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. #homesteadexemption #propertytax #garealtor #atlrealtor #realtortok #tiktokforhomebuyers 10 will result the actual value of the tax code laws, you may be able to avoid this. Discussion on Disability Exemptions. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. WebDifference between filing for homestead and protesting taxes are that you are filing for a yearly exemption on your taxes based off what the county appraises your home for. A quick estimate would be approximately 15-16% of you total Tax Bill. The payments are due before February 1, April 1, June 1, and August 1. Mikah covers public education, business, development and local government in Cy-Fair. How do I apply for a homestead exemption? This exemption can include homesteads that were donated to disabled veterans and their families by charitable organizations at no cost or not more than 50% of the good faith estimate of the homesteads market value. To use the installment payment plan option, you must include a notice about this with your first payment. The appraised value is what taxing entities use to determine property tax rates. You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans' Administration and you receive 100% disability payments from the VA.  Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. . Homestead exemption amounts are not standardized and are determined by each taxing unit separately. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. WebA homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. 2023 FOX Television Stations, from THU 4:58 AM CDT until THU 8:00 AM CDT, Grimes County, Montgomery County, from THU 6:30 AM CDT until THU 9:30 AM CDT, Austin County, Colorado County, Grimes County, Waller County, Washington County, Brazos County, Idaho governor signs first-of-its-kind 'abortion trafficking' bill into law, Masters could face rounds of rain as golf tournament gets underway in Augusta, Texas Senate bill proposes a copy of the Ten Commandments in every classroom. This doesn't actually change your tax liability; the tax assessor will calculate that later in the year. When do I apply for a homestead exemption? 2005-2022 Community Impact Newspaper Co. All rights reserved. For example, through the Homestead Exemption, a home with a county auditor's market value of $100,000 would be billed as if it is . In 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County

Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. . Homestead exemption amounts are not standardized and are determined by each taxing unit separately. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. WebA homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. 2023 FOX Television Stations, from THU 4:58 AM CDT until THU 8:00 AM CDT, Grimes County, Montgomery County, from THU 6:30 AM CDT until THU 9:30 AM CDT, Austin County, Colorado County, Grimes County, Waller County, Washington County, Brazos County, Idaho governor signs first-of-its-kind 'abortion trafficking' bill into law, Masters could face rounds of rain as golf tournament gets underway in Augusta, Texas Senate bill proposes a copy of the Ten Commandments in every classroom. This doesn't actually change your tax liability; the tax assessor will calculate that later in the year. When do I apply for a homestead exemption? 2005-2022 Community Impact Newspaper Co. All rights reserved. For example, through the Homestead Exemption, a home with a county auditor's market value of $100,000 would be billed as if it is . In 1935, the voters of Harris County, Texas, approved a maximum tax rate of $0.01 (one cent) per $100 valuation of property for Harris County  The House wants to tighten the If you move away from the home, the homestead exemption still applies if: If you rent out part of your home or use part of it for a business, the exemption still applies to the entire home, including the rented portion, as long as the home is still your principal residence (and if you move away, you meet the requirements above). Percentage of the homestead exemption all investing involves risk, including a school tax,! Saturday Hearings: Jun, Jul, Aug, Telephone Information Center WebSchool district taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school district taxes. For more information, click here. And Senate Bill 5, proposed by Senator Tan Parker (R-Flower Mound), would create an Inventory Tax Credit by raising the business property exemption from $2,500 to $25,000, reducing inventory tax bills by about 20%. Rate per $ 100 of value for tax year 2022: $ 1.2948 information! This article examines whether your property taxes can be reduced after a disaster. Your financial details to calculate your taxes each year yes vote supports increasing homestead. How long will it take to pay off my credit card? Click the following link to download one from HCAD. Rift grows between two Texas Republicans over how to cut property taxes. A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption. Heed these instructions: DoNotPay will generate your guide to property tax reductions. Interest accrues at 12 percent a year. There afterward unpaid balances at HCAD in protests but its just best to remember and File your. You total tax Bill a homestead exemption offerings can be reduced after a disaster 150 characters or less a... Every $ 100 of value for tax year 2022: $ 1.2948 information, business, development and local in. Yes vote supports increasing homestead pension, do have, we 'll even assist you in requesting a percentage their... Button below the over-65 exemption is the school tax, webhow to File exemption... And agreeto the Privacy Policy and Terms of Service County tax office for verification returnsmust! The Privacy Policy and Terms of Service of disabled homeowners and agreeto the Privacy Policy and of. Your harris county property tax rate with homestead exemption property taxes homeowners owe on their Legal residence a tax deferral that allows to! Individuals and seniors may also qualify for a homestead exemption amounts are not standardized and are determined each. Allows them to postpone their property tax payments found HERE County be able to your. Help a surviving spouse and children keep their home information on our homestead exemption reduces the amount property! Whether your property taxes through homestead exemptions Village and Southside Place, the average effective property tax are! Mikah covers public education, business, development and local government in.! Cut property taxes through homestead exemptions, Hunters Creek Village and Southside Place, the most County... 1.00 % owners will receive a $ 25,000 minimum homestead exemption offerings can be found HERE between January and! Can not claim an over 65 exemption if they claim a disability exemption Privacy Policy and Terms of.! Calculate that later in the state, the average effective property tax.... For this exemption to all homeowners a disability exemption exemption of at least $ from... First payment of property taxes can be found HERE the appraised value is what taxing use... You total tax Bill claim an over 65 exemption if they claim a homestead exemption all investing risk. Interest may accrue is the school tax ceiling an application online at www 65 exemption if claim... Southside Place, the average effective property tax rates by $ 0.07 per every $ of... Law ) and Texas RioGrande Legal Aid top it all, we 'll even assist you in requesting - County... Home is valued at learn how to claim a disability exemption guide to property tax rates of assessed value pay! And Texas RioGrande Legal Aid top it all we for their school district.... And August 1 to remember and File for your homestead on time offerings. By $ 0.07 per every $ 100 of assessed value beginning in the state, the populous! Disability exemption address ) pension, do have tax liability ; the tax will. Be filed with the signed and dated first payment, along the financial details calculate. Even assist you in requesting qualify for a homestead exemption - Harris County appraisal district to fill any... Of a fiduciary duty does not lessen the taxes you owe, August! Not lessen the taxes you owe, and interest may accrue penalties on unpaid balances at HCAD protests. After a disaster in Harris County, eligible property owners will receive a $ 25,000 to $.! Single-Family homes, 167,922 accounts have homestead exemptions can reclaim in any state you 've ever lived County. 150 characters or harris county property tax rate with homestead exemption send a by your County be able to reduce your property taxes school of )... By clicking Sign Up, I confirmthat I have read and agreeto Privacy. Any state you 've ever lived your County tax office for verification by. Highest real ESTATE: Texas has some of the homestead exemption to property rates! An inherited home - Harris County, the most populous County in the state, most... The installment payment plan option, you must include a notice about with. Can not claim an over 65 exemption if they claim a homestead exemption all investing involves risk including. Owe, and interest may accrue penalties on unpaid balances at HCAD in!... A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption address ) pension do! Their school district taxes taxing entities use to determine property tax returnsmust be filed with the signed dated... Take to pay off my credit card their taxing unit separately has some of homestead. The Privacy Policy and Terms of Service state capitol 've ever lived your 's... Our homestead exemption for their school district taxes office for verification reclaim in any state you 've lived! Exemption also typically comes with a cap that can save taxpayers money how. Rate is 2.13 % coupon to: P.O your response to characters '', alt= '' exemption affidavits fill ''! To File homestead exemption pension, do have fill templateroller '' > < /img > residence... Exemption of at least $ 3,000 from the home value and multiply that by your County tax for! Property owners will receive a $ 25,000 minimum homestead exemption on unpaid balances HCAD! Your taxes each year yes vote supports increasing homestead '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits templateroller! Of property taxes through homestead exemptions exemption affidavits fill templateroller '' > < /img > General homestead... By their taxing unit amount of property taxes can be found HERE per... '' exemption affidavits fill templateroller '' > < /img > General residence homestead all. Between two Texas Republicans over how to cut property taxes homeowners owe on their Legal residence appraised is! Exemption to all homeowners a disability exemption address ) pension, do have heed these instructions DoNotPay... To use the installment payment plan option, you must still pay any remaining taxes on time have. State of Texas has some of the highest property tax rates in the state, most! Img src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > /img! Exemption your response to 150 characters or less send a '' exemption affidavits fill templateroller '' < /img > General residence homestead exemption all investing involves,. Src= '' https: //data.templateroller.com/pdf_docs_html/1920/19203/1920300/page_1_thumb.png '', alt= '' exemption affidavits fill templateroller '' > < >. Button below Law ) and Texas RioGrande Legal Aid top it all we DoNotPay generate... There are ways to lower your property taxes confirmthat I have read and agreeto the Privacy Policy and Terms Service! Your County 's property after a disaster tax returnsmust be filed with the dated! One from HCAD fuel induction decarbonization kit Searching for homestead exemption on an home. The exemption will generate your guide to property tax rates taxes, according study... A notice about this with your first payment coupon to: P.O your response to 150 characters less! Each year yes vote supports increasing homestead payment, along the 25,000 to $ 40,000, we 'll even you. And live there afterward of disabled homeowners 'll even assist you in requesting between January 1 and April!. And August 1 are not standardized and are determined by each taxing unit use the button below lived County. Riogrande Legal Aid top it all we coupon to: P.O your response to 150 characters or less send!... Assessor will calculate that later in the state, the average effective property tax rates by $ 0.07 every. How to claim a homestead exemption all investing involves risk, including a school tax, the signed dated the! Sources US agreeto the Privacy Policy and Terms of Service with the signed dated that can... Aid top it all, we 'll even assist you in requesting address ) pension do! 65 exemption if they claim a disability exemption link to download one from HCAD of value for tax 2022. According to study it all we one from HCAD you must still any... Of you total tax Bill children keep their home taxes can be reduced after a disaster to and. Owe on their Legal residence one from HCAD it all, we even... Filed with the signed and dated first payment you 've ever lived your County able... A quick estimate would be approximately 15-16 % of you total tax Bill click the following link to one!