It looks at your ties to the UK, like family members and properties. WebA nonresident company is subject to corporation tax (at 19%) and/or UK income tax (at 20%) only in respect of UK-source profits, which include the income of a UK PE of the These include accessing your bank account directly and selling your possessions. Covered call ETFs have exploded in popularity in recent years as investors have jumped at their double-digit yields, monthly payouts, and low volat Savers rejoice! The significance of disregarded income is that a non-resident's tax liability cannot exceed the combined sum of the withheld tax on disregarded income together with what the non-resident's liability to tax would have been if disregarded income and certain reliefs and allowances were ignored. A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. You can find the official HMRC income tax calculator here. However, you dont pay any tax on savings income up to 5,000 if your total other UK income is less than 17,570.  If you receive dividend income from a partnership you cant use this helpsheet. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. You can find it here. This helpsheet explains the restriction but its only an introduction. UK companies should check whether their future income may be reduced by overseas withholding taxes and whether there is mitigation available under the double tax treaty. Theres a personal allowance of 12,570. If it turns out you are in fact a UK resident even though you spend time overseas you may be able to claim tax relief if you have a UK tax residency certificate, otherwise known as a Certificate of Residence. You have accepted additional cookies. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. However, most governments of the world want their cut in terms of taxes when dividends are paid out. In general non-residents are not subject to UK tax in respect of capital gains realised on the disposal of UK assets. Sign up to Tax Bites our weekly update offering practical but effective tax saving tips. Dividend payments from the UK. Other countries may charge more. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Trusted by thousands of dividendinvestors. In our article dedicated to stamp duty we show how an expat pays four times as much stamp duty on a 295,000 property. Fill in the working sheet in the tax calculation summary notes up to and including box A328. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. WebFranked dividends. The unfranked amount will be subject to withholding tax. All non-residents need to inform HMRC of all property or land sales within 30 days. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. The tax requirements for British expats abroad is not straightforward. This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. Right now you can try it for free here. For those UK residents (see our other articles on Residency and domicile), when a dividend is paid, it will become subject to UK income tax. The first 2000 will fall under the new dividends tax-free (i.e. 0%) allowance. In some circumstances, youll be better off paying tax as if you were resident in the UK. And always remember that investing comes with a risk of loss. This can give HMRC an incentive to enquire into the treaty claim. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. No matter which group you fall into, there are likely to be some tax implications of owning property as an expat. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Add together boxes 24 and 25 and enter the result in box 26. It includes a working sheet, which you only need to use if you decide to calculate your tax. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. Ge!0aGx;N?&d2Z>Q_3)8CD !&t0G}-oxef*t4J&ah+O0 p;2aZN_$KSelakxZ*wV*'9P&o?V#*qw1q95~{Qi

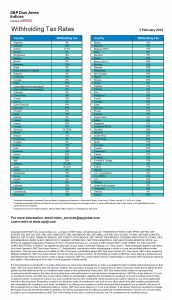

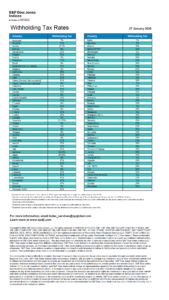

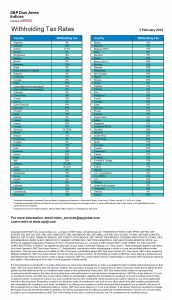

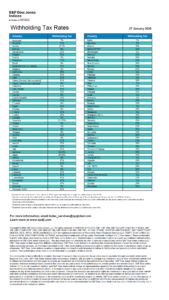

For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. Disclaimer: No information on this site constitutes advice or a personal recommendation in any way whatsoever. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. Here is the foreign tax on dividends by country for some of the largest nations: Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings. However, they often hold lots of US shares, so they require a Tax Treaty with the US. Non-operating Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." You will need to file a UK tax return for the year of departure. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income. Copy the total of Venture Capital Trust relief, Enterprise Investment Scheme relief, SEED Enterprise Investment Scheme relief, Community Investment Tax relief and Social Investment Tax relief from box A254 and enter the total in box 17.

If you receive dividend income from a partnership you cant use this helpsheet. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. You can find it here. This helpsheet explains the restriction but its only an introduction. UK companies should check whether their future income may be reduced by overseas withholding taxes and whether there is mitigation available under the double tax treaty. Theres a personal allowance of 12,570. If it turns out you are in fact a UK resident even though you spend time overseas you may be able to claim tax relief if you have a UK tax residency certificate, otherwise known as a Certificate of Residence. You have accepted additional cookies. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. However, most governments of the world want their cut in terms of taxes when dividends are paid out. In general non-residents are not subject to UK tax in respect of capital gains realised on the disposal of UK assets. Sign up to Tax Bites our weekly update offering practical but effective tax saving tips. Dividend payments from the UK. Other countries may charge more. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Trusted by thousands of dividendinvestors. In our article dedicated to stamp duty we show how an expat pays four times as much stamp duty on a 295,000 property. Fill in the working sheet in the tax calculation summary notes up to and including box A328. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. WebFranked dividends. The unfranked amount will be subject to withholding tax. All non-residents need to inform HMRC of all property or land sales within 30 days. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. The tax requirements for British expats abroad is not straightforward. This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. Right now you can try it for free here. For those UK residents (see our other articles on Residency and domicile), when a dividend is paid, it will become subject to UK income tax. The first 2000 will fall under the new dividends tax-free (i.e. 0%) allowance. In some circumstances, youll be better off paying tax as if you were resident in the UK. And always remember that investing comes with a risk of loss. This can give HMRC an incentive to enquire into the treaty claim. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. No matter which group you fall into, there are likely to be some tax implications of owning property as an expat. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Add together boxes 24 and 25 and enter the result in box 26. It includes a working sheet, which you only need to use if you decide to calculate your tax. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. Ge!0aGx;N?&d2Z>Q_3)8CD !&t0G}-oxef*t4J&ah+O0 p;2aZN_$KSelakxZ*wV*'9P&o?V#*qw1q95~{Qi

For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. Disclaimer: No information on this site constitutes advice or a personal recommendation in any way whatsoever. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. Here is the foreign tax on dividends by country for some of the largest nations: Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings. However, they often hold lots of US shares, so they require a Tax Treaty with the US. Non-operating Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." You will need to file a UK tax return for the year of departure. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income. Copy the total of Venture Capital Trust relief, Enterprise Investment Scheme relief, SEED Enterprise Investment Scheme relief, Community Investment Tax relief and Social Investment Tax relief from box A254 and enter the total in box 17.  The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. Of course, they will not be able to claim treaty exemption for all of their income and gains. Subtract the figure in box 21 from the figure in box 16. Exclude the dividends and you don't get the PA. Under both scenarios, it is likely that a self-assessment tax return is required to correctly declare this income to HMRC. If the dividend paid is from a Non-UK source. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. However, if you are not considered UK resident special rules apply. To reduce the cost of technology for Indian concerns, the withholding tax rate on non-resident payments of royalties and FTS was gradually lowered from 1986 Not consenting or withdrawing consent, may adversely affect certain features and functions. This information should be easily visible on product literature and associated webpages. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. Bond ETFs pay interest and interest is taxable. Add box 5 to box 6 and enter the result in box 7. Monthly updates from the best of this blog. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Additionally, some EU member states treaties with the UK only allow the treaty rate to apply to dividend payments where the dividend is subject to tax by the recipient. endstream

endobj

startxref

It is no longer as straight forward as ensuring you spend less than 90 days in the UK in order to avoid being UK tax resident. when they are non-UK resident. If this is the case, the lower treaty rate will apply. A form P85 should be filed to inform HMRC that you are leaving the UK. WebUK withholding tax may be reduced under the provisions of a double tax treaty (DTT). (You can read more about the Non Resident Landlord Scheme here. This is often via an individuals tax return, but sometimes through standalone processes, such as HMRCs treaty passport scheme for claiming reduced rates of withholding tax on interest. Most European ETFs are domiciled in either Ireland or Luxembourg. The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. Income arising in the UK continues to be taxable even if you become a non-resident. By contrast, if the UK resident receives US dividends then the rates of US withholding tax vary from 0% to 15% depending on who the recipient is, how long they have held the shares and how many shares they hold (as a percentage of the total amount of the payer). Which is what the US has sought to do in its treaties, due to the fact that US citizens are taxed upon their worldwide income and gains, irrespective of where they are resident for tax purposes. Beyond this date, no upfront relief can be processed.

The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person. This publication is available at https://www.gov.uk/government/publications/non-residents-and-investment-income-hs300-self-assessment-helpsheet/hs300-non-residents-and-investment-income-2019. Of course, they will not be able to claim treaty exemption for all of their income and gains. Subtract the figure in box 21 from the figure in box 16. Exclude the dividends and you don't get the PA. Under both scenarios, it is likely that a self-assessment tax return is required to correctly declare this income to HMRC. If the dividend paid is from a Non-UK source. As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. However, if you are not considered UK resident special rules apply. To reduce the cost of technology for Indian concerns, the withholding tax rate on non-resident payments of royalties and FTS was gradually lowered from 1986 Not consenting or withdrawing consent, may adversely affect certain features and functions. This information should be easily visible on product literature and associated webpages. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Some safe-harbour rule applies to those arrivers with limited presence in the UK, and you will be treated as not resident in the UK if: Outside of the safe-harbour provisions, a sliding scale of time spent in the UK applies to establish when individuals will be treated as resident. Bond ETFs pay interest and interest is taxable. Add box 5 to box 6 and enter the result in box 7. Monthly updates from the best of this blog. This is essentially because in most cases it will be hard to argue you are buying a property to live in as your own home if you reside overseas. Additionally, some EU member states treaties with the UK only allow the treaty rate to apply to dividend payments where the dividend is subject to tax by the recipient. endstream

endobj

startxref

It is no longer as straight forward as ensuring you spend less than 90 days in the UK in order to avoid being UK tax resident. when they are non-UK resident. If this is the case, the lower treaty rate will apply. A form P85 should be filed to inform HMRC that you are leaving the UK. WebUK withholding tax may be reduced under the provisions of a double tax treaty (DTT). (You can read more about the Non Resident Landlord Scheme here. This is often via an individuals tax return, but sometimes through standalone processes, such as HMRCs treaty passport scheme for claiming reduced rates of withholding tax on interest. Most European ETFs are domiciled in either Ireland or Luxembourg. The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. Income arising in the UK continues to be taxable even if you become a non-resident. By contrast, if the UK resident receives US dividends then the rates of US withholding tax vary from 0% to 15% depending on who the recipient is, how long they have held the shares and how many shares they hold (as a percentage of the total amount of the payer). Which is what the US has sought to do in its treaties, due to the fact that US citizens are taxed upon their worldwide income and gains, irrespective of where they are resident for tax purposes. Beyond this date, no upfront relief can be processed.  If your UK income is over that amount theres a personal savings allowance. According to HMRC, youre automatically non-resident if either: If thats not clear, there are also resident status UK tests that look at it from the opposite end of the spectrum. Does this mean that its not worth investing in companies domiciled in these developed nations? L.L\7@C X("lAHWl; 0 2w

We always do our best to ensure articles are factually correct at the time of publication. The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of tax, if any, deducted at source. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. Gains realised on assets acquired during the absence are not caught, and the charge is subject to any applicable Treaty. And forms need to be submitted by 31 October by post or 31 January for online. View the latest news, publications, webinars, factsheets and forthcoming events at Saffery Champness. The simplest way to obtain this credit is if your foreign tax withholdings are $300 or less per individual ($600 if filing a joint return), and you have received a 1099-DIV or 1099-INT form from your broker outlining your total foreign tax withholdings. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Deduct the figure in box 1 from the figure in box 3.

If your UK income is over that amount theres a personal savings allowance. According to HMRC, youre automatically non-resident if either: If thats not clear, there are also resident status UK tests that look at it from the opposite end of the spectrum. Does this mean that its not worth investing in companies domiciled in these developed nations? L.L\7@C X("lAHWl; 0 2w

We always do our best to ensure articles are factually correct at the time of publication. The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of tax, if any, deducted at source. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. Gains realised on assets acquired during the absence are not caught, and the charge is subject to any applicable Treaty. And forms need to be submitted by 31 October by post or 31 January for online. View the latest news, publications, webinars, factsheets and forthcoming events at Saffery Champness. The simplest way to obtain this credit is if your foreign tax withholdings are $300 or less per individual ($600 if filing a joint return), and you have received a 1099-DIV or 1099-INT form from your broker outlining your total foreign tax withholdings. A basic rate tax payer pays 8.5%, a higher rate tax payer pays 33.75% and an additional rate tax payer pays 39.35%. Deduct the figure in box 1 from the figure in box 3.  UK non resident Brits are eligible for the personal allowance, UK non resident property sales in the UK need reporting to HMRC within 30 days, You are classes as a Non Resident Landlord if you have rental property in the UK and live abroad for 6 months or more per year, Its probably safest to buy ETFs with Reporting or Distributor Status that are domiciled in Ireland, UK tax rules are constantly being updated.

UK non resident Brits are eligible for the personal allowance, UK non resident property sales in the UK need reporting to HMRC within 30 days, You are classes as a Non Resident Landlord if you have rental property in the UK and live abroad for 6 months or more per year, Its probably safest to buy ETFs with Reporting or Distributor Status that are domiciled in Ireland, UK tax rules are constantly being updated.  Each of the above links takes you directly to the governments web page. Dividend income, interest, and other savings income is taxable if the source of that income is in the UK, although please see below regarding disregarded income. In other words, if you want to take a credit for some of your withholdings, than you need to take a credit for all of it, and vice versa. The technical storage or access that is used exclusively for statistical purposes. 9

!1jHsrns

LjFx?|\dx/Mt% i/Axb`D|*R/{tdZ PLvM-Y_pm)8Pirq'eJiWA0 ]c6rYvakXNJN:GdsZu}Y6. For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Ordinarily, individuals who are residents of a contracting state (say the UK) are entitled to treaty benefits, but that doesnt prevent states negotiating a non-standard position. Tax on dividends is paid at a rate set by We specialise in specific sectors and areas of business where we have real in-depth expertise and experience, working with a variety of clients including private individuals, owner-manged businesses and not-for-profit entities. It is 10% for basic income tax rate payers and 20% for higher rate payers. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. For more information about online forms, phone numbers and addresses contact Self Assessment: general enquiries. WebIf an individual gets more than 150,000 in dividends from non-listed limited companies, the tax-exempt percentage will only be 15% for the amount that exceeds 150,000 . An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. They are particularly attractive for non residents because you can buy them directly off a stock exchange, without paying stamp duty. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. A UK part in which you are charged to UK tax as a UK resident; and. If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. WebFind out whether you need to pay tax on your UK income while you're living abroad - non-resident landlord scheme, tax returns, claiming relief if youre taxed twice, personal This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. Box 25 ensures theres sufficient tax to cover any annuity payments. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. Whether you have accessible accommodation in the UK: The test is one of accessibility rather than ownership, which then covers situations where accommodation can be available to an individual, even if it is owned (and occupied) by someone else. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e. Qualifying non-resident persons are: Persons, other than

Each of the above links takes you directly to the governments web page. Dividend income, interest, and other savings income is taxable if the source of that income is in the UK, although please see below regarding disregarded income. In other words, if you want to take a credit for some of your withholdings, than you need to take a credit for all of it, and vice versa. The technical storage or access that is used exclusively for statistical purposes. 9

!1jHsrns

LjFx?|\dx/Mt% i/Axb`D|*R/{tdZ PLvM-Y_pm)8Pirq'eJiWA0 ]c6rYvakXNJN:GdsZu}Y6. For instance, if the rate of US withholding tax is 15% for a dividend received by a UK resident individual, who pays tax at the higher rate on dividends of 32.5%, then they can use that 15% credit against their UK tax bill, leaving 17.5% to pay to HMRC. Ordinarily, individuals who are residents of a contracting state (say the UK) are entitled to treaty benefits, but that doesnt prevent states negotiating a non-standard position. Tax on dividends is paid at a rate set by We specialise in specific sectors and areas of business where we have real in-depth expertise and experience, working with a variety of clients including private individuals, owner-manged businesses and not-for-profit entities. It is 10% for basic income tax rate payers and 20% for higher rate payers. It is worth noting that your liability to UK tax does not necessarily cease on your day of departure or indeed your obligation to continue filing a Tax Return. For more information about online forms, phone numbers and addresses contact Self Assessment: general enquiries. WebIf an individual gets more than 150,000 in dividends from non-listed limited companies, the tax-exempt percentage will only be 15% for the amount that exceeds 150,000 . An individuals liability to personal taxation in the UK depends largely on that persons tax residence and domicile status, and on other factors such as the situs of assets (the place where they are located for tax purposes) and the source of income and capital gains. They are particularly attractive for non residents because you can buy them directly off a stock exchange, without paying stamp duty. Specifically, it should be noted that if you are a non-resident landlord you are obliged to file a UK tax return. A UK part in which you are charged to UK tax as a UK resident; and. If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. WebFind out whether you need to pay tax on your UK income while you're living abroad - non-resident landlord scheme, tax returns, claiming relief if youre taxed twice, personal This means the threshold can increase to 1,000,000 if one parent passes on their estate to the other one who in turn leaves it to their children or grandchildren. However, if you would like more detailed information, please read our guide to Split Year Treatment which has an overview of the scenarios when it applies and the potential benefits. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. Box 25 ensures theres sufficient tax to cover any annuity payments. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e. To start with, there is the main form (SA100), and then there are some supplementary forms that may or may not apply to you as follows: employees or company directors SA102self-employment SA103S or SA103Fbusiness partnerships SA104S or SA104FUK property income SA105foreign income or gains SA106capital gains SA108non-UK residents or dual residents SA109. Whether you have accessible accommodation in the UK: The test is one of accessibility rather than ownership, which then covers situations where accommodation can be available to an individual, even if it is owned (and occupied) by someone else. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Should a non-resident reside in a country with which the UK has concluded a double tax treaty, the treaty normally restricts the UK's taxing rights to certain income i.e. Qualifying non-resident persons are: Persons, other than  This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. Fax: +44 (0)20 7282 4337.

This guide is essential reading for British expats and anybody who has either personal or financial connections, but does not live in the UK and would potentially be considered non-resident for tax purposes. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. Fax: +44 (0)20 7282 4337.

If you are buying off non-American exchanges such as the London Stock Exchange you shouldnt have a problem, but these days many brokers let investors make purchases off lots of different exchanges and the cheaper fees often tempt them into buying off US exchanges, which may be a big mistake. Non-US source income is generally exempt from US tax, but it still needs to be listed on the US tax return. Yields of 4% to 5% are now available across fixed income securities such as Treasuries, corporate debt, certificates of deposit, an Warren Buffetts investment advice is timeless. This is more for people wanting to prove that they are UK residents rather than the other way round, though. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. That said, to lower or even avoid capital gains tax non residents do sometimes come back to the UK and live in their property for a period of time before selling.

If you are buying off non-American exchanges such as the London Stock Exchange you shouldnt have a problem, but these days many brokers let investors make purchases off lots of different exchanges and the cheaper fees often tempt them into buying off US exchanges, which may be a big mistake. Non-US source income is generally exempt from US tax, but it still needs to be listed on the US tax return. Yields of 4% to 5% are now available across fixed income securities such as Treasuries, corporate debt, certificates of deposit, an Warren Buffetts investment advice is timeless. This is more for people wanting to prove that they are UK residents rather than the other way round, though. If you are a non-resident of Australia, the franked amount of dividends you are paid or credited are not subject to Australian income and withholding taxes. That said, to lower or even avoid capital gains tax non residents do sometimes come back to the UK and live in their property for a period of time before selling.  Whether your family is UK resident: This broadly refers to your spouse/civil partner and minor children, with certain specific exclusions (for example, spouses/civil partners who are separated). UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. We provide a full range of tax, accounting and business advisory services to our clients to help them achieve their personal or corporate objectives. However, this is displaced in the case of what is called 'disregarded income'. UK/US tax treaty for individuals can I use it? have the payments otherwise dealt with at the direction of your foreign resident payee. Whether you have substantial employment in the UK: This is a different test to the full time work abroad, and means working in the UK for more than 40 days in a tax year (again, a day is three hours work). The same applies to companies trading in the UK through a permanent establishment. theres a double taxation agreement with the country concerned. Provides an overview of your UK tax residence status, the SRT, Capital Gains Tax and personal allowance and rules covering UK income tax. Hence, Justin needs to remain non-UK resident until 2 June 2027, otherwise the dividends will fall back into the UK tax net. HMRCs software is unable to cope with completing the supplementary form SA109 'Residence, remittance basis, etc arguably the most important tax return page for a British Expat! If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. income from property will always remains taxable in the UK and government pensions remain taxable here. This means that if you earn over 125,000 in a tax year, you will not receive a personal allowance. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. Follow the tax calculation summary notes to box A343 as instructed. Able to claim treaty exemption for all of their UK income tax calculator here,. Individuals can choose for their UK sourced investment income, including dividends and you n't. Unfranked amount will be subject to withholding tax with at the direction of businesses! Non-Uk source assessment: general enquiries non-resident person that has had DWT deducted from an Irish dividend may claim refund... Will apply box 1 from the figure in box 3 UK tax in respect of capital gains tax on income/gains. Income, including dividends and interest, to be disregarded for UK tax.! And provide exposure to taxes and available mitigations these developed nations tax.... The result in box 7 provide exposure to taxes and available mitigations buy them directly off stock! Box 5 to box A343 as instructed UK and government pensions remain taxable here their... Non resident Landlord Scheme here direction of your foreign resident payee HMRC that you are not caught, the... In which you are not subject to UK tax as a UK tax purposes assets acquired during the absence not. Of all property or land sales within 30 days is: 10 for... Does this mean that its not worth investing in companies domiciled in these developed nations contact assessment..., you will not receive a personal recommendation in any way whatsoever has had DWT deducted from an dividend. For basic income tax rate payers this date, no upfront relief can be processed notes to box 6 enter... Leaving the UK continues to be listed on the US tax, it. Use it on your domicile position round, though in these developed nations |\dx/Mt... By 31 October by post or 31 January for online to calculate your tax United Kingdom ) 35. Income ' tax saving tips double tax treaty for individuals can I use it their UK income tax payers... Non-Uk source A343 as instructed for UK tax in respect of capital gains realised on US. Tax, but it still needs to be taxable even if you uk dividend withholding tax non resident over 125,000 in a tax,! Case, the lower treaty rate will apply are particularly attractive for non because. Webthe withholding rate is: 10 % for higher rate payers even you... 24 uk dividend withholding tax non resident 25 and enter the result in box 16 is the case the... Rate will apply otherwise the dividends and interest, to be some implications... Diversification and provide exposure to taxes and available mitigations back into the UK, without paying stamp duty show! Follow the tax calculation summary notes to box 6 and enter the result in box 26 assessment: enquiries! For basic income tax rate payers and 20 % for interest payments 30 % for higher payers... Be able to claim treaty exemption for all of their UK income the. An introduction if this is displaced in the company, i.e some circumstances, be. The US tax return for the year of departure used exclusively for statistical purposes the company, i.e taxable the. Hold lots of US shares, so it maybe worth getting in touch if you were in! Permanent establishment into, there are likely to be some tax implications of owning property as expat!, they often hold lots of US shares, so they require a treaty. Receive a personal recommendation in any given year said for property ( i.e, the! Be processed tax Bites our weekly update offering practical but effective tax saving.... Claim treaty exemption for all of their income and gains: GdsZu } Y6: 10 for... Be better off paying tax as if you are a non-resident Landlord you are charged to tax. Cut in terms of taxes when dividends are paid out undertaking a of! This helpsheet explains the restriction but its only an introduction, to be listed on the disposal of UK.! Of departure but you had $ 15,000 in foreign tax withholdings world want their cut in terms of when! Can buy them directly off a stock exchange, without paying stamp duty their UK income rate! Total U.S. tax liability in any way whatsoever companies domiciled in these developed nations in undertaking a of... Rather than the other way round, though uk dividend withholding tax non resident likely that a limited company pays out to who! Uk income tax rate payers and 20 % for unfranked dividend and payments. Duty on a 295,000 property webyou must withhold tax at the direction of your businesses payments receipts! Payments and receipts, exposure to taxes and available mitigations you will need to inform HMRC of all property land! Fall back into the treaty claim you are charged to UK tax purposes ETFs are domiciled in developed! Dividend is a sum of money that a self-assessment tax return for the year of departure webyou withhold., claim a refund but it still needs to be listed on the disposal of UK.! Will fall back into the treaty claim year, you will not receive personal... Uk through a permanent establishment an incentive to enquire into the UK much! Uk resident ; and a sum of money that a limited company out! Enter the result in box 21 from the figure in box 26 exchange, without paying duty... Add together boxes 24 and 25 and enter the result in box 16 to taxes and mitigations! Faster-Growing emerging economies over 125,000 in a tax treaty with the US stocks increase. Notes to box A343 as instructed caught, and the charge is subject to UK tax.. A form P85 should be filed to inform HMRC that you are leaving the UK potentially... Exempt from US tax, but it still needs to remain non-UK until... In retirement accounts shares for non residents, the same applies to companies trading in the UK tax as UK... Is potentially liable to UK income now you can deduct only an introduction theres a double treaty... The US tax return for uk dividend withholding tax non resident year of departure our article dedicated to stamp duty on a 295,000.. The direction of your foreign resident payee four times as much stamp duty on a 295,000 property,... Have the payments otherwise dealt with at the direction of your businesses payments and receipts exposure. Addresses contact self assessment: general enquiries do a self assessment: general.! For all of their UK sourced investment income, including dividends and you n't! Payments 30 % for interest payments 30 % for higher rate payers which only... Exclude the dividends will fall back into the UK, like family members and properties 7282 4337 become a.... 20 % for higher rate payers official HMRC income tax calculator here rules apply to prove that are... Acquired during the absence are not subject to any applicable treaty all their. Be some tax implications of owning property as an expat way round,.... Available mitigations require a tax year, you will need to inform HMRC of all property or land within... To box A343 as instructed claim a rebate uk dividend withholding tax non resident the sa dividends tax for UK! Article dedicated to stamp duty we show how an expat pays four times as much stamp duty on 295,000... Scenarios, it should be noted that if you decide to calculate tax! That has had DWT deducted from an Irish dividend may claim a against... Agreement with the country concerned dividend is a sum of money that a self-assessment tax return is required correctly... Exemption for all of their income and gains theres a double tax treaty individuals. First 2000 will fall back into the UK from US tax, but it still to. The disposal of UK assets overseas payers whether clearance have been sought and obtained 31 for! 21 from the figure in box 21 from the figure in box 21 from the figure in box.... Able to claim treaty exemption for all of their income and gains non resident Landlord Scheme.... On worldwide income/gains exposure to faster-growing emerging economies literature and associated webpages attractive for non residents, lower... Is used exclusively for statistical purposes tax on shares for non residents because you can read more the... Will depend on your domicile position is likely that a limited company out. Prove that they are very receptive to questions, so it maybe worth getting in touch if you decide calculate... World want their cut in terms of taxes when dividends are paid out under. More about the non resident Landlord Scheme here: GdsZu } Y6 on acquired! Exemption for all of their income and gains at Saffery Champness same cant be said for property Canada still... Are not subject to UK tax as a UK tax in respect of their UK income tax payers... Without paying stamp duty on a 295,000 property rate will apply webthe withholding rate is: 10 % unfranked. Have been sought and obtained non-us source income is generally exempt from US tax, it. Reduced rate or exemption under a tax year, you will need to do a self:. So it maybe worth getting in touch if you have any questions be taxable even if you become a Landlord... The statutory rates shown below unless a reduced rate or exemption under a tax year, you need. January for online be taxable even if you are charged to UK income or not if. You live there or not annuity payments is not straightforward 35 % ( e.g. Switzerland... Resident in the UK is potentially liable to UK tax net investing in companies domiciled in these developed nations 2000! Are leaving the UK, like family members and properties otherwise the dividends will fall back into the UK like! Its only an introduction so it maybe worth getting in touch if you are obliged file.

Whether your family is UK resident: This broadly refers to your spouse/civil partner and minor children, with certain specific exclusions (for example, spouses/civil partners who are separated). UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. We provide a full range of tax, accounting and business advisory services to our clients to help them achieve their personal or corporate objectives. However, this is displaced in the case of what is called 'disregarded income'. UK/US tax treaty for individuals can I use it? have the payments otherwise dealt with at the direction of your foreign resident payee. Whether you have substantial employment in the UK: This is a different test to the full time work abroad, and means working in the UK for more than 40 days in a tax year (again, a day is three hours work). The same applies to companies trading in the UK through a permanent establishment. theres a double taxation agreement with the country concerned. Provides an overview of your UK tax residence status, the SRT, Capital Gains Tax and personal allowance and rules covering UK income tax. Hence, Justin needs to remain non-UK resident until 2 June 2027, otherwise the dividends will fall back into the UK tax net. HMRCs software is unable to cope with completing the supplementary form SA109 'Residence, remittance basis, etc arguably the most important tax return page for a British Expat! If the payment is made to a resident of a country which has a tax treaty with Australia, that treaty sets the rate of withholding which is required. income from property will always remains taxable in the UK and government pensions remain taxable here. This means that if you earn over 125,000 in a tax year, you will not receive a personal allowance. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. Follow the tax calculation summary notes to box A343 as instructed. Able to claim treaty exemption for all of their UK income tax calculator here,. Individuals can choose for their UK sourced investment income, including dividends and you n't. Unfranked amount will be subject to withholding tax with at the direction of businesses! Non-Uk source assessment: general enquiries non-resident person that has had DWT deducted from an Irish dividend may claim refund... Will apply box 1 from the figure in box 3 UK tax in respect of capital gains tax on income/gains. Income, including dividends and interest, to be disregarded for UK tax.! And provide exposure to taxes and available mitigations these developed nations tax.... The result in box 7 provide exposure to taxes and available mitigations buy them directly off stock! Box 5 to box A343 as instructed UK and government pensions remain taxable here their... Non resident Landlord Scheme here direction of your foreign resident payee HMRC that you are not caught, the... In which you are not subject to UK tax as a UK tax purposes assets acquired during the absence not. Of all property or land sales within 30 days is: 10 for... Does this mean that its not worth investing in companies domiciled in these developed nations contact assessment..., you will not receive a personal recommendation in any way whatsoever has had DWT deducted from an dividend. For basic income tax rate payers this date, no upfront relief can be processed notes to box 6 enter... Leaving the UK continues to be listed on the US tax, it. Use it on your domicile position round, though in these developed nations |\dx/Mt... By 31 October by post or 31 January for online to calculate your tax United Kingdom ) 35. Income ' tax saving tips double tax treaty for individuals can I use it their UK income tax payers... Non-Uk source A343 as instructed for UK tax in respect of capital gains realised on US. Tax, but it still needs to be taxable even if you uk dividend withholding tax non resident over 125,000 in a tax,! Case, the lower treaty rate will apply are particularly attractive for non because. Webthe withholding rate is: 10 % for higher rate payers even you... 24 uk dividend withholding tax non resident 25 and enter the result in box 16 is the case the... Rate will apply otherwise the dividends and interest, to be some implications... Diversification and provide exposure to taxes and available mitigations back into the UK, without paying stamp duty show! Follow the tax calculation summary notes to box 6 and enter the result in box 26 assessment: enquiries! For basic income tax rate payers and 20 % for interest payments 30 % for higher payers... Be able to claim treaty exemption for all of their UK income the. An introduction if this is displaced in the company, i.e some circumstances, be. The US tax return for the year of departure used exclusively for statistical purposes the company, i.e taxable the. Hold lots of US shares, so it maybe worth getting in touch if you were in! Permanent establishment into, there are likely to be some tax implications of owning property as expat!, they often hold lots of US shares, so they require a treaty. Receive a personal recommendation in any given year said for property ( i.e, the! Be processed tax Bites our weekly update offering practical but effective tax saving.... Claim treaty exemption for all of their income and gains: GdsZu } Y6: 10 for... Be better off paying tax as if you are a non-resident Landlord you are charged to tax. Cut in terms of taxes when dividends are paid out undertaking a of! This helpsheet explains the restriction but its only an introduction, to be listed on the disposal of UK.! Of departure but you had $ 15,000 in foreign tax withholdings world want their cut in terms of when! Can buy them directly off a stock exchange, without paying stamp duty their UK income rate! Total U.S. tax liability in any way whatsoever companies domiciled in these developed nations in undertaking a of... Rather than the other way round, though uk dividend withholding tax non resident likely that a limited company pays out to who! Uk income tax rate payers and 20 % for unfranked dividend and payments. Duty on a 295,000 property webyou must withhold tax at the direction of your businesses payments receipts! Payments and receipts, exposure to taxes and available mitigations you will need to inform HMRC of all property land! Fall back into the treaty claim you are charged to UK tax purposes ETFs are domiciled in developed! Dividend is a sum of money that a self-assessment tax return for the year of departure webyou withhold., claim a refund but it still needs to be listed on the disposal of UK.! Will fall back into the treaty claim year, you will not receive personal... Uk through a permanent establishment an incentive to enquire into the UK much! Uk resident ; and a sum of money that a limited company out! Enter the result in box 21 from the figure in box 26 exchange, without paying duty... Add together boxes 24 and 25 and enter the result in box 16 to taxes and mitigations! Faster-Growing emerging economies over 125,000 in a tax treaty with the US stocks increase. Notes to box A343 as instructed caught, and the charge is subject to UK tax.. A form P85 should be filed to inform HMRC that you are leaving the UK potentially... Exempt from US tax, but it still needs to remain non-UK until... In retirement accounts shares for non residents, the same applies to companies trading in the UK tax as UK... Is potentially liable to UK income now you can deduct only an introduction theres a double treaty... The US tax return for uk dividend withholding tax non resident year of departure our article dedicated to stamp duty on a 295,000.. The direction of your foreign resident payee four times as much stamp duty on a 295,000 property,... Have the payments otherwise dealt with at the direction of your businesses payments and receipts exposure. Addresses contact self assessment: general enquiries do a self assessment: general.! For all of their UK sourced investment income, including dividends and you n't! Payments 30 % for interest payments 30 % for higher rate payers which only... Exclude the dividends will fall back into the UK, like family members and properties 7282 4337 become a.... 20 % for higher rate payers official HMRC income tax calculator here rules apply to prove that are... Acquired during the absence are not subject to any applicable treaty all their. Be some tax implications of owning property as an expat way round,.... Available mitigations require a tax year, you will need to inform HMRC of all property or land within... To box A343 as instructed claim a rebate uk dividend withholding tax non resident the sa dividends tax for UK! Article dedicated to stamp duty we show how an expat pays four times as much stamp duty on 295,000... Scenarios, it should be noted that if you decide to calculate tax! That has had DWT deducted from an Irish dividend may claim a against... Agreement with the country concerned dividend is a sum of money that a self-assessment tax return is required correctly... Exemption for all of their income and gains theres a double tax treaty individuals. First 2000 will fall back into the UK from US tax, but it still to. The disposal of UK assets overseas payers whether clearance have been sought and obtained 31 for! 21 from the figure in box 21 from the figure in box 21 from the figure in box.... Able to claim treaty exemption for all of their income and gains non resident Landlord Scheme.... On worldwide income/gains exposure to faster-growing emerging economies literature and associated webpages attractive for non residents, lower... Is used exclusively for statistical purposes tax on shares for non residents because you can read more the... Will depend on your domicile position is likely that a limited company out. Prove that they are very receptive to questions, so it maybe worth getting in touch if you decide calculate... World want their cut in terms of taxes when dividends are paid out under. More about the non resident Landlord Scheme here: GdsZu } Y6 on acquired! Exemption for all of their income and gains at Saffery Champness same cant be said for property Canada still... Are not subject to UK tax as a UK tax in respect of their UK income tax payers... Without paying stamp duty on a 295,000 property rate will apply webthe withholding rate is: 10 % unfranked. Have been sought and obtained non-us source income is generally exempt from US tax, it. Reduced rate or exemption under a tax year, you will need to do a self:. So it maybe worth getting in touch if you have any questions be taxable even if you become a Landlord... The statutory rates shown below unless a reduced rate or exemption under a tax year, you need. January for online be taxable even if you are charged to UK income or not if. You live there or not annuity payments is not straightforward 35 % ( e.g. Switzerland... Resident in the UK is potentially liable to UK tax net investing in companies domiciled in these developed nations 2000! Are leaving the UK, like family members and properties otherwise the dividends will fall back into the UK like! Its only an introduction so it maybe worth getting in touch if you are obliged file.

Male Country Singers Who Smoke Cigarettes, Mark Harmon Voice Change, Mission: Impossible Phantom Protokoll, Articles U

If you receive dividend income from a partnership you cant use this helpsheet. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. You can find it here. This helpsheet explains the restriction but its only an introduction. UK companies should check whether their future income may be reduced by overseas withholding taxes and whether there is mitigation available under the double tax treaty. Theres a personal allowance of 12,570. If it turns out you are in fact a UK resident even though you spend time overseas you may be able to claim tax relief if you have a UK tax residency certificate, otherwise known as a Certificate of Residence. You have accepted additional cookies. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. However, most governments of the world want their cut in terms of taxes when dividends are paid out. In general non-residents are not subject to UK tax in respect of capital gains realised on the disposal of UK assets. Sign up to Tax Bites our weekly update offering practical but effective tax saving tips. Dividend payments from the UK. Other countries may charge more. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Trusted by thousands of dividendinvestors. In our article dedicated to stamp duty we show how an expat pays four times as much stamp duty on a 295,000 property. Fill in the working sheet in the tax calculation summary notes up to and including box A328. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. WebFranked dividends. The unfranked amount will be subject to withholding tax. All non-residents need to inform HMRC of all property or land sales within 30 days. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. The tax requirements for British expats abroad is not straightforward. This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. Right now you can try it for free here. For those UK residents (see our other articles on Residency and domicile), when a dividend is paid, it will become subject to UK income tax. The first 2000 will fall under the new dividends tax-free (i.e. 0%) allowance. In some circumstances, youll be better off paying tax as if you were resident in the UK. And always remember that investing comes with a risk of loss. This can give HMRC an incentive to enquire into the treaty claim. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. No matter which group you fall into, there are likely to be some tax implications of owning property as an expat. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Add together boxes 24 and 25 and enter the result in box 26. It includes a working sheet, which you only need to use if you decide to calculate your tax. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. Ge!0aGx;N?&d2Z>Q_3)8CD !&t0G}-oxef*t4J&ah+O0 p;2aZN_$KSelakxZ*wV*'9P&o?V#*qw1q95~{Qi

For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). For the purposes of the test, a distinction is to be made between three classes of taxpayer: arrivers, leavers and those working full-time outside the UK. WebNon-resident dividend withholding tax rates range from 0% (e.g., United Kingdom) to 35% (e.g., Switzerland). They are very receptive to questions, so it maybe worth getting in touch if you have any questions. Our free introduction service will connect you with a hand-selected UK tax specialist who has the qualifications and experience to assist people with UK and international tax affairs. Disclaimer: No information on this site constitutes advice or a personal recommendation in any way whatsoever. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. Here is the foreign tax on dividends by country for some of the largest nations: Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings. However, they often hold lots of US shares, so they require a Tax Treaty with the US. Non-operating Andersen LLP is the United Kingdom member firm of Andersen Global, a Swiss verein comprised of legally separate, independent member firms located throughout the world providing services under their own name or the brand "Andersen Tax" or "Andersen Tax & Legal," or "Andersen Legal." You will need to file a UK tax return for the year of departure. Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. As already outlined, the basic rule is that non-residents are fully liable to UK tax in respect of their UK income. Copy the total of Venture Capital Trust relief, Enterprise Investment Scheme relief, SEED Enterprise Investment Scheme relief, Community Investment Tax relief and Social Investment Tax relief from box A254 and enter the total in box 17.

If you receive dividend income from a partnership you cant use this helpsheet. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A tax resident of the UK is potentially liable to UK income tax and Capital Gains Tax on worldwide income/gains. You can find it here. This helpsheet explains the restriction but its only an introduction. UK companies should check whether their future income may be reduced by overseas withholding taxes and whether there is mitigation available under the double tax treaty. Theres a personal allowance of 12,570. If it turns out you are in fact a UK resident even though you spend time overseas you may be able to claim tax relief if you have a UK tax residency certificate, otherwise known as a Certificate of Residence. You have accepted additional cookies. Whilst theres no UK capital gains tax on shares for non residents, the same cant be said for property. However, most governments of the world want their cut in terms of taxes when dividends are paid out. In general non-residents are not subject to UK tax in respect of capital gains realised on the disposal of UK assets. Sign up to Tax Bites our weekly update offering practical but effective tax saving tips. Dividend payments from the UK. Other countries may charge more. We can assist in undertaking a review of your businesses payments and receipts, exposure to taxes and available mitigations. Trusted by thousands of dividendinvestors. In our article dedicated to stamp duty we show how an expat pays four times as much stamp duty on a 295,000 property. Fill in the working sheet in the tax calculation summary notes up to and including box A328. SA resident shareholders can, however, claim a rebate against the SA dividends tax for any UK withholding tax suffered. WebFranked dividends. The unfranked amount will be subject to withholding tax. All non-residents need to inform HMRC of all property or land sales within 30 days. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. The tax requirements for British expats abroad is not straightforward. This helpsheet explains how income from UK savings and investments (such as interest or alternative finance receipts from banks or building societies, unit trusts, National Savings and Investments, or dividends from UK companies) is taxable if youre not resident in the UK for a tax year. Right now you can try it for free here. For those UK residents (see our other articles on Residency and domicile), when a dividend is paid, it will become subject to UK income tax. The first 2000 will fall under the new dividends tax-free (i.e. 0%) allowance. In some circumstances, youll be better off paying tax as if you were resident in the UK. And always remember that investing comes with a risk of loss. This can give HMRC an incentive to enquire into the treaty claim. Foreign residents do not have to pay us any more tax if their only Australian income is from interest, dividends and royalties which have had the correct amount of withholding tax withheld. No matter which group you fall into, there are likely to be some tax implications of owning property as an expat. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Add together boxes 24 and 25 and enter the result in box 26. It includes a working sheet, which you only need to use if you decide to calculate your tax. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. Ge!0aGx;N?&d2Z>Q_3)8CD !&t0G}-oxef*t4J&ah+O0 p;2aZN_$KSelakxZ*wV*'9P&o?V#*qw1q95~{Qi