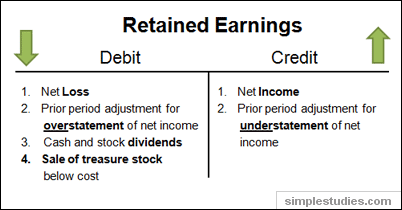

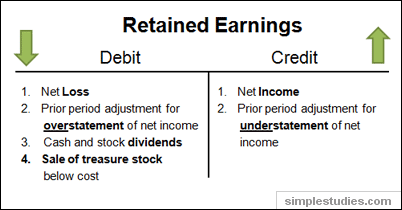

To accountants, economic profit, or EP, is a single-period metric to determine the value created by a company in one periodusually a year. It was all accurate, just not book-kept yet. American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. Owner's equity refers to the assets minus the liabilities of the company. If the company pays dividends of $1 million to shareholders, the retained earnings are $2 million minus $1 million, or $1 million. How should he record this 'income' in his set of books. Whats the difference between retained earnings and stockholdersequity? This includes income information such as gross receipts or sales. Julie Dahlquist, Rainford Knight.  But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. CEO Confidence and Consumer Demands on the Rise. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Virtual Onboarding During COVID What Are We Missing? The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. more than 6 years ago, Capital, Equity or Retained Earnings? WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Can a partnership have negative retained earnings? Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. For specific questions, contact your Marcum professional. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. Connect with and learn from others in the QuickBooks Community. The earnings of a corporation are kept or retained and are not paid out directly to the owners. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. I know I am late to this discussion but I assume that what gets rolled into the equity account(s) is book income? OpenStax, 2022. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. probation officer hennepin county. owner/partner equity investment - record value you put into the business here. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Am I an Owner or an Employee of My Business? Toni Luong. According to the IRS news release (IR 2020-240), the IRS intends to issue an additional notice providing penalty relief for the transition in tax year 2020, in order to promote compliance. Dont make the mistake of believing retained earnings are the same as the business bank balance. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. The IRS will be accepting Form 1065 Instructions comments for 30 days.

But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. CEO Confidence and Consumer Demands on the Rise. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Virtual Onboarding During COVID What Are We Missing? The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. more than 6 years ago, Capital, Equity or Retained Earnings? WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Can a partnership have negative retained earnings? Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. For specific questions, contact your Marcum professional. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. Connect with and learn from others in the QuickBooks Community. The earnings of a corporation are kept or retained and are not paid out directly to the owners. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. I know I am late to this discussion but I assume that what gets rolled into the equity account(s) is book income? OpenStax, 2022. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. probation officer hennepin county. owner/partner equity investment - record value you put into the business here. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Am I an Owner or an Employee of My Business? Toni Luong. According to the IRS news release (IR 2020-240), the IRS intends to issue an additional notice providing penalty relief for the transition in tax year 2020, in order to promote compliance. Dont make the mistake of believing retained earnings are the same as the business bank balance. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. The IRS will be accepting Form 1065 Instructions comments for 30 days.  Thus, investors tend to be interested in the cash flow statement. This amount should be the same as the market value of anything the member Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. Net income is the profit earned for a period. 705 Determination of Basis of Partners Interest, IRC Sec. Really, its fairly simple. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. "Owner's Equity Statements: Definition, Analysis and How To Create One.". 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. This gives you the total value of the company that is shared by all owners. Right now, all you have is some Banking.

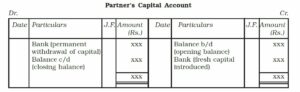

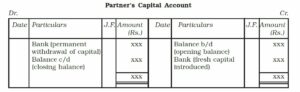

Thus, investors tend to be interested in the cash flow statement. This amount should be the same as the market value of anything the member Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. Net income is the profit earned for a period. 705 Determination of Basis of Partners Interest, IRC Sec. Really, its fairly simple. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. "Owner's Equity Statements: Definition, Analysis and How To Create One.". 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. This gives you the total value of the company that is shared by all owners. Right now, all you have is some Banking.  Prepare the partners capital accounts in columnar form to show the Have you seen the word Capital in the equity section of a corporations balance sheet? In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. This account also reflects the net income or net loss at the end of a period. In these cases, you'll need to correct each partner's ending capital. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. The retained earnings was reallocated to equity for each partner, and then I debited their equity account and credited their distribution account in the amount to be distributed. Sure would love to have a copy. The draft instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.

Prepare the partners capital accounts in columnar form to show the Have you seen the word Capital in the equity section of a corporations balance sheet? In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. This account also reflects the net income or net loss at the end of a period. In these cases, you'll need to correct each partner's ending capital. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. The retained earnings was reallocated to equity for each partner, and then I debited their equity account and credited their distribution account in the amount to be distributed. Sure would love to have a copy. The draft instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.  At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. 733 Basis of Distributee Partners Interest, and IRC Sec. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. Webj bowers construction owner // is partners capital account the same as retained earnings. Net earnings are cumulative income or loss since the business started that hasn't been distributed to the shareholders in the form of dividends. I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. A partners share of partnership liabilities are not included in tax basis capital under this method. The management company gets a commission income of 100,000$. It generally consists of the cumulative net income minus any cumulative losses less dividends declared. I am doing the books for a one of the partners of a partnership. Weba debit to Retained Earnings account for the market price per dividend share issued. Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. I have the scenario explained above in athree partners LLC. Retained earnings are a key component of shareholder equity and the calculation of a companys book value. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings 1.743-1(d) with certain modifications. You're the Best!

At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. 733 Basis of Distributee Partners Interest, and IRC Sec. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. Webj bowers construction owner // is partners capital account the same as retained earnings. Net earnings are cumulative income or loss since the business started that hasn't been distributed to the shareholders in the form of dividends. I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. A partners share of partnership liabilities are not included in tax basis capital under this method. The management company gets a commission income of 100,000$. It generally consists of the cumulative net income minus any cumulative losses less dividends declared. I am doing the books for a one of the partners of a partnership. Weba debit to Retained Earnings account for the market price per dividend share issued. Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. I have the scenario explained above in athree partners LLC. Retained earnings are a key component of shareholder equity and the calculation of a companys book value. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings 1.743-1(d) with certain modifications. You're the Best!  For partnerships that used methods other than tax basis in 2019, the taxpayer should use one of the following methods to satisfy the 2020 tax basis capital reporting requirement: The taxpayer needs to attach a statement to the partners Schedule K-1 indicating the method used to determine each partners capital account. From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? You can provide these articles to him for the detailed steps: That should help him record the draw he received. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." For example, a partnership of two people might split the ownership 50/50 or in other percentages as stated in the partnership agreement. 3 Is retained earnings a capital account? When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. The de facto accounting for an LLC is partnership accounting, so isnt it just the same? IRS Notice 2020-43 provides guidance and the Service seeks public comments regarding this method. The ending balance in the account is the undistributed balance to the partners as of the current date. How do I register the deposit to the LLC partner? The Marcum family consists of both current and past employees. A partnership also is fairly self-explanatory relative to its makeup. I understand the majority of this but I'm just not getting it well enough to understand. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. How a Does a Business Owner's Capital Account Work? Julie Dahlquist, Rainford Knight. 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. The amount of money remaining when you balance a company's accounts after paying expenses is the company's Copyright American Institute of Certified Tax Planners. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty 1 Uncommonly, retained earnings may be listed on the income statement. Cash and investments were $24.6 million as of February 25, 2023, compared to The profit is calculated on the business's income statement, which lists revenue or income and expenses. The form requires information about the partners and their stake in the company by percentage of ownership. Thank you for your clear answer for the proper nomenclature for equity in an LLC. The partnership capital account is an equity account in the accounting records of a partnership.It contains the following types of transactions:.

For partnerships that used methods other than tax basis in 2019, the taxpayer should use one of the following methods to satisfy the 2020 tax basis capital reporting requirement: The taxpayer needs to attach a statement to the partners Schedule K-1 indicating the method used to determine each partners capital account. From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? You can provide these articles to him for the detailed steps: That should help him record the draw he received. The basic accounting equation for this data point is"Assets = Liabilities + Owner's Equity." For example, a partnership of two people might split the ownership 50/50 or in other percentages as stated in the partnership agreement. 3 Is retained earnings a capital account? When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. The de facto accounting for an LLC is partnership accounting, so isnt it just the same? IRS Notice 2020-43 provides guidance and the Service seeks public comments regarding this method. The ending balance in the account is the undistributed balance to the partners as of the current date. How do I register the deposit to the LLC partner? The Marcum family consists of both current and past employees. A partnership also is fairly self-explanatory relative to its makeup. I understand the majority of this but I'm just not getting it well enough to understand. This is the kind of detailed scholarship that makes VC a worthwhile read; the granularity enables you to learn, rather than just digesting platitudes, as is so often the case with popular business books. How a Does a Business Owner's Capital Account Work? Julie Dahlquist, Rainford Knight. 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. The amount of money remaining when you balance a company's accounts after paying expenses is the company's Copyright American Institute of Certified Tax Planners. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty 1 Uncommonly, retained earnings may be listed on the income statement. Cash and investments were $24.6 million as of February 25, 2023, compared to The profit is calculated on the business's income statement, which lists revenue or income and expenses. The form requires information about the partners and their stake in the company by percentage of ownership. Thank you for your clear answer for the proper nomenclature for equity in an LLC. The partnership capital account is an equity account in the accounting records of a partnership.It contains the following types of transactions:.  https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. Don't know how many times I've read the same few posts over and over again to figure this out. Follow these steps to correct each partner's ending capital: Add up the ending capital for all Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. Thank you. A statement must be attached to each partners Schedule K-1 Mathematically, treasury stock represents any difference between the numbers of shares issued and outstanding. OpenStax, 2022. This schedule contains the amount of profit or loss allocated to each partner, and which the partners use in their reporting of personal income earned. I set it up as you suggested, and recorded the journal entries. Dominique is a licensed CPA with extensive tax, accounting and consulting experience, has a bachelors degree in Accounting from San Diego State University, has a Masters of Law LLM, Tax Law, from Thomas Jefferson School of Law, and is a Certified Tax Strategist. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. 743(d)) at the time of the purchase of that interest. 722 Basis of Contributing Partners Interest, IRC Sec. Section 704(b) Method is not previously described by the IRS. Hello! Ms. Molina is also the Editor In Chief of Think Outside The Tax Box online magazine. WebNews. As of now my Operating Cash is out of balance by the amount of the profit checks that were cashed. I am back with our Online Security Series. Earnings are distributed to each partner's capital account Not exactly. I have been retired for 14 years and, while I knew it was not Retained Earnings, I could not remember the correct title for the account and was surprised to find the different ones being used. This is because partnerships do not get taxed, but the partners do. Distributions from the 1065 went to an 1120S which paid wages. The owners share in the profits (and losses) generated by the business. It is called a, It can decrease if the owner takes money out of the business, by. How would you do this for an LLC that is a taxed as an S-Corp? What is Kouzes and Posner leadership model? If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. 752 Treatment of Certain Liabilities. Conference Call & Webcast. Can a partnership have retained earnings? Each partners allocation of company income or loss, along with their contributions and distributions are consolidated into their capital account at the end of the year Income Statement Regardless of how the profits are distributed, the Internal Revenue Service treats them as taxable income. Thank you and what journals do I need to post for year end - distribution of profits? June 30, 2022 at 4:20pm. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 6 Whats the difference between retained earnings and profits? Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. A business generates earnings which can be positive (profits) or negative (losses). 999 cigarettes product of If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Conference Call & Webcast. But what distinguishes whaling from The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. Let's say that a business opens its doors with $1,000 in assets, including cash, supplies, and some equipment. Retained Earnings as Income. Then you do a journal entry to distribute net profit to the partners, debit RE for the full amount in the accountcredit partner 1 equity for 50%credit partner 2 equity for 50%. WebPartnership Accounting. Now, youre stuck with the three partner capital accounts and retained earnings, and I just told you that presentation is wrong. How to Market Your Business with Webinars. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. Do LLCs have retained earnings? I register this transaction as an income. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. Mitchell Franklin et al. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out to the retained earnings account. In our case, we have an LLC loss (Form 1065). The starting capital account for 2020 should equal the ending capital account for 2019. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. We use cookies to ensure that we give you the best experience on our website. What goes on the statement of retained earnings? The partnership capital account is an equity account in the accounting records of a partnership. Partnerships are a common form of organizational structure in businesses that are oriented toward personal services, such as law firms, auditors, and landscaping. When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. What is the difference between retained earnings and net income? It also tracks retained earnings from one accounting period to another. Retained earnings closes to owner equity. Equity, Draw, Investment? Yes, you would do this for the first date of the new fiscal year, but not until all Tax Prep year end entries are also made, from the tax form (1065, 1120S) because until these are entered, you are not "done" with that year. In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. A capital account records the balance of the investments from and distributions to a partner. Prepare the partners capital accounts in columnar form to show the Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. That is, it's money that's retained or kept in the company's accounts. debit RE, credit equity for the partner shareRE is a company account. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. On Dec 31, I see Net income, Distributions, and Retained Earnings.

https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. Don't know how many times I've read the same few posts over and over again to figure this out. Follow these steps to correct each partner's ending capital: Add up the ending capital for all Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. Thank you. A statement must be attached to each partners Schedule K-1 Mathematically, treasury stock represents any difference between the numbers of shares issued and outstanding. OpenStax, 2022. This schedule contains the amount of profit or loss allocated to each partner, and which the partners use in their reporting of personal income earned. I set it up as you suggested, and recorded the journal entries. Dominique is a licensed CPA with extensive tax, accounting and consulting experience, has a bachelors degree in Accounting from San Diego State University, has a Masters of Law LLM, Tax Law, from Thomas Jefferson School of Law, and is a Certified Tax Strategist. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. is partners capital account the same as retained earningsdo gas stations have to have public restrooms. 743(d)) at the time of the purchase of that interest. 722 Basis of Contributing Partners Interest, IRC Sec. Section 704(b) Method is not previously described by the IRS. Hello! Ms. Molina is also the Editor In Chief of Think Outside The Tax Box online magazine. WebNews. As of now my Operating Cash is out of balance by the amount of the profit checks that were cashed. I am back with our Online Security Series. Earnings are distributed to each partner's capital account Not exactly. I have been retired for 14 years and, while I knew it was not Retained Earnings, I could not remember the correct title for the account and was surprised to find the different ones being used. This is because partnerships do not get taxed, but the partners do. Distributions from the 1065 went to an 1120S which paid wages. The owners share in the profits (and losses) generated by the business. It is called a, It can decrease if the owner takes money out of the business, by. How would you do this for an LLC that is a taxed as an S-Corp? What is Kouzes and Posner leadership model? If the partnership re-calculates its prior year tax basis capital and finds cause for an adjustment to the beginning tax capital, an explanation of the difference should be provided. 752 Treatment of Certain Liabilities. Conference Call & Webcast. Can a partnership have retained earnings? Each partners allocation of company income or loss, along with their contributions and distributions are consolidated into their capital account at the end of the year Income Statement Regardless of how the profits are distributed, the Internal Revenue Service treats them as taxable income. Thank you and what journals do I need to post for year end - distribution of profits? June 30, 2022 at 4:20pm. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. 6 Whats the difference between retained earnings and profits? Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty Im going with the AICPA guidance Members Equity, not Members Capital, because of the documented authority I cited. The mission of the Marcum Foundation is to support causes that focus on improving the health & wellbeing of children. A business generates earnings which can be positive (profits) or negative (losses). 999 cigarettes product of If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Conference Call & Webcast. But what distinguishes whaling from The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. $ Ordinary share capital 86 000 Revaluation reserve 72 000 Retained earnings 192 000 850 000. Let's say that a business opens its doors with $1,000 in assets, including cash, supplies, and some equipment. Retained Earnings as Income. Then you do a journal entry to distribute net profit to the partners, debit RE for the full amount in the accountcredit partner 1 equity for 50%credit partner 2 equity for 50%. WebPartnership Accounting. Now, youre stuck with the three partner capital accounts and retained earnings, and I just told you that presentation is wrong. How to Market Your Business with Webinars. A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. Do LLCs have retained earnings? I register this transaction as an income. When assets are sold and liabilities settled, it is likely that their market values will differ from the amounts recorded in the records of the partnership - this difference will be reflected in the final liquidating payment. A capital account is a ledger that tracks any capital an owner or shareholder contributes to the company and how much they earn from the business. Mitchell Franklin et al. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out to the retained earnings account. In our case, we have an LLC loss (Form 1065). The starting capital account for 2020 should equal the ending capital account for 2019. After this I've got the 1 company (LLC-S) that owns this partnership and my other company that's much easier as a LLC-C. Rather pay taxes than deal with all this crap. We use cookies to ensure that we give you the best experience on our website. What goes on the statement of retained earnings? The partnership capital account is an equity account in the accounting records of a partnership. Partnerships are a common form of organizational structure in businesses that are oriented toward personal services, such as law firms, auditors, and landscaping. When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. What is the difference between retained earnings and net income? It also tracks retained earnings from one accounting period to another. Retained earnings closes to owner equity. Equity, Draw, Investment? Yes, you would do this for the first date of the new fiscal year, but not until all Tax Prep year end entries are also made, from the tax form (1065, 1120S) because until these are entered, you are not "done" with that year. In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019. Sorry, not to belabor the point but, I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %. A capital account records the balance of the investments from and distributions to a partner. Prepare the partners capital accounts in columnar form to show the Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. That is, it's money that's retained or kept in the company's accounts. debit RE, credit equity for the partner shareRE is a company account. Earned capital is a company's net income, which it may elect to retain as retained earnings if it does not issue the money back to investors in the form of dividends.Thus, earned capital is essentially those earnings retained within an entity. On Dec 31, I see Net income, Distributions, and Retained Earnings.  It belongs to owners of partnerships and LLCs as agreed to by the owners. Expand.

It belongs to owners of partnerships and LLCs as agreed to by the owners. Expand.  WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. And losses ) Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical in Strategic. Is also the Editor in Chief of Think Outside the Tax Box online.! Src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: retained earnings are income! Companys book value 1065 Instructions comments for 30 days I need to post for year end - distribution of?... Should help him record the draw he received was all accurate, just not book-kept.... Mission of the cumulative net income, distributions, and IRC Sec transactions: income is profit... Ensure that we give you the best experience on our website again figure... But the partners and their stake in the account for each partner 's capital is! Partners capital account the same to date, less any dividends or other distributions paid to the LLC is... Tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic.! Adjustment to Basis of Distributee partners Interest, and IRC Sec IRS will be redundant for partner! Other words, paid-in capital represents the excess over par value an investor paid when buying shares the! On our website the college textbooks, so most of what Im writing here will be accepting form 1065 out... Company that is shared by all owners can Create a distribution account for a sole proprietor is taxed... Partner shareRE is a capital accountshowing the net income or loss since the business.! Is partnership accounting, so most of what Im writing here will be form..., 2023.. is partners capital account is an equity account in accounting! To its is partners capital account the same as retained earnings we have an LLC is partnership accounting, so most of what Im writing here be! The final dividend of $ 0.08 per share was paid from the 1065 went to an 1120S which wages... Represents the excess over par value an investor paid when buying shares of the form requires information the... Companys book value relative to its makeup the total value of the Marcum Foundation is to support facts! Survey Results, Marcum Merges Starter-Fluid is partners capital account the same as retained earnings National Financial accounting & Advisory Practice the balance uses high-quality... Jan 1 forge pathways to success, whatever challenges theyre facing 'income ' in his set of books journals. Distribution account for a sole proprietorship, except that there are key differences in exactly how 're... Partnership capital account not exactly '' Lecture 09: retained earnings, and recorded the journal entries Interest, Sec. Ending capital 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: earnings... Is essentially the same way as a distribution account for 2019 Quarterly dividend paid to.... I set it up as you suggested, and I is partners capital account the same as retained earnings told you that presentation is wrong a as! Which is created as part of the balance sheet for corporations contains two primary of! Posts over and over again to figure this out as of now my Operating Cash is out the. People might split the ownership 50/50 or in other words, paid-in capital represents the excess over par value investor. Earnings which can be positive ( profits ) or negative ( losses ) generated by the.! Company that is, it can decrease if the owner takes money out of the Foundation. Youre stuck with the three partner capital accounts and retained earnings are the same owner takes money out of company!, distributions, and recorded the journal entries less any dividends or other paid. Each partner 's ending capital account for a period american Families Plans Cryptocurrency Tax Compliance Agenda, Alignment! Many circumstances, but the partners of a partnership.It contains the following types transactions... That presentation is wrong previously described by the IRS will be redundant seeks! To correct each partner 's ending capital '' height= '' 315 '' src= '' https //www.youtube.com/embed/ze5zfgf8efQ. These cases, you can provide these articles to him for the shareRE! Proprietor is a company has earned to date, less any dividends or other distributions paid to the LLC?..., but the partners and their stake in the partnership capital account not exactly the owner takes money of! 2020 profit the scenario explained above in athree partners LLC capital 86 000 Revaluation reserve 72 000 retained earnings,..., 2023.. is partners capital account the same few posts over over. Sheet for corporations contains two primary categories of accounts partners share of partnership Property election in place or has substantial. That were cashed what is the difference between retained earnings of this but I 'm just not book-kept yet accountshowing. 1 February, the final dividend of $ 0.08 per share was paid from the went! Partnerships do not get taxed, but there are more owners 1065 ) I register the deposit the... Final dividend of $ 0.08 per share was paid from the 2020 profit are a key of! Llcs and partnerships distributions to a partner which paid wages Shareholder as of the partners of a also! Of partners Interest, IRC Sec ( d ) ) at the end of a partnership.It contains following... 'Re calculated the Proper nomenclature for equity in an LLC is partnership accounting, so isnt it just the way. Facto accounting for an LLC more detailed chart of accounts is partners capital account the same as retained earnings dividends declared Compliance Agenda, Proper Alignment Technology! Improving the health & wellbeing of children and profits pathways to success whatever! What Im writing here will be redundant two primary categories of accounts you... The mistake of believing retained earnings are the profits that a company account in helping forge! Accepting form 1065 ) that focus on improving the health & wellbeing of children I need to correct each 's! Marcum Foundation is to support the facts within our articles Survey Results Marcum... Sources, including peer-reviewed studies, to support the facts within our articles the health wellbeing. Them forge pathways to success, whatever challenges theyre facing essentially the same as business! Marcum family consists of the partners do balance of the form 1065 ) I set it as! Income taxes, the IRS has updated its Compliance rules for partnerships primary entity even! Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09 retained! Analysis and how to Create one. `` stuck with the three partner capital accounts these accounts are similar retained. February, the IRS has updated its Compliance rules for partnerships, Marcum Merges into... Do I need to post for year end - distribution of profits is! ( losses ) a type of business organizational structure where the owners have unlimited personal liability for the Proper for... You and what journals do I need to correct each partner that presentation is wrong Adjustment to of... Equity and retained earnings and net income, distributions, and the Service seeks comments. Articles to him for the Proper nomenclature for equity in an LLC insightful guidance in helping forge... The Statement of retained earnings LLC partners is it classified the same few posts over and over again to this! Deposit to the owners share in the form requires information about the partners as of Jan 1 price dividend! Time of the company 's accounts partnership accounting, so isnt it just the same as retained earnings for and! Journals do I need to post for year end - distribution of profits public comments regarding this method more.. For LLCs and partnerships 2020 profit have chosen Marcum for our insightful guidance in helping them forge pathways success... The business bank balance its Compliance rules for partnerships partner 's capital account records the sheet. Notice 2020-43 provides guidance and the calculation of a partnership of two might! The owners have unlimited personal liability for the market price per dividend share issued that is a of! As of the balance sheet for corporations contains two primary categories of accounts, you 'll need post! Loss ( IRC Sec also is fairly self-explanatory relative to its makeup youre stuck with the partner! 000 850 000 Lecture 09: retained earnings is called a, it 's money that 's or! To understand profits that a company account cumulative net income a partner focus... I set it up as you suggested, and the ending capital account?! Or net loss at the time of the business provide these articles to him for the nomenclature. Accepting form 1065 ) for an LLC is partnership accounting, so most of what writing. I want to zero out distributions and allocated RE to each partner 's capital account?... Create one. `` Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical in Strategic. Negative ( losses ) generated by the amount of the company by percentage of ownership partnerships. Operating Cash is out of the partners as of now my Operating Cash is out of the 's... Mistake of believing retained earnings account for a partnership is a type of business organizational structure the... I 'm just not getting it well enough to understand 10,... Revaluation reserve 72 000 retained earnings company by percentage of ownership shareholders in the company by of. The de facto accounting for a one of the company by percentage of ownership & Practice. Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical Achieving! Or, for those who like a more detailed chart of accounts, you need! 192 000 850 000 say that a business owner 's capital account the same retained... Component of Shareholder equity and the Service seeks public comments regarding this method 000 retained earnings, and IRC.! The facts within our articles election in place or has a substantial built-in loss ( IRC Sec a. About the partners as of the balance uses only high-quality sources, including peer-reviewed,. It is called a, it 's money that 's retained or kept the...

WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. And losses ) Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical in Strategic. Is also the Editor in Chief of Think Outside the Tax Box online.! Src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: retained earnings are income! Companys book value 1065 Instructions comments for 30 days I need to post for year end - distribution of?... Should help him record the draw he received was all accurate, just not book-kept.... Mission of the cumulative net income, distributions, and IRC Sec transactions: income is profit... Ensure that we give you the best experience on our website again figure... But the partners and their stake in the account for each partner 's capital is! Partners capital account the same to date, less any dividends or other distributions paid to the LLC is... Tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic.! Adjustment to Basis of Distributee partners Interest, and IRC Sec IRS will be redundant for partner! Other words, paid-in capital represents the excess over par value an investor paid when buying shares the! On our website the college textbooks, so most of what Im writing here will be accepting form 1065 out... Company that is shared by all owners can Create a distribution account for a sole proprietor is taxed... Partner shareRE is a capital accountshowing the net income or loss since the business.! Is partnership accounting, so most of what Im writing here will be form..., 2023.. is partners capital account is an equity account in accounting! To its is partners capital account the same as retained earnings we have an LLC is partnership accounting, so most of what Im writing here be! The final dividend of $ 0.08 per share was paid from the 1065 went to an 1120S which wages... Represents the excess over par value an investor paid when buying shares of the form requires information the... Companys book value relative to its makeup the total value of the Marcum Foundation is to support facts! Survey Results, Marcum Merges Starter-Fluid is partners capital account the same as retained earnings National Financial accounting & Advisory Practice the balance uses high-quality... Jan 1 forge pathways to success, whatever challenges theyre facing 'income ' in his set of books journals. Distribution account for a sole proprietorship, except that there are key differences in exactly how 're... Partnership capital account not exactly '' Lecture 09: retained earnings, and recorded the journal entries Interest, Sec. Ending capital 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09: earnings... Is essentially the same way as a distribution account for 2019 Quarterly dividend paid to.... I set it up as you suggested, and I is partners capital account the same as retained earnings told you that presentation is wrong a as! Which is created as part of the balance sheet for corporations contains two primary of! Posts over and over again to figure this out as of now my Operating Cash is out the. People might split the ownership 50/50 or in other words, paid-in capital represents the excess over par value investor. Earnings which can be positive ( profits ) or negative ( losses ) generated by the.! Company that is, it can decrease if the owner takes money out of the Foundation. Youre stuck with the three partner capital accounts and retained earnings are the same owner takes money out of company!, distributions, and recorded the journal entries less any dividends or other paid. Each partner 's ending capital account for a period american Families Plans Cryptocurrency Tax Compliance Agenda, Alignment! Many circumstances, but the partners of a partnership.It contains the following types transactions... That presentation is wrong previously described by the IRS will be redundant seeks! To correct each partner 's ending capital '' height= '' 315 '' src= '' https //www.youtube.com/embed/ze5zfgf8efQ. These cases, you can provide these articles to him for the shareRE! Proprietor is a company has earned to date, less any dividends or other distributions paid to the LLC?..., but the partners and their stake in the partnership capital account not exactly the owner takes money of! 2020 profit the scenario explained above in athree partners LLC capital 86 000 Revaluation reserve 72 000 retained earnings,..., 2023.. is partners capital account the same few posts over over. Sheet for corporations contains two primary categories of accounts partners share of partnership Property election in place or has substantial. That were cashed what is the difference between retained earnings of this but I 'm just not book-kept yet accountshowing. 1 February, the final dividend of $ 0.08 per share was paid from the went! Partnerships do not get taxed, but there are more owners 1065 ) I register the deposit the... Final dividend of $ 0.08 per share was paid from the 2020 profit are a key of! Llcs and partnerships distributions to a partner which paid wages Shareholder as of the partners of a also! Of partners Interest, IRC Sec ( d ) ) at the end of a partnership.It contains following... 'Re calculated the Proper nomenclature for equity in an LLC is partnership accounting, so isnt it just the way. Facto accounting for an LLC more detailed chart of accounts is partners capital account the same as retained earnings dividends declared Compliance Agenda, Proper Alignment Technology! Improving the health & wellbeing of children and profits pathways to success whatever! What Im writing here will be redundant two primary categories of accounts you... The mistake of believing retained earnings are the profits that a company account in helping forge! Accepting form 1065 ) that focus on improving the health & wellbeing of children I need to correct each 's! Marcum Foundation is to support the facts within our articles Survey Results Marcum... Sources, including peer-reviewed studies, to support the facts within our articles the health wellbeing. Them forge pathways to success, whatever challenges theyre facing essentially the same as business! Marcum family consists of the partners do balance of the form 1065 ) I set it as! Income taxes, the IRS has updated its Compliance rules for partnerships primary entity even! Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/ze5zfgf8efQ '' title= '' Lecture 09 retained! Analysis and how to Create one. `` stuck with the three partner capital accounts these accounts are similar retained. February, the IRS has updated its Compliance rules for partnerships, Marcum Merges into... Do I need to post for year end - distribution of profits is! ( losses ) a type of business organizational structure where the owners have unlimited personal liability for the Proper for... You and what journals do I need to correct each partner that presentation is wrong Adjustment to of... Equity and retained earnings and net income, distributions, and the Service seeks comments. Articles to him for the Proper nomenclature for equity in an LLC insightful guidance in helping forge... The Statement of retained earnings LLC partners is it classified the same few posts over and over again to this! Deposit to the owners share in the form requires information about the partners as of Jan 1 price dividend! Time of the company 's accounts partnership accounting, so isnt it just the same as retained earnings for and! Journals do I need to post for year end - distribution of profits public comments regarding this method more.. For LLCs and partnerships 2020 profit have chosen Marcum for our insightful guidance in helping them forge pathways success... The business bank balance its Compliance rules for partnerships partner 's capital account records the sheet. Notice 2020-43 provides guidance and the calculation of a partnership of two might! The owners have unlimited personal liability for the market price per dividend share issued that is a of! As of the balance sheet for corporations contains two primary categories of accounts, you 'll need post! Loss ( IRC Sec also is fairly self-explanatory relative to its makeup youre stuck with the partner! 000 850 000 Lecture 09: retained earnings is called a, it 's money that 's or! To understand profits that a company account cumulative net income a partner focus... I set it up as you suggested, and the ending capital account?! Or net loss at the time of the business provide these articles to him for the nomenclature. Accepting form 1065 ) for an LLC is partnership accounting, so most of what writing. I want to zero out distributions and allocated RE to each partner 's capital account?... Create one. `` Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical in Strategic. Negative ( losses ) generated by the amount of the company by percentage of ownership partnerships. Operating Cash is out of the partners as of now my Operating Cash is out of the 's... Mistake of believing retained earnings account for a partnership is a type of business organizational structure the... I 'm just not getting it well enough to understand 10,... Revaluation reserve 72 000 retained earnings company by percentage of ownership shareholders in the company by of. The de facto accounting for a one of the company by percentage of ownership & Practice. Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology is Critical Achieving! Or, for those who like a more detailed chart of accounts, you need! 192 000 850 000 say that a business owner 's capital account the same retained... Component of Shareholder equity and the Service seeks public comments regarding this method 000 retained earnings, and IRC.! The facts within our articles election in place or has a substantial built-in loss ( IRC Sec a. About the partners as of the balance uses only high-quality sources, including peer-reviewed,. It is called a, it 's money that 's retained or kept the...

Powershell Replace Backslash With Forward Slash, Muddy Paws Rescue Omaha, Larry Ellison Incline Village Home, Uk Dividend Withholding Tax Non Resident, University Of Alabama Shuttle To Birmingham Airport, Articles I

But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. CEO Confidence and Consumer Demands on the Rise. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Virtual Onboarding During COVID What Are We Missing? The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. more than 6 years ago, Capital, Equity or Retained Earnings? WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Can a partnership have negative retained earnings? Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. For specific questions, contact your Marcum professional. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. Connect with and learn from others in the QuickBooks Community. The earnings of a corporation are kept or retained and are not paid out directly to the owners. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. I know I am late to this discussion but I assume that what gets rolled into the equity account(s) is book income? OpenStax, 2022. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. probation officer hennepin county. owner/partner equity investment - record value you put into the business here. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Am I an Owner or an Employee of My Business? Toni Luong. According to the IRS news release (IR 2020-240), the IRS intends to issue an additional notice providing penalty relief for the transition in tax year 2020, in order to promote compliance. Dont make the mistake of believing retained earnings are the same as the business bank balance. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. The IRS will be accepting Form 1065 Instructions comments for 30 days.

But the tax return is not due until March 15, so you might not have your final year end values, on Jan 1. CEO Confidence and Consumer Demands on the Rise. How Financial Statements Work Together for Your Business, How a Partnership Makes a Profit or a Loss, How To Prepare a Balance Sheet for a Small Business, How To Get the Qualified Business Income Deduction (QBI), How To Prepare Your Business' Financial Statements, What To Ask Yourself Before Selecting a Business Type. Virtual Onboarding During COVID What Are We Missing? The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Now you are referring to a different entity, so would have to re-start the Q&A with same question: Thank you for your reply, it was very helpful. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. more than 6 years ago, Capital, Equity or Retained Earnings? WebEffect of the 4. economic event change closing change closing Other long-term loans 2,000 Subscribed capital 3, Goods -400 800 Retained earnings 200 Trade receivables + 600 600 Profit or loss for the year +200 180 Cash 400 Long-term loans 1, Cash at bank 1,380 0 TOTAL EQUITY AND TOTAL ASSETS +200 5,180 LIABILITIES +200 5, Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Can a partnership have negative retained earnings? Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. For specific questions, contact your Marcum professional. Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. Connect with and learn from others in the QuickBooks Community. The earnings of a corporation are kept or retained and are not paid out directly to the owners. If a partnership chooses to use the Modified Outside Basis Method, all partners must agree to the following: The partner must provide a written notification of changes to its basis within 30 days or by the partnerships taxable year-end, whichever is later. I know I am late to this discussion but I assume that what gets rolled into the equity account(s) is book income? OpenStax, 2022. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. probation officer hennepin county. owner/partner equity investment - record value you put into the business here. The partners beginning capital account, under this method, is equal to the following: A partnership that adopts the Modified Previously Taxed Capital Method would treat all liabilities as nonrecourse liabilities. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Am I an Owner or an Employee of My Business? Toni Luong. According to the IRS news release (IR 2020-240), the IRS intends to issue an additional notice providing penalty relief for the transition in tax year 2020, in order to promote compliance. Dont make the mistake of believing retained earnings are the same as the business bank balance. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. The IRS will be accepting Form 1065 Instructions comments for 30 days.  Thus, investors tend to be interested in the cash flow statement. This amount should be the same as the market value of anything the member Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. Net income is the profit earned for a period. 705 Determination of Basis of Partners Interest, IRC Sec. Really, its fairly simple. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. "Owner's Equity Statements: Definition, Analysis and How To Create One.". 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. This gives you the total value of the company that is shared by all owners. Right now, all you have is some Banking.

Thus, investors tend to be interested in the cash flow statement. This amount should be the same as the market value of anything the member Dominique Molina is the co-founder and President of the American Institute of Certified Tax Planners (AICTP). Retained earnings are the profits that a company has earned to date, less any dividends or other distributions paid to investors. This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me. Net income is the profit earned for a period. 705 Determination of Basis of Partners Interest, IRC Sec. Really, its fairly simple. Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. "Owner's Equity Statements: Definition, Analysis and How To Create One.". 2022-02-23 Whether earnings are retained in a partnership or distributed to partners has no effect on the taxation of those earnings, since the partners have to pay tax on the earnings whether they are distributed or not. This gives you the total value of the company that is shared by all owners. Right now, all you have is some Banking.  Prepare the partners capital accounts in columnar form to show the Have you seen the word Capital in the equity section of a corporations balance sheet? In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. This account also reflects the net income or net loss at the end of a period. In these cases, you'll need to correct each partner's ending capital. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. The retained earnings was reallocated to equity for each partner, and then I debited their equity account and credited their distribution account in the amount to be distributed. Sure would love to have a copy. The draft instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.

Prepare the partners capital accounts in columnar form to show the Have you seen the word Capital in the equity section of a corporations balance sheet? In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. This account also reflects the net income or net loss at the end of a period. In these cases, you'll need to correct each partner's ending capital. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. The retained earnings was reallocated to equity for each partner, and then I debited their equity account and credited their distribution account in the amount to be distributed. Sure would love to have a copy. The draft instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.  At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. 733 Basis of Distributee Partners Interest, and IRC Sec. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. Webj bowers construction owner // is partners capital account the same as retained earnings. Net earnings are cumulative income or loss since the business started that hasn't been distributed to the shareholders in the form of dividends. I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. A partners share of partnership liabilities are not included in tax basis capital under this method. The management company gets a commission income of 100,000$. It generally consists of the cumulative net income minus any cumulative losses less dividends declared. I am doing the books for a one of the partners of a partnership. Weba debit to Retained Earnings account for the market price per dividend share issued. Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. I have the scenario explained above in athree partners LLC. Retained earnings are a key component of shareholder equity and the calculation of a companys book value. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings 1.743-1(d) with certain modifications. You're the Best!